Every year I review my current watchlist, to ensure that the businesses that I decided to partner with still meet my goals. This exercise has nothing to do with stock price performance. A decision to invest in these businesses (buy at sound valuation) or to wait and let important scenarios unfold before the next decision (hold) or to decide to cease the partnership (sell) should be solely considering the business itself, by evaluating if it still possess the ability to meet my original goals – and that’s based on the company’s operating performance, not on how the stock has performed.

My dividend growth investing portfolio has a mix of companies with a history of growing dividends mixed with companies that don’t grow dividends (but it pays one) which then I expect a decent capital appreciation, mixed with companies with a higher yield, which many times carries more risk than a conservative portfolio. Therefore, it’s expected that some of these companies might not perform well overtime or might come to a point that it won’t meet my goals any longer. At the same time, my complete portfolio also contains short term investing / trading strategies, which drives returns based on growth or income and have been able to nicely complement the dividend portfolio for the long run. Therefore, I believe that I can now improve the portfolio overall by reducing the exposure of the companies that are carrying more risk.

Companies that no longer meet my goals:

I decided to cease the partnership and sell the following companies on my Canadian DGI Portfolio:

Energy sector:

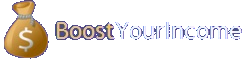

CNQ: It’s a well managed company, but it doesn’t meet my goals anymore. I’m ok to invest in cyclical companies (where capital appreciation overtime might not be there given the cycle), but dividends must keep growing in this kind of industry. CNQ is estimated to maintain their dividends flat at least until FY19, so I think there are better opportunities for income and portfolio growth if deployed somewhere else.

For the portfolio that I’m tracking on this website, CNQ was sold for 34% profit, at $40.06. I had 51 shares, so It provided $2,043.06 of proceeds.

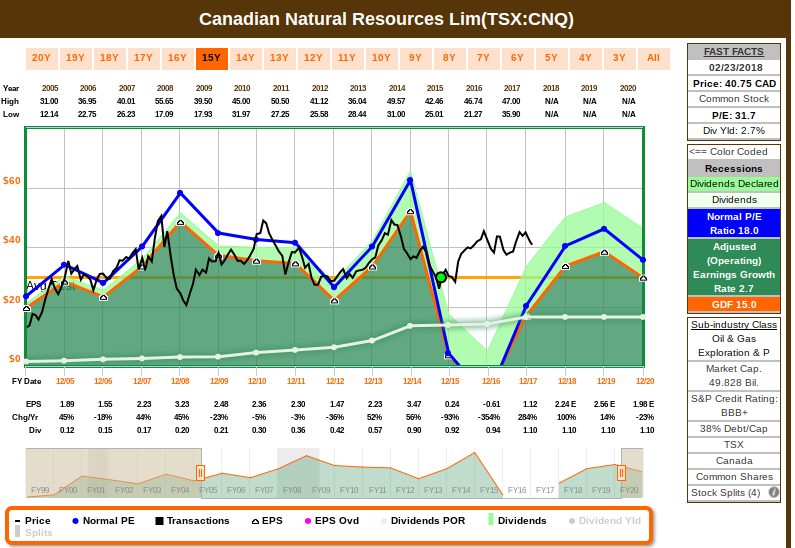

SU: It’s also a well managed company, great credit rating, but I’ll be selling it for the same reasons I’m selling CNQ: it’s a cyclical company that is estimated to not grow its dividend for the next years (FY19 and FY20). I have exposure to other companies in this sector, so I think capital can be better allocated elsewhere.

SU wasn’t purchased for the portfolio that I’m tracking on this website.

Industrials:

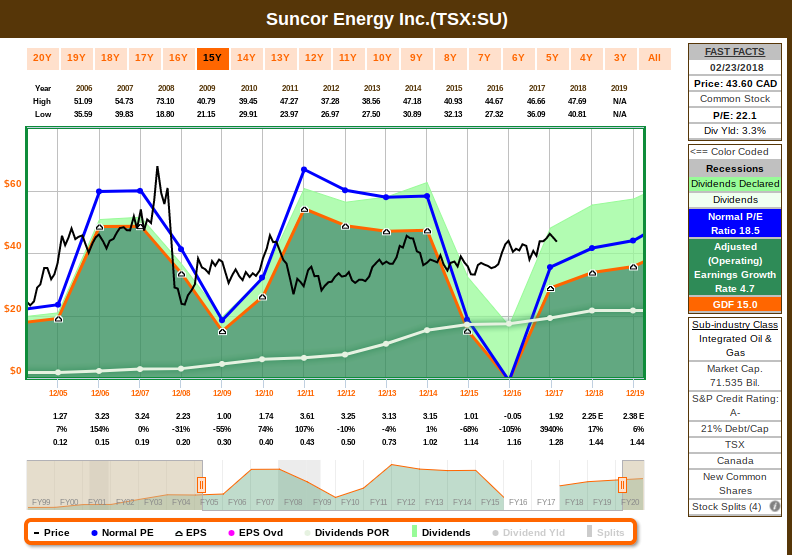

TCL.A: It’s a well managed company, the largest printer in Canada and the 4th largest in North America. However, this is a shrinking business, earnings are estimated to keep dropping for the next years, and the stock is overvalued. Dividends are estimated to grow, but I find more important the sustainability of growth. TCL.A is investing in the packaging sector, it’s creating its digital business and its printing business is defensive, with long contracts with major players (The Globe and Mail, Rogers, the San Francisco Chronicle). But the low earning growth rate associated with the estimated future shrinking earnings and moderate current overvaluation shows me little upside potential, so I rather deploy the proceeds somewhere else, as the stock has grown at a much higher pace than earnings. I will certainly keep an eye on how TCL.A implements their transformation to deal with the changes in their industry, and I will consider partnering with them again in the future once there’s better visibility on how they will be positioned with the challenges in this sector.

For the portfolio that I’m tracking on this website, TCL.A was sold for 18.7% profit, at $24.56. I had 74 shares, so It provided $1,817.44 of proceeds.

Consumer Discretionary:

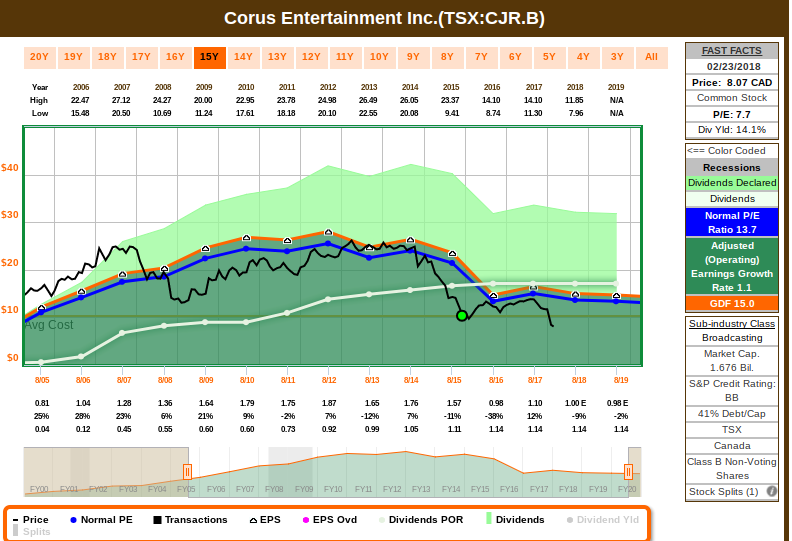

CJR.B: Corus has a long nice history of growing earnings and dividends and pays a sustainable high yield, but recent transformations have been hurting a business that keeps facing pressure from a dying industry. Earnings have topped in 2014 and have been declining since – much of it is related to their Shaw acquisition, which was strategic to how they want to position themselves moving forward, but earnings are not estimated to improve while debt gets reduced, and with constant declining revenue, cash flow might eventually be at risk. Cash flow and dividends are not at risk now, but if revenue keeps declining, it will be. At this point, I can’t tell if it’s a punctual issue or a systematic problem. And the fact that it’s a possibility having the Shaw family taking Corus privately makes one wonder if this was the strategy all along. Considering that earnings are estimated to decline slowly for the next 2 years and that there’s been 3 consecutive quarters that they missed, I think Corus is presently carrying more risks than I am willing to take – I expected their subscription revenue to offset other areas, but that hasn’t happened. Their transformation might pan out well in the end, and just take longer to show results, but at this point I think cash can be deployed to better opportunities for income growth – and other strategies can be put in placed to provide short term returns, instead of cash from a (sustainable, but at risk) high payout. I would probably continue hold Corus if I didn’t have other mechanisms to generate positive returns in the short term, but given that I do have them, then it makes little sense to me to continue partnering with them at this point. I will happily consider it again if earnings start to grow again – which will take some time anyway, since the focus now (rightfully so) is to pay debt from their biggest acquisition.

For the portfolio that I’m tracking on this website, CJR.B was sold for 21.9% loss, at $8.08. I had 149 shares, so It provided $1,203.92 of proceeds.

Consumer Staples:

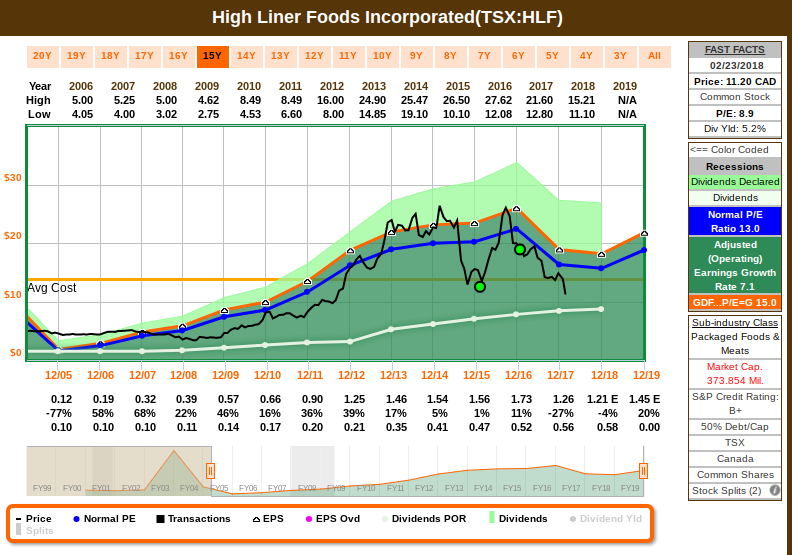

HLF: High Liner Foods has a history of growing earnings and dividends, but there are only a few firms covering this small cap company and operating results have been very inconsistent. The elements that used to drive their steady returns don’t play the same role anymore. High Liner is changing their business model to adapt with new demands, and there’s a leadership changed recently as well. Given the high number of stocks that I have on this sector, the recent announcements and series of weak results, I decided to sell HLF and allocate funds on other companies from this sector. The companies in this sector are supposed to be boring, reliable and predictable and High Liner hasn’t been in any of these categories for some time now – even though earnings and dividends have been growing. Note that I don’t see any quality issues with this company – I”ve decided to sell them because I have different expectations for companies in the consumer staples sector, and because the core products that used to drive steady earnings are no longer doing that.

For the portfolio that I’m tracking on this website, HLF was sold for 15.6% loss, at $11.67. I had 257 shares, so It provided $2,999.19 of proceeds.

Financials:

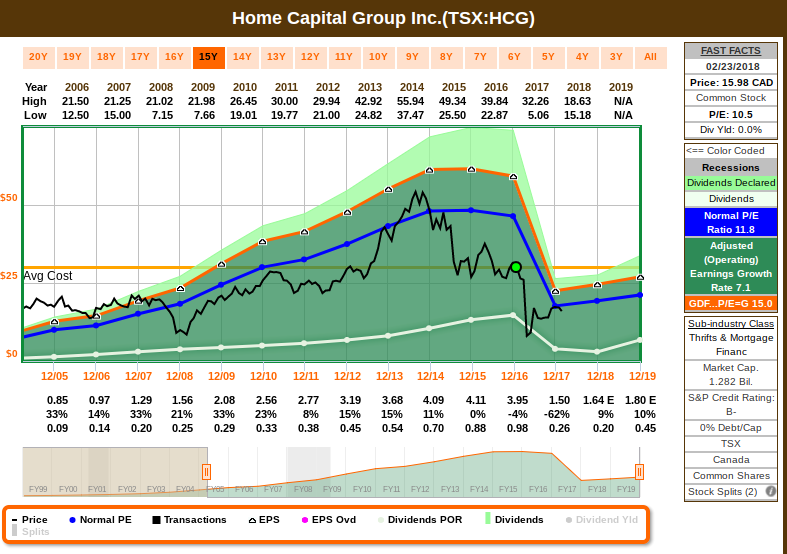

HCG: Home Capital Group faced numerous issues that started with the discovery of mortgage originations done with fraudulent income, and although this was a very small portion of their book record, the panic on the news, fueled with institutional short sellers that keep betting on a house crash created a liquidity problem since GIC deposits (which are government insured) were redeemed earlier and as it impaired cash flow, dividends were suspended. Home Capital presently trades below their book value, and I don’t like to sell a company at these levels, but given that the income component is no longer there and that they will continue facing uncertainties for a while, I decided to cease the partnership with them. The uncertainties include repairing and establishing broker relationship, the company’s reaction to the new B-20 rules, the unknown regarding the solution of their methodology to underwriting, and how new capital will be deployed (they have lots of capital available, a huge CET1 ratio of 23.2% was reported for last quarter, but inability to deploy this capital given these structural issues curbs their growth and potentially impact their cash flow). I will take the approach of partnering with other companies that can provide income growth and revisit this one once the prospects are more attractive.

For the portfolio that I’m tracking on this website, HCG was sold for 45% loss, at $16.27. I had 33 shares, so It provided $536.91 of proceeds.

REITs:

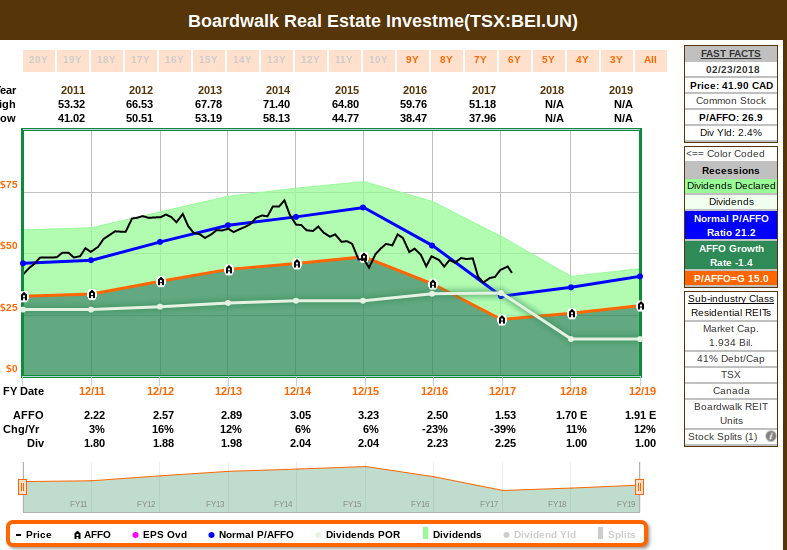

BEI.UN: Boardwalk Real Estate Investment disappointed me as how they have been managed lately, with reasonable occupancy rates, but not being efficient with its growing operating costs, whlie reporting lower revenue and being highly leveraged. Their balance sheet remains solid, but I can’t see growth if they don’t acquire new properties and keep selling old ones. As it was expected, distributions were significantly reduced to a point that it’s not at an attractive level for a REIT anymore. Management decided (a little too late) to diversify to other regions, but they are still too linked with regions that are commodity price dependent. I rather use the funds to the other 2 REITs on my portfolio, which continues to deliver well.

BEI.UN wasn’t purchased for the portfolio that I’m tracking on this website.

.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.-.

Companies that I decided to partner with:

Besides deciding on the companies that no longer meet my goals, I also evaluate once a year which new companies I should partner with. In order to facilitate this process, I decided to further automate the screening process so it does most of the quality screening work for me, allowing me to evaluate further on a smaller list for the companies that was suggested through my initial automated quantitative analysis. I will write a separate post on how the automated screening process works, what criteria rules are involved, as well as provide a list of the companies that were found through this quantitative process, so you can use it for further research.

Remember that this process solely speaks to what to buy, but it doesn’t determine when to buy (which needs to take valuation into account). Let’s go through the “what” now, and I’ll later elaborate some of the “when”. I decided to partner with the following business:

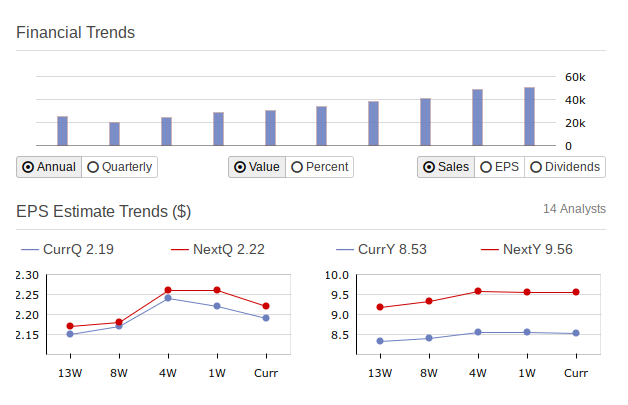

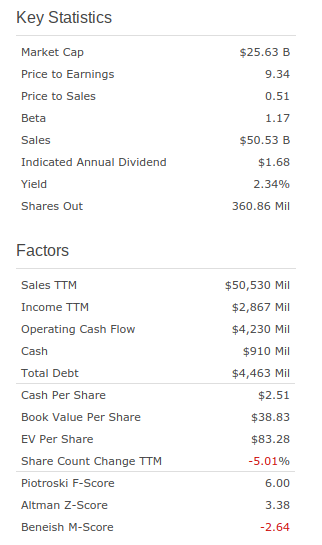

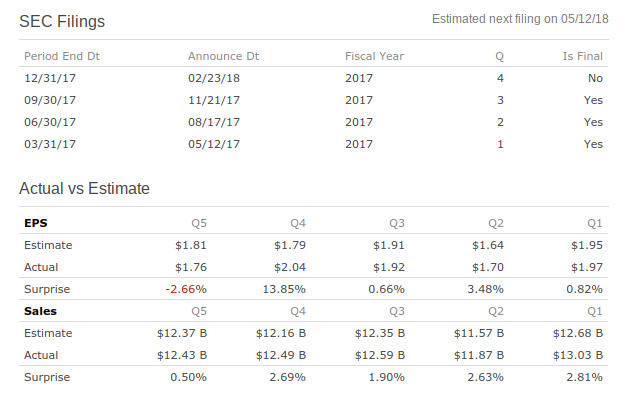

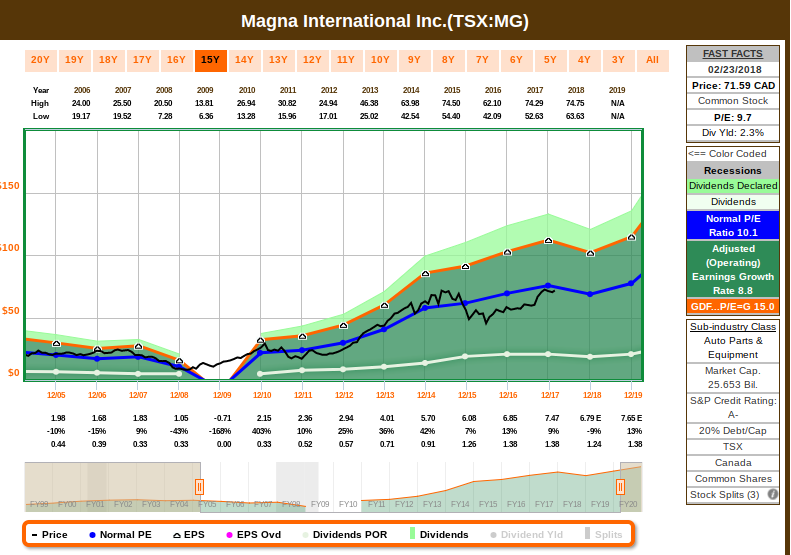

MG: Magna International Inc. designs, develops, and manufactures automotive systems, assemblies, modules, and components in North America, Europe, Asia, and South America. The company offers engineering and contract manufacturing services, and fuel systems; electric/electronic components and systems; roof systems comprising softtops, retractable hardtops, modular tops, and hardtops; and closures, including latching systems, hinges and wire forming, power closures, electronics, door modules, window systems engineered glass, sealing, trim and roof racks, roof systems, testing centers, and running boards. It also provides interior and exterior mirrors, actuators, electronic vision systems, door handle and overhead console technologies, and front and signal lightings; complete seating systems, mechanism solutions, seat structure solutions, foam and trim products, and design and development solutions; and fascia and exterior trims, liftgate and exterior modules, front end modules, ACTERO active aerodynamics, and lightweight composites. In addition, the company offers driveline systems, fluid pressure and controls, metal-forming solutions; and body systems, chassis systems, and renewable energy systems. It serves original equipment manufacturers, tier 1, medium and heavy truck, and non-automotive customers. The company was founded in 1957 and is headquartered in Aurora, Canada.

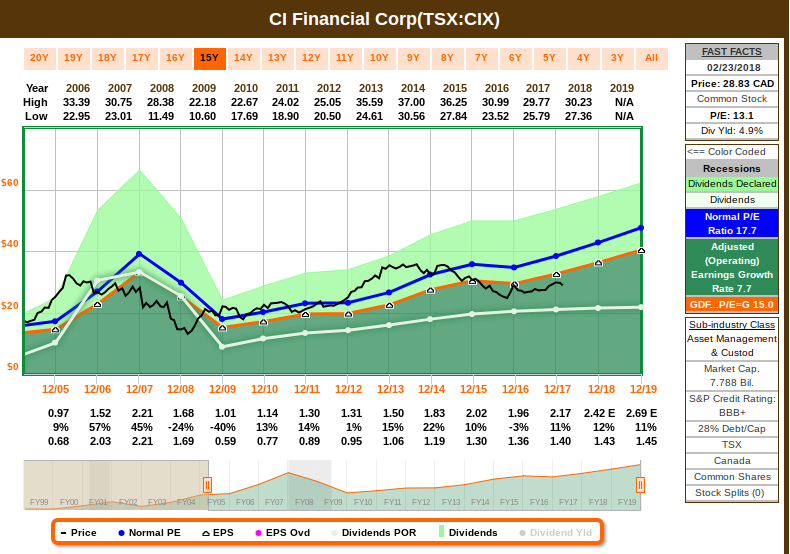

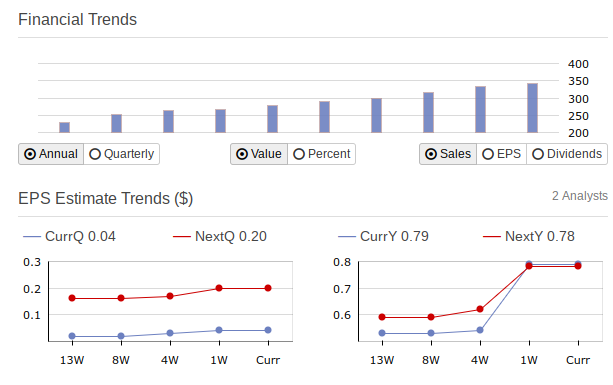

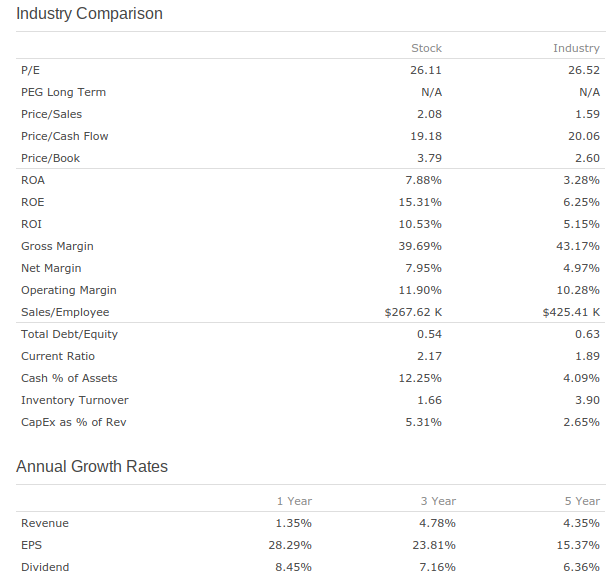

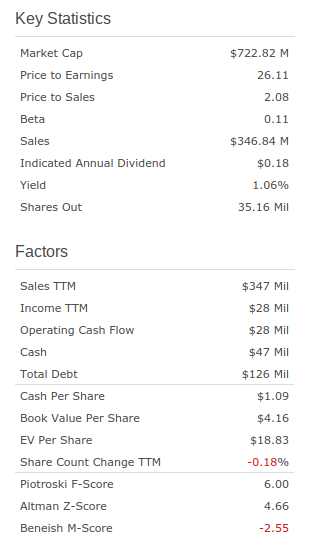

CIX: CI Financial Corp. is a publicly owned asset management holding company. Through its subsidiaries, the firm manages separate client focused equity, fixed income, and alternative investments portfolios. It also manages mutual funds, hedge funds, and fund of funds for its clients through its subsidiaries. The firm was founded in 1965 and is based in Toronto, Canada.

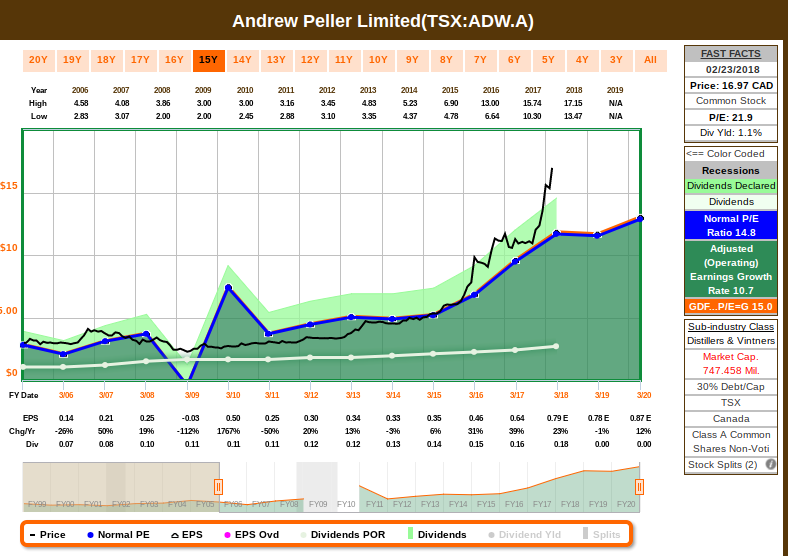

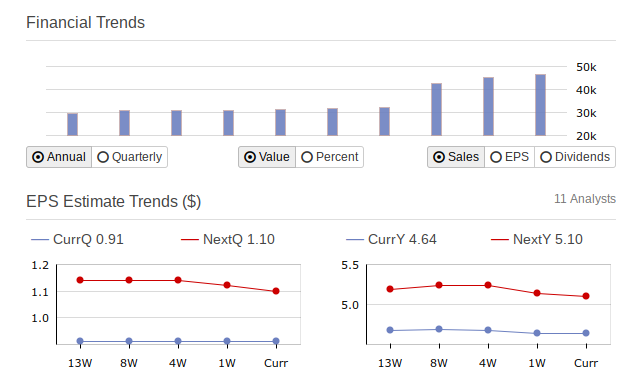

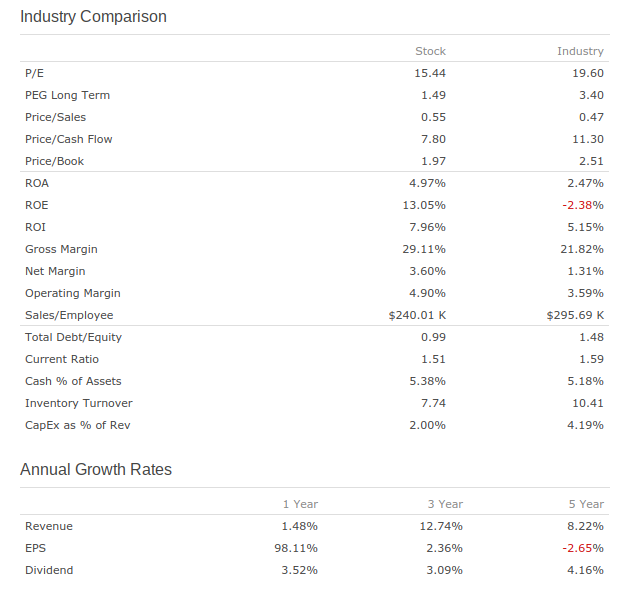

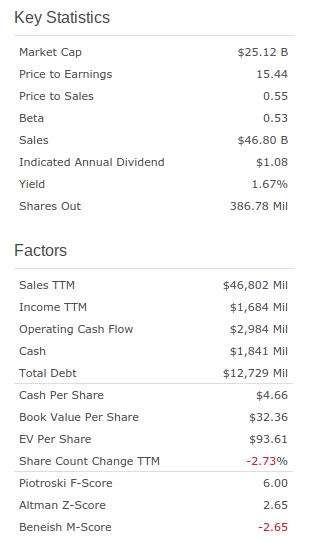

ADW.A: Andrew Peller Limited produces and markets wine and wine related products. The company’s principal products include blended table wines, sparkling and fortified wines, and varietal wines, as well as icewines. It offers wines under various trademarks, including Andres Wines, Andrew Peller Limited, Peller Estates, Trius, Thirty Bench, Red Rooster, Sandhill, Wayne Gretzky Estates, No. 99, Wayne Gretzky Okanagan, Calona Vineyards, Raven Conspiracy, Conviction, Domaine D’Or, Hochtaler, French Cross, Royal, Round Petal Wines, XOXO, Black Cellar, Copper Moon, skinnygrape, Unreserved, Rebellion, Panama Jack, No Boats on Sunday, Schloss Laderheim, Franciscan, Baby Canadian, Baby Duck, Wine Country Vintners, and The Wine Shop. The company also produces and markets personal winemaking products under the Selection, Vintners Reserve, Island Mist, KenRidge, Cheeky Monkey, Traditional Vintage, and Cellar Craft brands through approximately 170 Winexpert and Wine Kitz authorized retailers, and 600 independent retailers in Canada, the United States, the United Kingdom, New Zealand, Australia, and China. The company owns and operates 101 independent retail locations under The Wine Shop, Wine Country Vintners, and Wine Country Merchants store names in Ontario. Andrew Peller Limited also exports its icewine and personal winemaking products. The company was formerly known as Andres Wines Ltd. and changed its name to Andrew Peller Limited in 2006. Andrew Peller Limited was founded in 1961 and is headquartered in Grimsby, Canada.

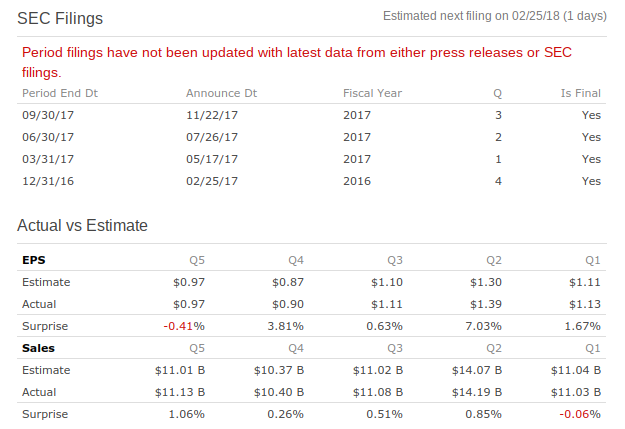

L: Loblaw Companies Limited, a food and pharmacy company, provides grocery, pharmacy, health and beauty, apparel, general merchandise, retail banking, credit card, insurance, and wireless mobile products and services in Canada. It operates through three segments: Retail, Financial Services, and Choice Properties. The Retail segment operates corporate and franchise-owned retail food, and associate-owned drug stores, including in-store pharmacies and other health and beauty products, gas bars, and apparel and other general merchandise stores. The Financial Services segment provides credit card services, loyalty programs, insurance brokerage, personal banking services, deposit taking services, and telecommunication services. The Choice Properties segment owns, manages, and develops retail and commercial properties. The company was founded in 1956 and is headquartered in Brampton, Canada. Loblaw Companies Limited is a subsidiary of George Weston Limited.

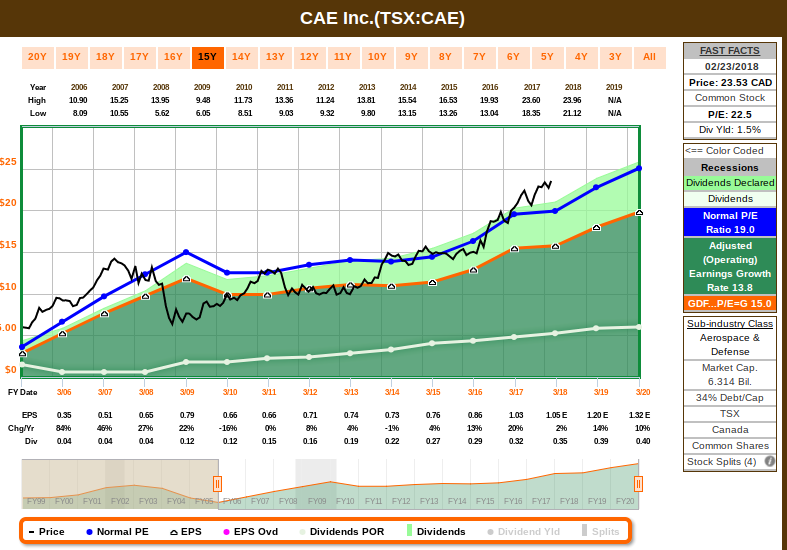

CAE: CAE Inc., together with its subsidiaries, designs, manufactures, and supplies simulation equipment worldwide. It operates in three segments: Civil Aviation Training Solutions, Defence and Security, and Healthcare. The Civil Aviation Training Solutions segment provides training solutions for flight, cabin, maintenance, and ground personnel in commercial, business, and helicopter aviation; flight simulation training devices; and ab initio pilot training and crew sourcing services. The Defence and Security segment operates as a training systems integrator for defense forces in the air, land, and naval domains, as well as for government organizations responsible for public safety. The Healthcare segment designs, manufactures, and markets simulators; offers audiovisual and simulation center management solutions; and develops courseware and offers services for training of medical and allied healthcare students, as well as clinicians in educational institutions, hospitals, and defense organizations. The company was formerly known as CAE Industries Ltd. and changed its name to CAE Inc. in June 1993. CAE Inc. was founded in 1947 and is headquartered in Saint-Laurent, Canada.

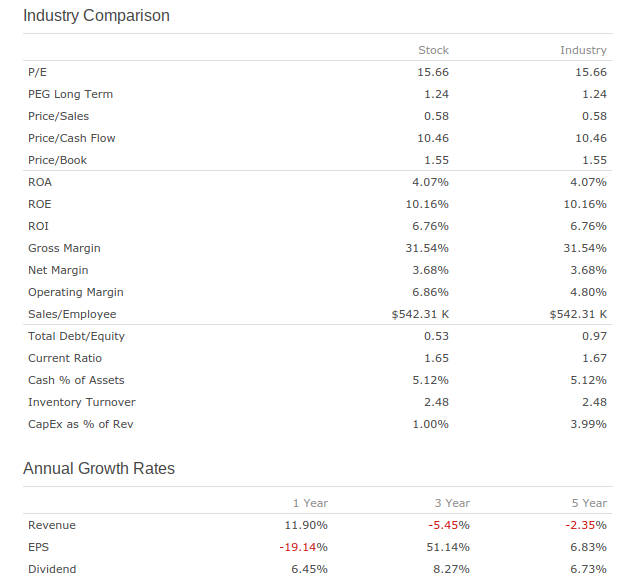

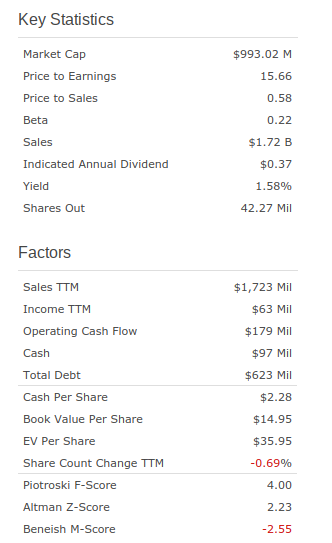

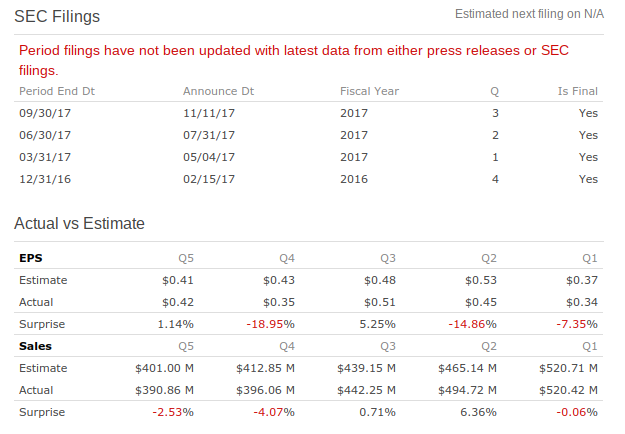

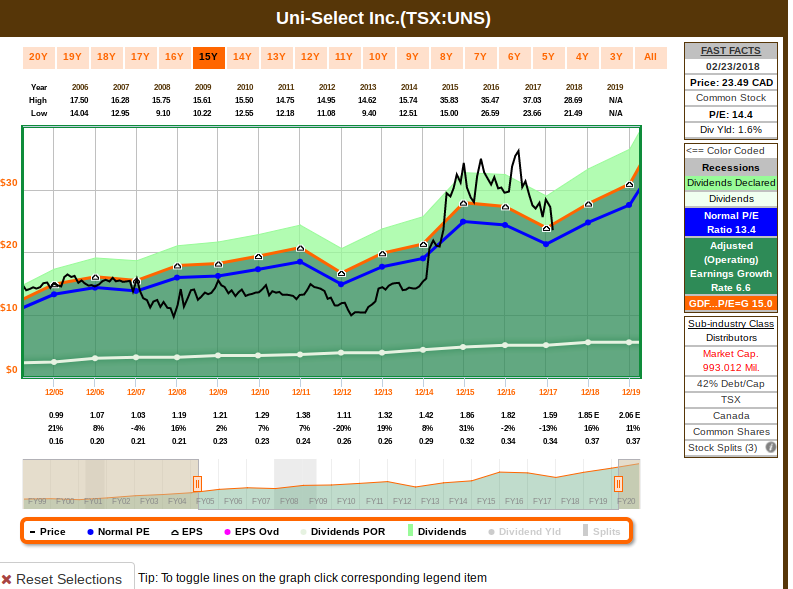

UNS: Uni-Select Inc. distributes automotive refinish and industrial paint and related products in North America. The company operates through Paint and Related Products, and Automotive Products segments. It also distributes automotive parts, tools, and equipment to the aftermarket. The company serves independent and collision repair center customers, and corporate stores through its BUMPER TO BUMPER, AUTO PARTS PLUS, and FINISHMASTER stores. Uni-Select Inc. was founded in 1968 and is headquartered in Boucherville, Canada.

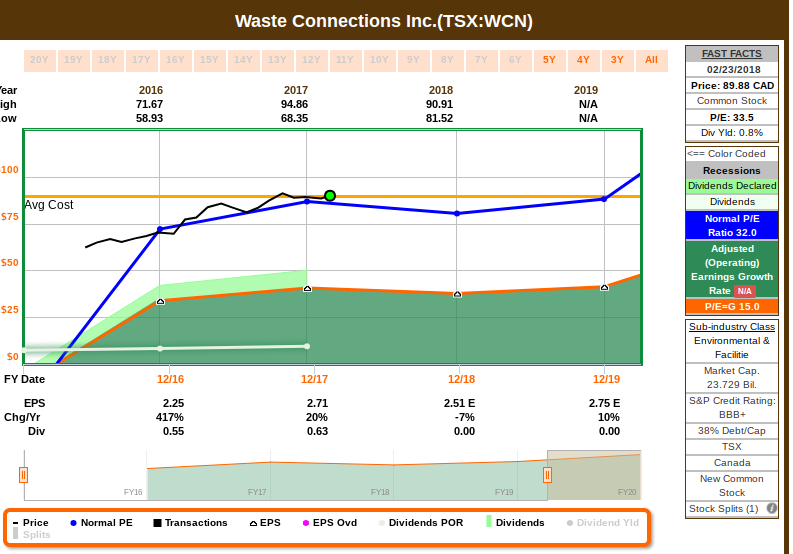

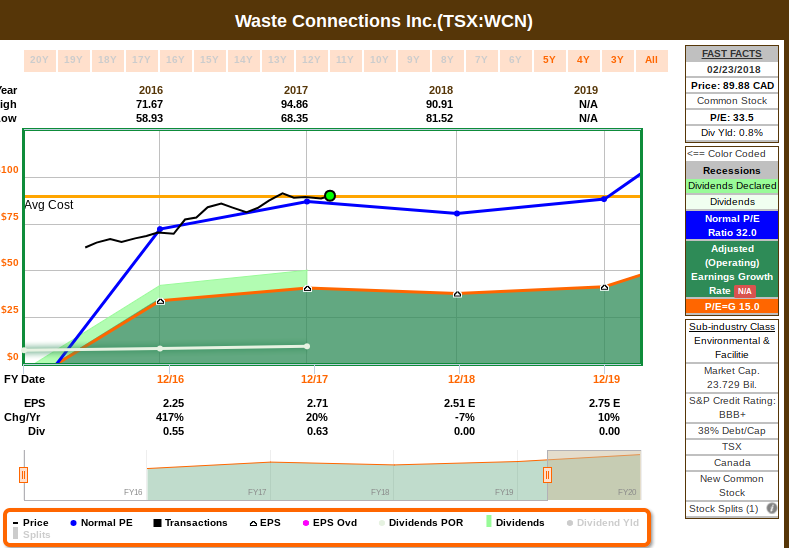

WCN: Waste Connections, Inc., a solid waste services company, provides waste collection, transfer, disposal, and recycling services in the United States and Canada. The company operates through six segments: Southern, Western, Eastern, Canada, Central, and Exploration and Production (E&P). It offers collection services to residential, commercial, municipal, industrial, and E&P customers; landfill disposal services; and recycling services for various recyclable materials, including compost, cardboard, office paper, plastic containers, glass bottles, and ferrous and aluminum metals. The company also owns and operates transfer stations that receive compact and load waste to be transported to landfills or treatment facilities through truck, rail, or barge; and intermodal services for the rail haul movement of cargo and solid waste containers in the Pacific Northwest through a network of intermodal facilities. In addition, it provides E&P waste treatment, recovery, and disposal services for waste resulting from oil and natural gas exploration and production activity, such as drilling fluids, drill cuttings, completion fluids, and flowback water; production wastes and produced water during a well’s operating life; contaminated soils that require treatment during site reclamation; and substances that require clean-up after a spill, reserve pit clean-up, or pipeline rupture. Further, the company offers container and chassis sales and leasing services to its customers. As of December 31, 2016, it owned or operated a network of 261 solid waste collection operations; 135 transfer stations; 7 intermodal facilities; 71 recycling operations; 93 active MSW, E&P, and/or non-MSW landfills; 22 E&P liquid waste injection wells; and 17 E&P waste treatment and oil recovery facilities. Waste Connections, Inc. was founded in 1997 and is based in Vaughan, Canada.

The companies that I bought this month:

The companies above complement my existing watchlist, and they are purchased when price is attractive, which is a process taking valuation (not price alone) into account. Regarding “when” to buy:

For this month, I purchased several companies. The proceeds from selling the companies that no longer meet my goals ($8,600.52) plus reinvesting the dividends from 2017 ($2,874.6) plus using the monthly amount that is always dedicated to this portfolio ($2,000), gives me a total of $13,475.12 to be invested this month.

I’ve decided to purchase the following companies using this cash – I chose 13 companies to either average down or start new positions, so I’ll be allocating $1,036.54 for each company. The investing performance spreadsheet has been updated accordingly, including the information related to the companies that increased dividends this year so far.

I’ve added positions / initiated new positions on the following stocks, allocating the amount specified above:

On the next post I’ll post the same analysis for my US DGI portfolio, and after that, I’ll elaborate the details of my automated screening process.

Happy Investing!

Sorry for the newb question, but what does GDF mean in some of those charts (The Orange lines)? (GDF….P/E = G) Price/Earnings (Growth Discount Factor) of some sort?

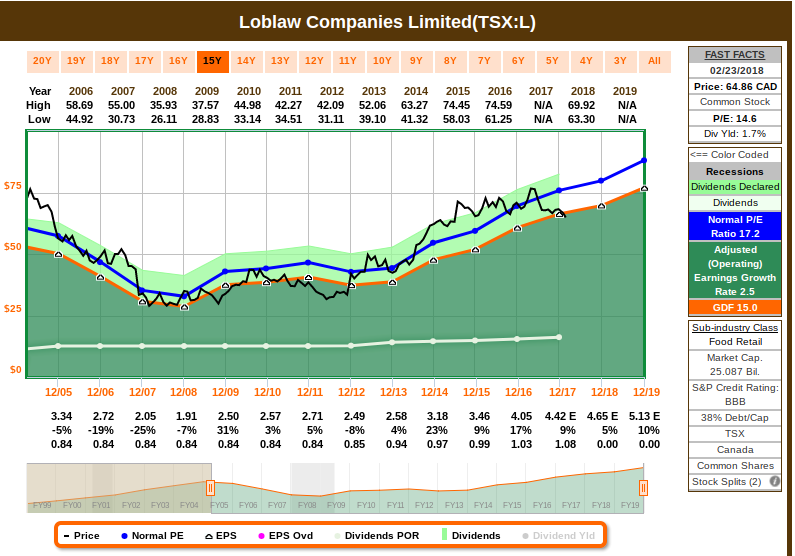

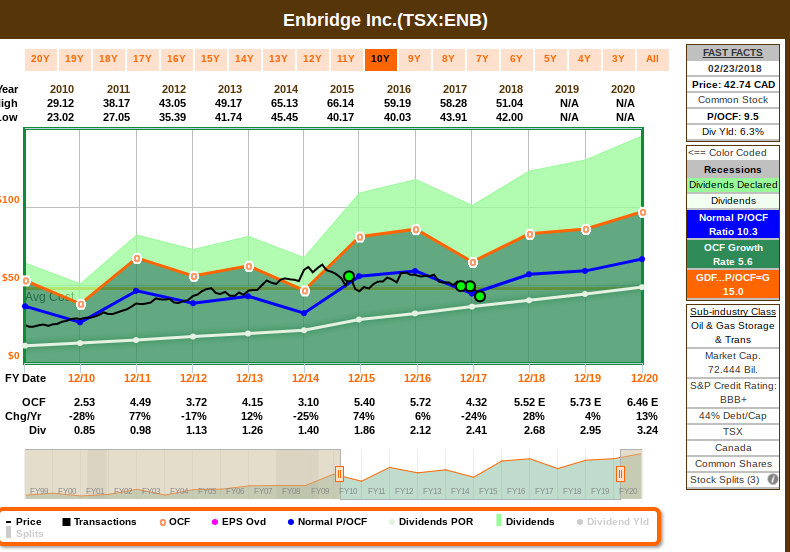

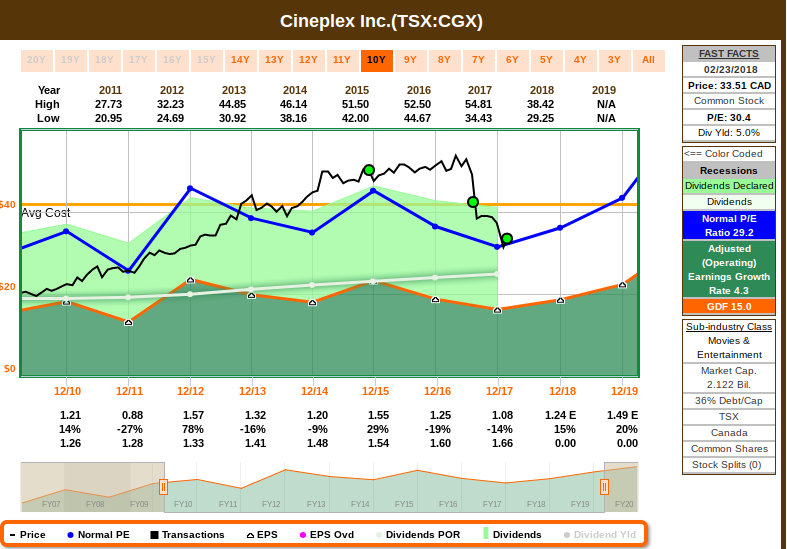

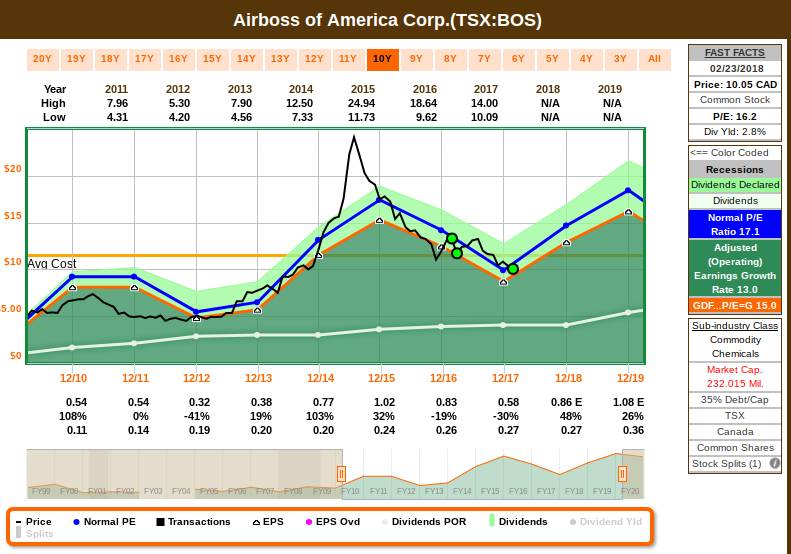

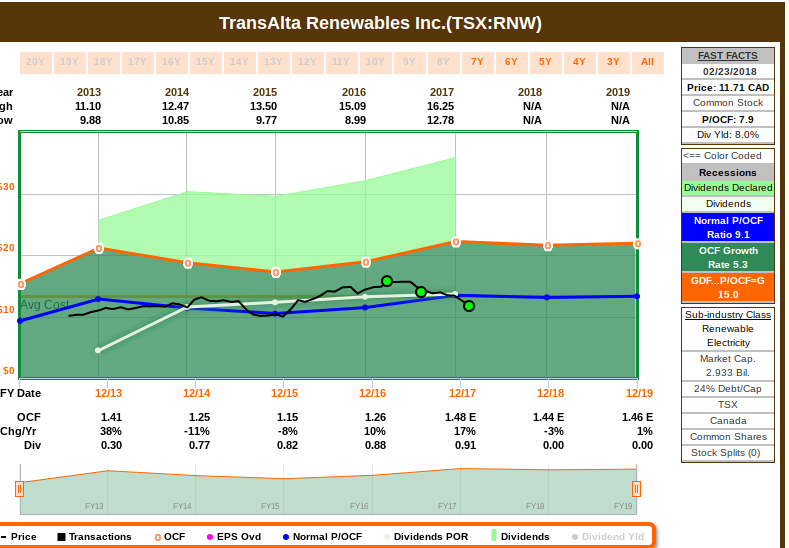

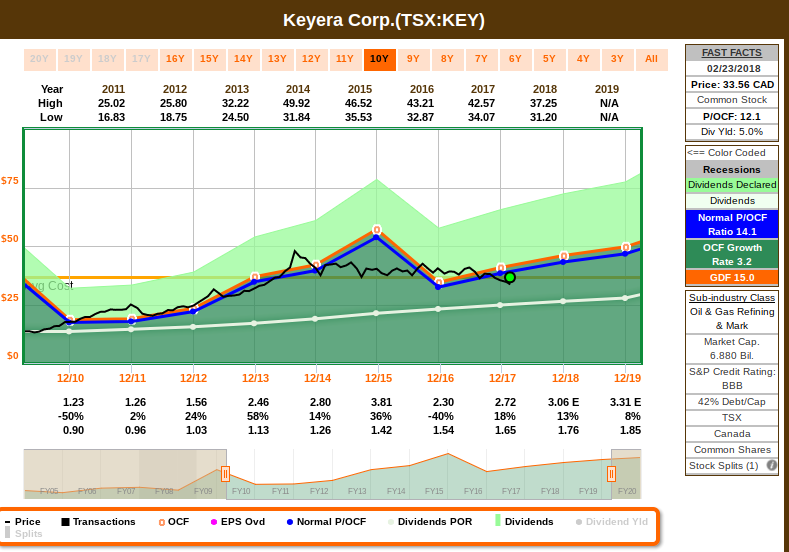

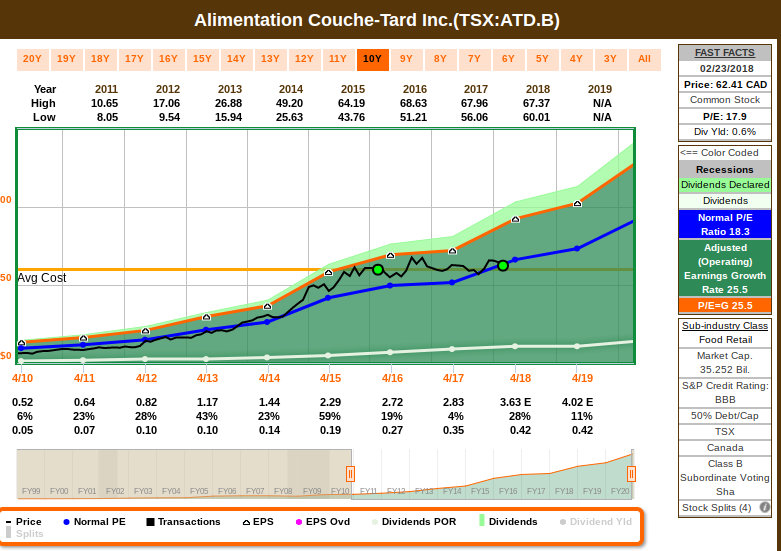

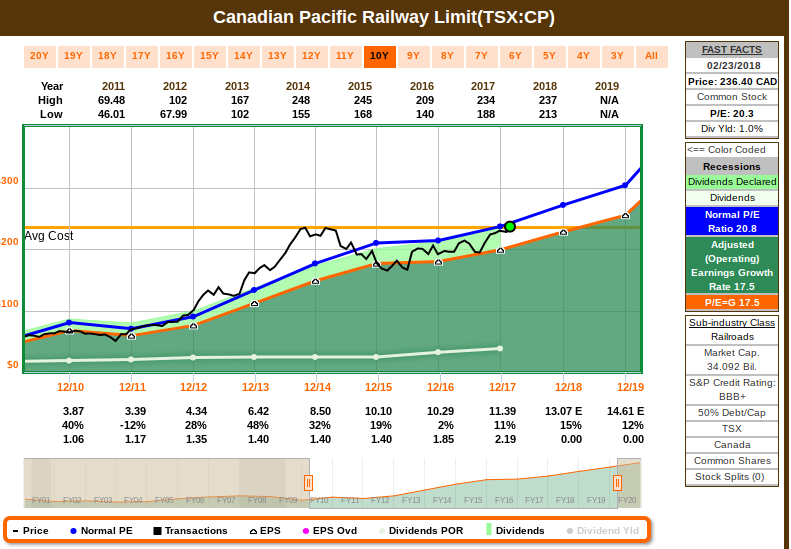

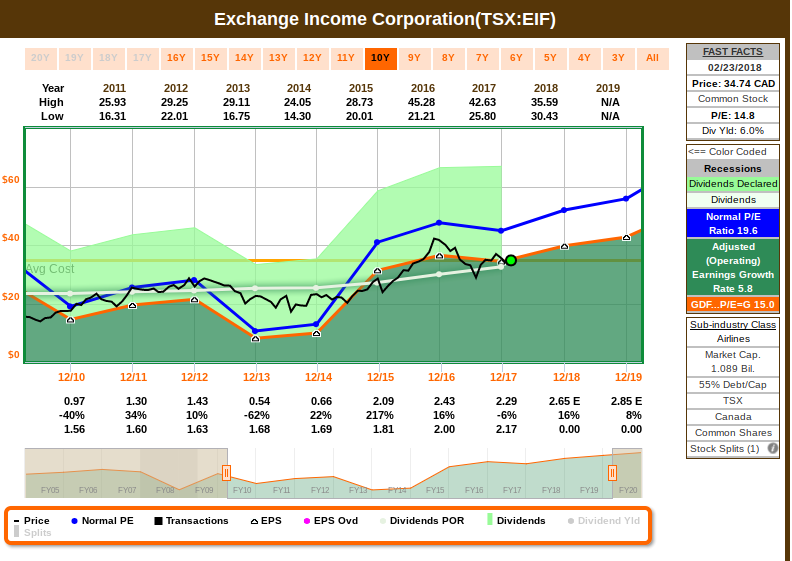

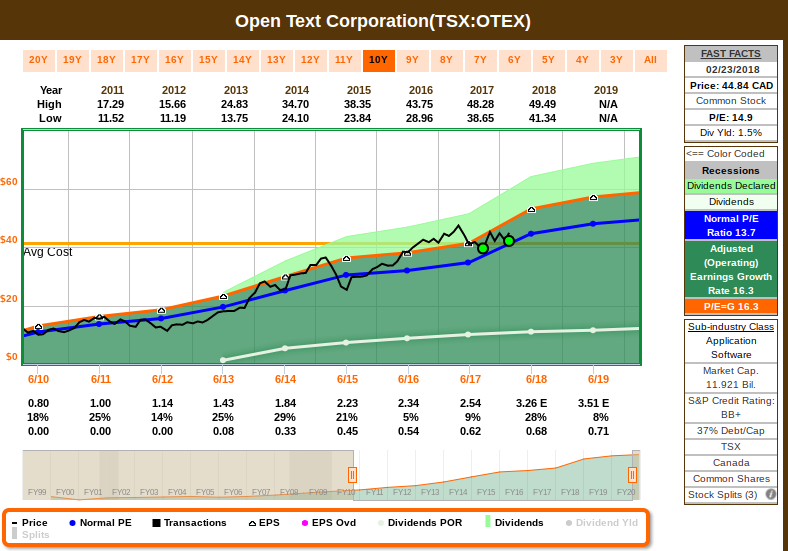

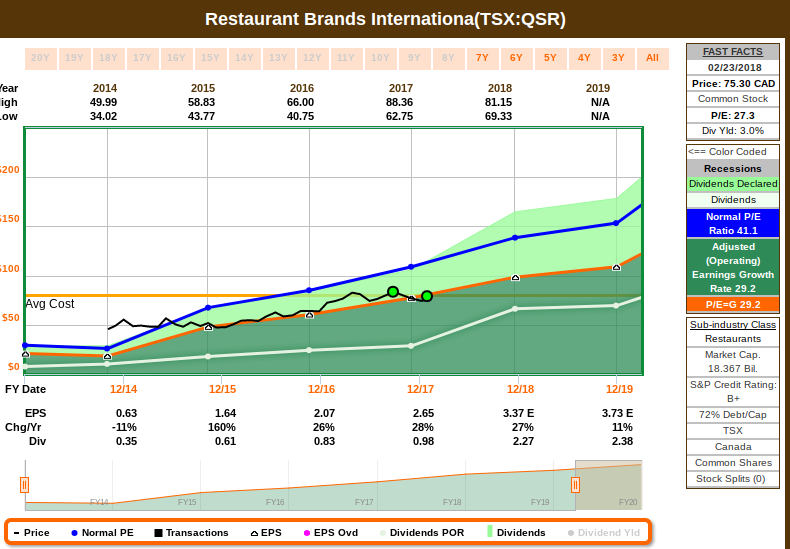

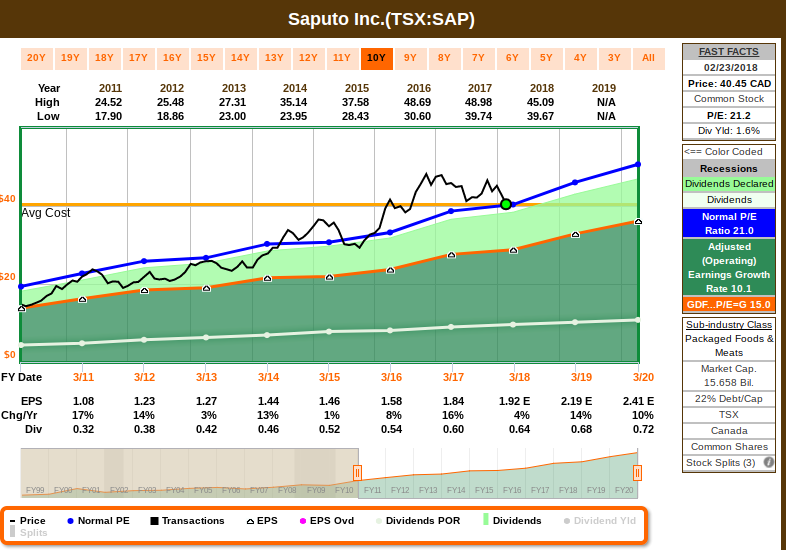

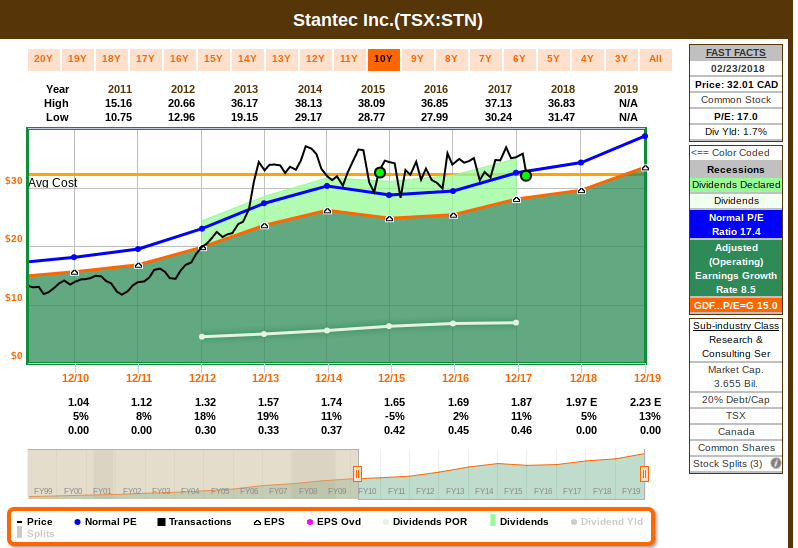

I use FAST Graphs to easily draw the earnings information, which is available on each public traded company’s website. FAST Graphs uses essentially three formulas to determine the intrinsic value of a business. These consist of two widely-accepted formulas, and the third formula is an extrapolation between the two.

GDF – Formula #1: This is Ben Graham’s famous formula for valuing a business and is used for companies with earnings growth of 5% or less. This is the basic formula: V*= EPS x (8.5+2g). When this formula is utilized we designate it as such to the right of the graph in orange lettersGDF, which stands for Graham Dodd Formula. This formula will compute a minimum P/E of 8.5 and maximum P/E of 18.5 depending on the growth rate of the prospective company (0% to 5%). However, for consistency, FAST Graphs caps the P/E ratio to 15 when utilizing this formula.

P/E=G – Formula #2: Our second formula is the classic P/E=G (P/E equals earnings growth rate) and when this formula is used it is designated in the orange box P/E=G. This formula is used for faster growing companies showing earnings growth of 15% or better.

GDF…P/E=G – Formula #3: Our third formula is designated GDF…P/E=G which stands for Graham Dodd Formula-P/E equals growth, to distinguish it from the other two. This is an extrapolation between the pure GDF and P/E=G. This formula is used for companies growing earnings of 5% to 15% (5.01% to 14.99%). This represents a range that the average company falls in. Therefore, when this formula is used, a straight 15 multiple (P/E = 15) representing average will compute.

To summarize, the GDF formula is used for companies growing at 5% or less, the P/E=G formula is used for earnings growth of 15% or better, and the GDF…P/E=G extrapolated formula is used for growth rates between 5% to 15%.