Greetings!!

I haven’t posted in a while, as I have been busy with other projects, but the beauty of a dividend growth portfolio is that it keeps working for us and it doesn’t require much baby-sitting. Typically at any period, dividends keep piling on,while we accumulate cash for our next purchase. Once we’re ready to purchase, we can then evaluate that the quality factors are still there and that valuation is attractive to get an additional share of that business.

2020 has been a very different year, where I expected the pandemic and recession to bring a much lower valuation and stay at those lower levels until companies start posting better earnings revision or at least clarity regarding guidance. However, the Fed reacted very quickly to inject liquidity plus the technology sector was clearly poised to benefit from the new wave of working remotely. This combination brought valuation to higher levels much quicker than anticipated by many. The positive effect on this is that it has helped to evaluate which companies were able to react and adapt while maintaining my goals, versus the ones that were affected in a way that they no longer can meet my goals. Some of them were already on my probation list, and this crisis only reinforced my thoughts and accelerated my decision to terminate my partnership with them. It’s important to note that stock price has nothing to do with this decision – only business performance and their ability to meet my goals drives my decision to sell. Dividend cuts / suspension is not a black-and-white decision to me, although I typically get inclined to cease the partnership with a business that no longer can provide a meaningful income or the growth of it.

The intent of this post is to review my Canadian watchlist, from a quality perspective (not valuation, that will be covered on a separate post), as I decided to no longer partner with some companies, and decided to start a partnership with other companies.

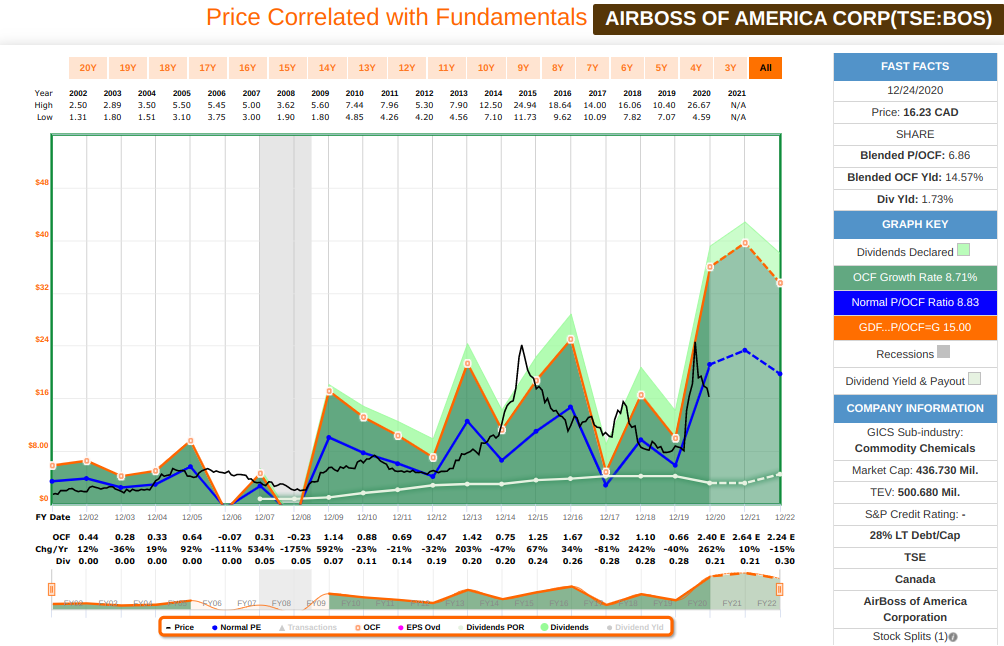

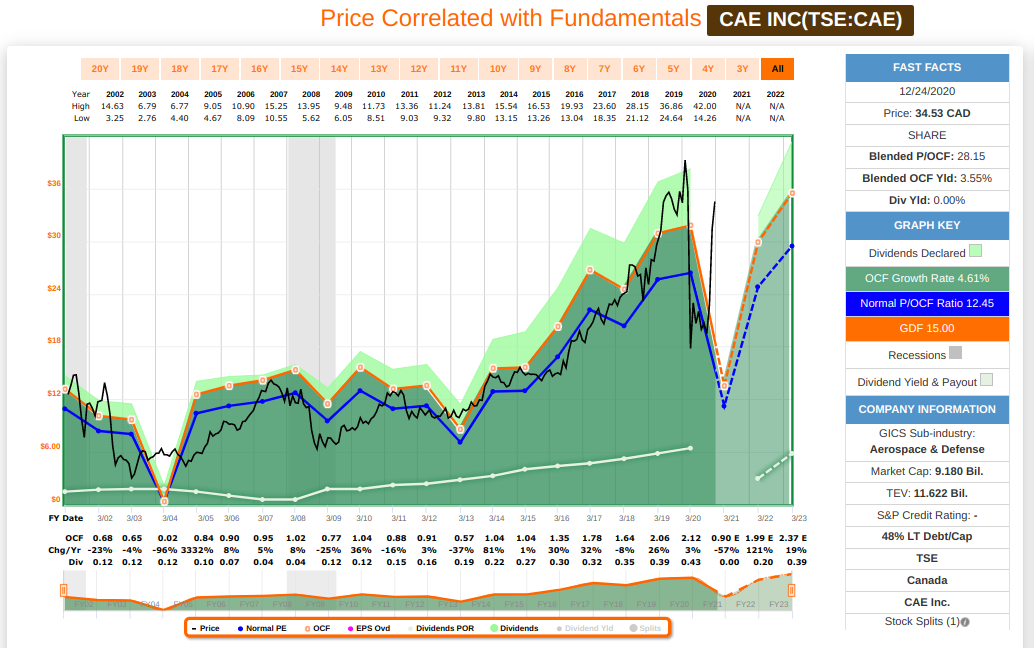

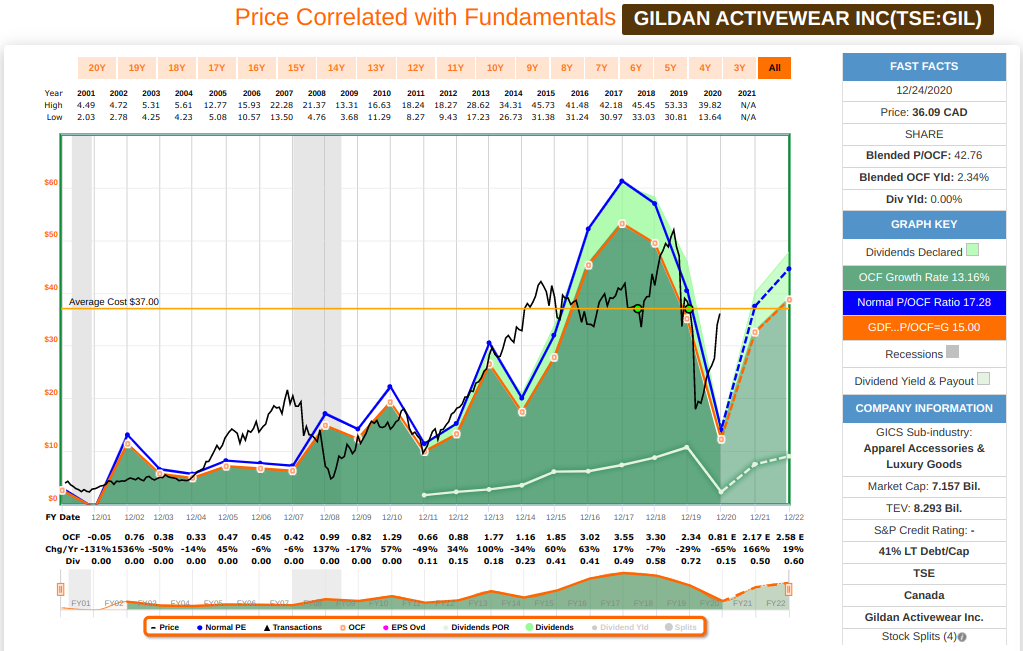

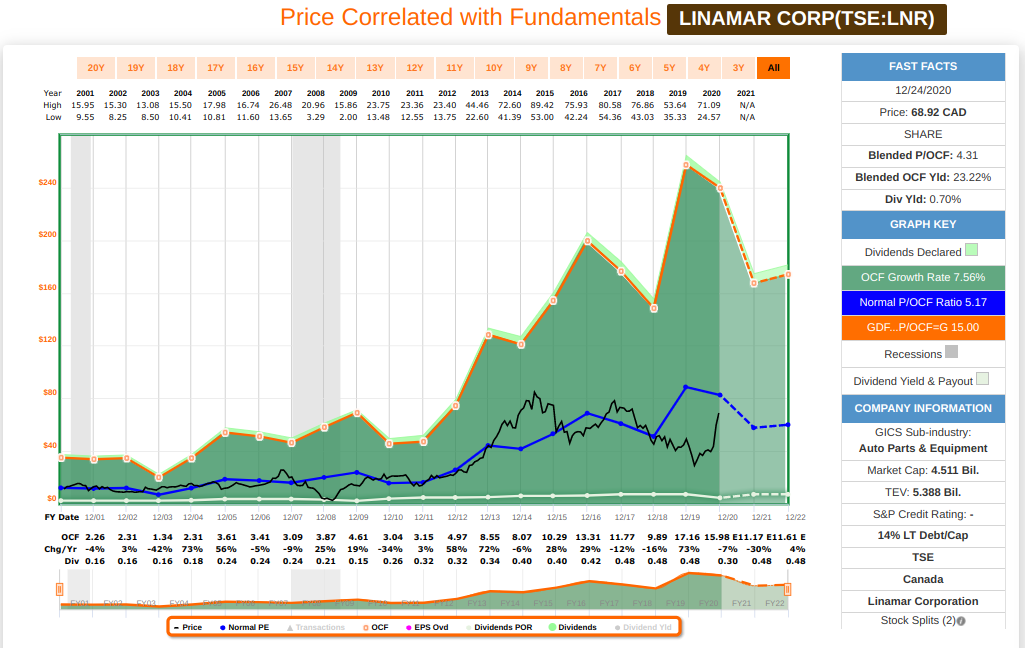

Each company is evaluated separately, and given the size of my watchlist, I’m unable to cover each one in detail in this post. Therefore, the graphs on earnings and cash flow performance including on what’s reported already plus estimates from street consensus should be used as an initial research point, since your goals and risk tolerance might differ than mine. Having said that, these graphs give a nice glance of recent business performance (including previous recession periods), and how these businesses are estimated to progress in the short term.

List of Canadian companies that I decided to no longer partner with:

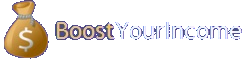

IPL (Inter Pipeline): IPL changed their business model for sometime now, which enables them to have commodity price exposure and potential higher growth – and with that, additional risks than their previous setup. Dividends were reduced this year, and the street estimates that it should be reduced further. I believe there are better opportunities for growth, and without a prospect of reasonable yield and growth of income, I rather allocate funds somewhere else.

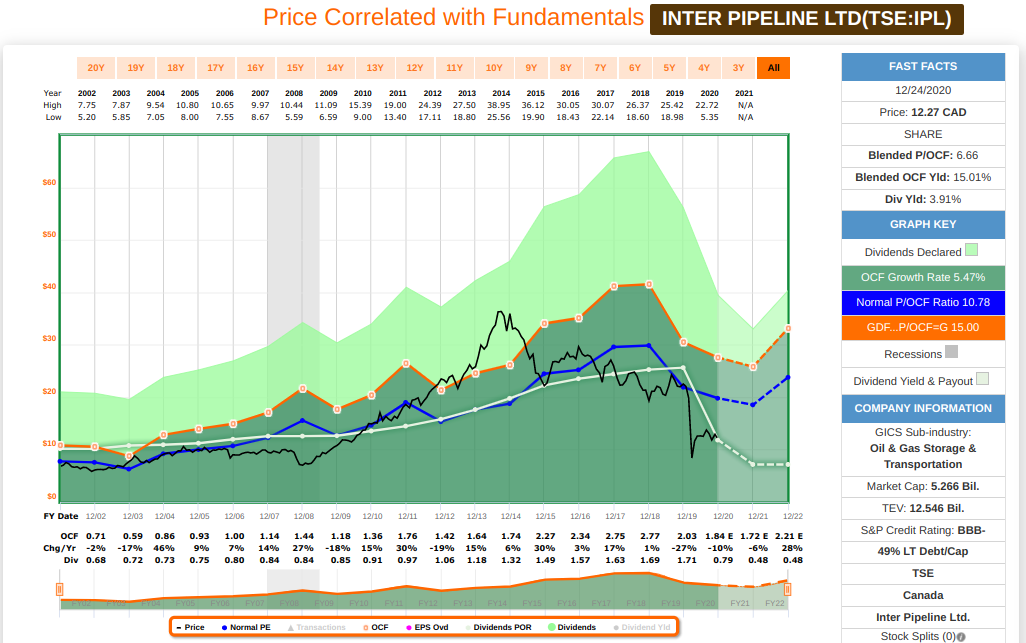

UNS (Uni Select): UNS has posting declining earnings since 2018, and it’s barely estimated to improve by 2021. This pandemic certainly affected their fundamentals, where the business now has more risks than I am comfortable with. Dividends have been suspended with no estimates to be back, and cash flows are estimated to continue to deteriorate in the future, with estimated numbers not seen in the last 20 years. For these reasons, I rather take the loss and move on, as the capital can be better allocated somewhere else.

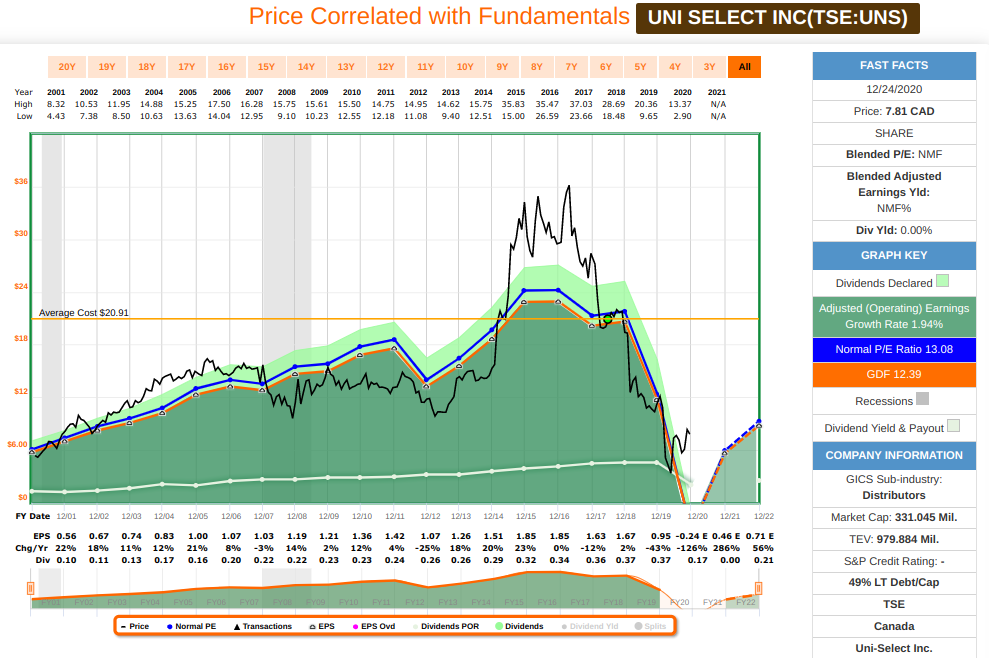

LB (Laurentian Bank): LB has been posting declining earnings since 2018, dividends were reduced this year and are estimated to be reduced further. Other institutions have been performing better, with dividends intact or estimated to grow, while LB has been struggling. Given that my watchlist has a sizeable number of stocks just on this sector, I think I don’t need the additional risks on LB, as they have been struggling more than peers.

I have not added any new Canadian companies to my watchlist.

I always say that good businesses function in any environment. And while many companies continue to be very well managed to the point that dividends were not reduced, and for some companies, they were increased, I will still hold, for now, companies that have reduced or suspended dividends, but which have a solid tracking operating record, which hasn’t significantly changed their business model, and which are estimated to perform before the pandemic started. In other words, I don’t want to penalize certain partnerships due to the pandemic. I trust that management will continue to make the right decisions to continue to reward shareholders, so time will tell how recovery for these companies will take place.

The following companies have reduced or suspended their dividend, or are estimated to do so in the short term, but overall I think it’s worth continuing the partnership with them given their operating performance, the income that they continue to produce and potentially grow overtime and the niche that they operate to sustain that growth. Since dividends come from cash, I will be plotting cash flow graphs for most of these companies, except where it doesn’t make sense for certain industries. These graphs are similar in the way that the pandemic affected their business, but I believe that it affected them temporarily only. I’ll be paying attention to these companies as they post their results – not monitoring stock price daily, but evaluating their business results through earnings, which are only posted 4 times a year.

AirBoss of America Corp., through its subsidiaries, designs, develops, manufactures, and sells rubber compounds and specialty finished products to industrial, automotive, defense, first response, and healthcare markets primarily in Canada and the United States. The company operates through three segments: Rubber Solutions, Engineered Products, and AirBoss Defense Group. The Rubber Solutions segment develops, manufactures custom rubber compounds, calendered and extruded materials, and molded products for use in various applications and industries, including mining, transportation, industrial rubber products, military, automotive, conveyor belting, and oil and gas; and sources chemicals. The Engineered Products segment designs, engineers, manufactures, and sells rubber, synthetic rubber, and rubber-to-metal bonded products that are used to eliminate or control undesired vibration and noise. The AirBoss Defense Group segment develops, manufactures, and sells chemical, biological, radiological, and nuclear protective equipment and related products for military, first response, and healthcare applications. The company was formerly known as IATCO Industries Inc. and changed its name to AirBoss of America Corp. in April 1994. AirBoss of America Corp. is headquartered in Newmarket, Canada.

CAE Inc., together with its subsidiaries, provides training solutions for the civil aviation, defence and security, and healthcare markets worldwide. The company’s Civil Aviation Training Solutions segment provides training solutions for flight, cabin, maintenance, and ground personnel in commercial, business, and helicopter aviation; flight simulation training devices; and ab initio pilot training and crew sourcing services. Its Defence and Security segment operates as a training systems integrator for defense forces in the air, land, and naval domains, as well as for government organizations responsible for public safety. The company’s Healthcare segment designs and manufactures simulators; offers audiovisual and simulation center management solutions; and develops courseware and offers services for training of medical, nursing, and allied healthcare students, as well as medical practitioners. It trains approximately 220,000 civil and defence crewmembers, including approximately 135,000 pilots and various healthcare professionals. The company was formerly known as CAE Industries Ltd. and changed its name to CAE Inc. in June 1993. CAE Inc. was founded in 1947 and is headquartered in Saint-Laurent, Canada.

Gildan Activewear Inc. manufactures and sells a range of apparel products in North America, Europe, the Asia-Pacific, and Latin America. The company manufactures and markets active wear products, including T-shirts, fleece tops and bottoms, and sport shirts under Gildan, Gildan Performance, Gildan Platinum, Gildan Hammer, Comfort Colors, American Apparel, Anvil by Gildan, Alstyle, Prim + Preux, and Gold Toe brands. It also offers hosiery products, such as athletic, dress, casual, workwear, liner, and therapeutic socks, as well as sheer panty hose, tights, and leggings under the Gildan, Gildan Platinum, Under Armour, Gold Toe, PowerSox, GT a Gold Toe Brand, Silver Toe, Signature Gold by Goldtoe, Peds, MediPeds, Kushyfoot, Therapy Plus, All Pro, Secret, Silks, Secret Silky, and American Apparel brand names. In addition, the company provides men’s and boys’ top and bottom underwear, and ladies panties under Gildan and Gildan Platinum brand names; and ladies shapewear, intimates, and accessories under Secret and Secret Silky brand names. It offers its products through wholesale distributors, screen printers/embellishers, and retailers, as well as through its e-commerce platforms. The company was formerly known as Textiles Gildan Inc. and changed its name to Gildan Activewear Inc. in March 1995. Gildan Activewear Inc. was incorporated in 1984 and is headquartered in Montreal, Canada.

Linamar Corporation together with its subsidiaries design, develop, and produce engineered products in Canada, Rest of North America, the Asia Pacific, and Europe. It operates through two segments, Transportation and Industrial. The Transportation segment engages in the design, development, and manufacture of precision metallic components, modules, and systems for vehicle and power generation markets. It manufactures precision-machined components and assemblies that are used in transmissions, engines, and driveline systems; driveline systems, such as power transfer units, rear-drive units, and engineered gears; and engine components, including cylinder blocks and assemblies, cylinder heads and complete head assemblies, camshaft assemblies, connecting rods, flywheels, fuel rails, and fuel body/pumps. This segment serves automotive original equipment manufacturer and commercial vehicle customers. The Industrial segment designs and produces mobile industrial equipment, primarily aerial work platforms, telehandlers, and agricultural equipment. It offers mobile products, such as compact and rough terrain scissor lifts, vertical mast lifts, and booms primarily to construction equipment rental companies. This segment sells harvesting equipment, including combine grain header attachments, self-propelled windrowers, pick-up headers, and hay products through wholesale dealer and distributor network. In addition, it designs and manufactures combine corn and sunflower headers; and private label agriculture and industrial equipment assemblies. Linamar Corporation was founded in 1966 and is headquartered in Guelph, Canada.

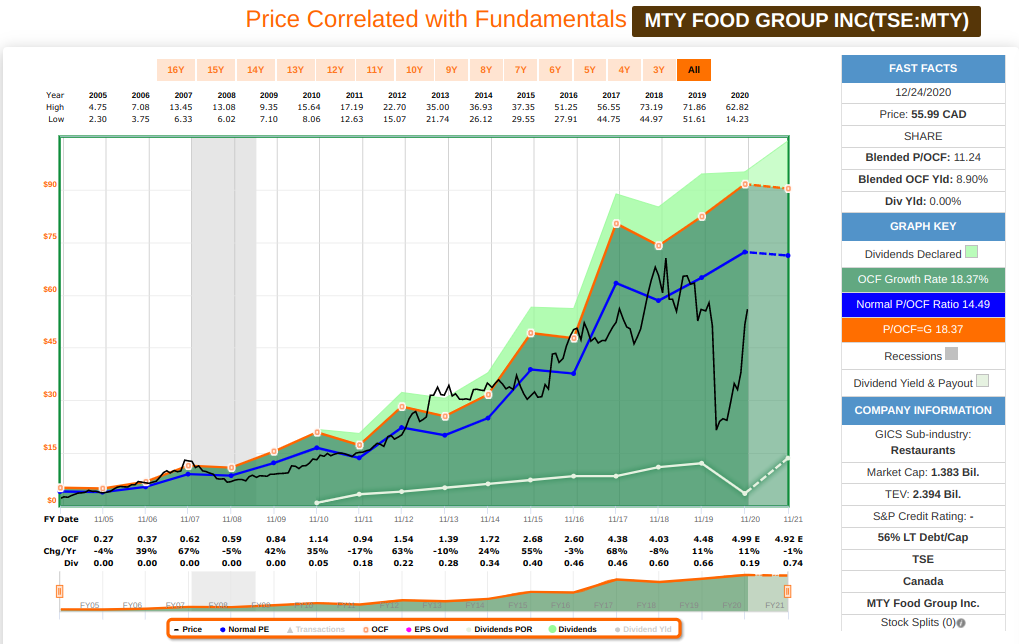

MTY Food Group Inc. franchises and operates quick service, fast casual, and casual dining restaurants in Canada, the United States, and internationally. The company franchises and operates corporate-owned locations in the quick service restaurant and casual dining segments of the restaurant industry; and sells retail products under a multitude of banners. It also operates two distribution centers and two food processing plants. As of May 31, 2020, the company had 7,236 locations comprising 7,077 franchised, 22 joint ventures, and 137 company operated locations. The company was formerly known as iNsu Innovations Group Inc. and changed its name to MTY Food Group Inc. in July 2003. MTY Food Group Inc. was founded in 1979 and is headquartered in Saint-Laurent, Canada.

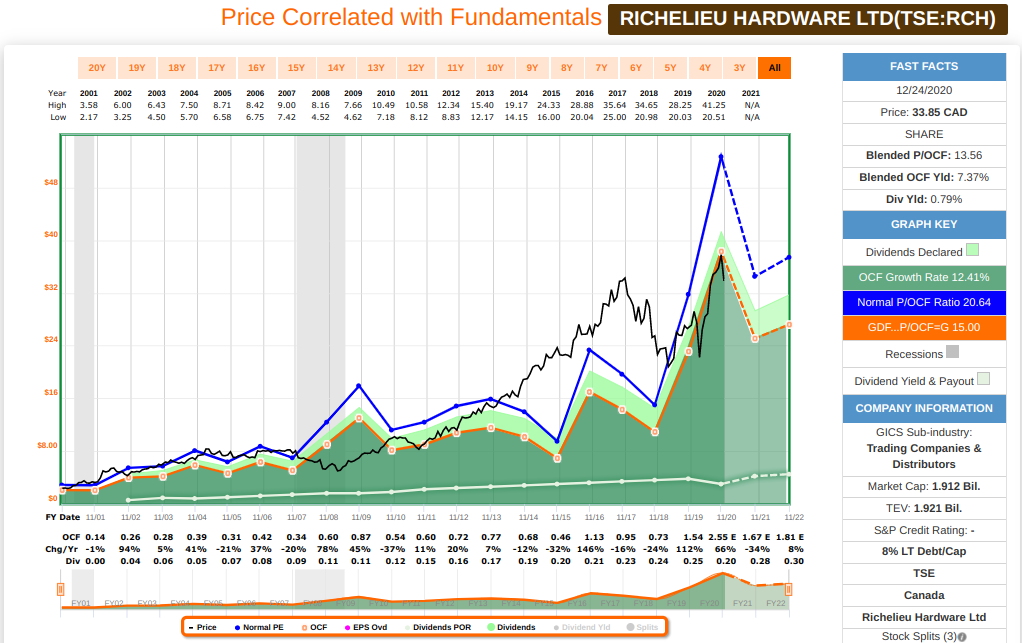

Richelieu Hardware Ltd. manufactures, imports, and distributes specialty hardware and complementary products in North America. The company’s principal product categories include furniture, glass and building decorative and functional hardware, lighting systems, finishing and decorating products, ergonomic workstation components, kitchen and closet storage solutions, sliding door systems, decorative and functional panels, high-pressure laminates, and floor protection products. It also manufactures veneer sheets and edge banding products; and various decorative moldings and components for the window and door industry. The company serves kitchen and bathroom cabinet, storage and closet, home and office furniture manufacturers; residential and commercial woodworkers; and hardware retailers, such as renovation superstores. Richelieu Hardware Ltd. was founded in 1968 and is headquartered in Montreal, Canada.

Meanwhile, the other companies on my watchlist continue firm with their dividends and operating results. We are still in a recession and in the middle of a pandemic. So I am aware that business results might get affected this year and potentially next year. Stock price might react to that as well. But the key is to monitor operating results, so that if a business reports poor results, we can determine if that’s a temporary issue or a permanent impair to capital. It’s the CEO and management’s job to figure out how to continue to grow their business in these conditions. Ours is to find quality companies that meet our criteria and partner with them when sound valuation appear. Strong companies react and adapt, and they tend to emerge strong from crisis. A portfolio allocated to these companies will perform as a function of how these business perform. So don’t let a company price or a macro environment such as a recession or uncertainty to distract from quality business that might be trading at fair valuation. A diversified portfolio of these companies tend to do well overtime, and dividends can be reinvested or cashed out as needed.

Happy Investing!!

Timing is funny

IPL got $16’s buyout offer from Brookfield (so thankfully I’m breakeven to little profit now LOL)

Pot stocks made new highs after 2018

BlackBerry made 10-year highs after GME-induced WSB run-up?

Do you consider any of these to be fairly valued or undervalued right now?

Surprised to see Richelieu Hardware on the “parting” list. You just added it to the Graham(Canada) portfolio.

RCH is not on “parting” list. Only the ones in red that are estimated to not improve were removed from my watchlist. As per blog post that shows RCH and others, “The following companies have reduced or suspended their dividend, or are estimated to do so in the short term, but overall I think it’s worth continuing the partnership with them given their operating performance, the income that they continue to produce and potentially grow overtime and the niche that they operate to sustain that growth.”.

Furthermore, the Graham model is a trading model. It follows specific trading rules that might or might not match the DGI long term strategy described here. On this case, RCH is on both strategies are a company estimated to do well in the future, despite the recent dividend cut.

Missed that line … Sorry….

No worries!

Thanks Rod, and Happy New Year!

I’m thinking through the answer to this riddle.

“By the time COVID19 crisis is over, even rich govts will end up with massive debt, with almost every country printing money to “stimulate” the economy.

Next phase: governments have to cut spending severely. Guess which industries will suffer the most then?” ~Anas Alhajji