It’s been 3 months since my last purchases, as other projects continue to keep me very busy. But that’s the beauty of dividend growth, the monthly cash that I set aside keeps piling in and now that I have some time, I can deploy them to further partner with businesses that are trading at a reasonable price.

I typically set aside $2,000 per month (for each Canadian and US portfolios), so I will deploy C$6,000 and US$6,000 accordingly. Furthermore, I sold the remaining of my MAXR holdings and will add that bit ($373.8) to the C$6,000 available so far. This is the second time that I sell my shares at a significant loss (first time was with Home Capital Group), and in both cases it’s very unfortunate that these businesses, which once had stellar earnings and cash flow tracking record for many years, deteriorated fundamentals so fast. But it happens, and it will happen again. This is what a diversified portfolio is for – even with these losses, the portfolio as a whole continued to produce higher income year over year, and if I ever need to liquidate it today, I’d still have a profit overall. For this reason, I don’t let the mistakes that will happen from time to time to influence the approach to seek to partner with quality companies at an attractive valuation.

My April 2019 purchases for the Canadian portfolio:

For this month, I’m adding to 2 existing positions and I’m starting a new position – Rogers Communications – which finally has an opportunity to be purchased at a reasonable valuation.

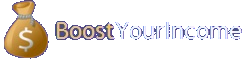

My first purchase is to add to Canadian Pacific (CP.TO).

Canadian Pacific Railway Limited, together with its subsidiaries, owns and operates a transcontinental freight railway in Canada and the United States. The company transports bulk commodities, including grain, coal, potash, fertilizers, and sulphur; and merchandise freight, such as energy, chemicals and plastics, metals, minerals and consumer, automotive, and forest products. It also transports intermodal traffic comprising retail goods in overseas containers. The company offers rail and intermodal transportation services through a network of approximately 12,500 miles serving business centers in Quebec and British Columbia, Canada; and the United States Northeast and Midwest regions. Canadian Pacific Railway Limited was founded in 1881 and is headquartered in Calgary, Canada.

CP is estimated to grow earnings by double digits, so considering how CP is trading at a lower multiples I believe this a good opportunity to add while maintaining a decent margin of safety. Although Q1 / FY19 saw lower volume growth due to weather conditions, industry consensus is that the volume will be pushed to Q2 and Q3 – which aligns with management’s confirmation that the outlook for double digits earnings growth hasn’t changed. CP (as well as CNR) should benefit from contract wins, port expansions which increases volume and from the volume of commodities that are not as cyclical. CP is also estimated to continue to rise dividends at a very attractive growth rate.

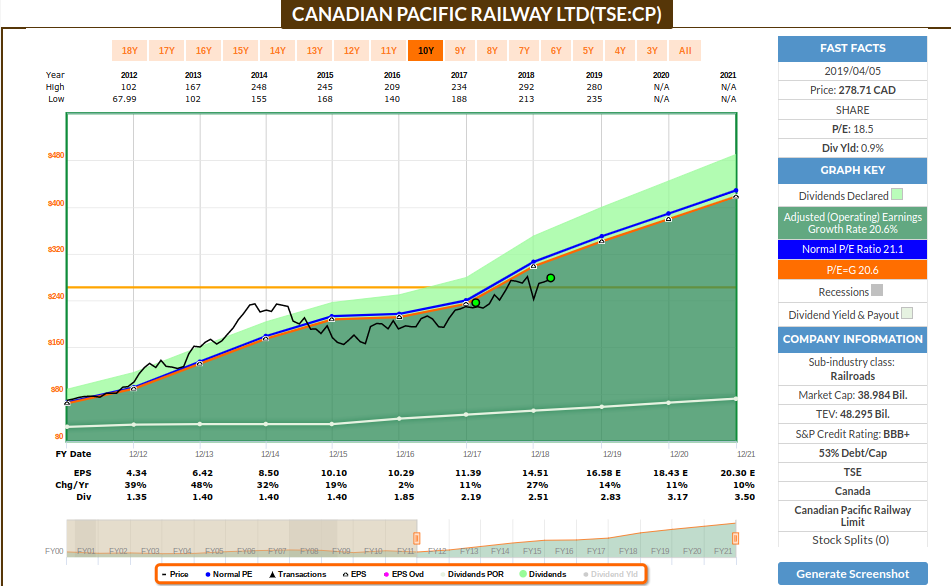

My next purchase was to add to IA Financial (IAG.TO).

iA Financial Corporation Inc., through its subsidiary, Industrial Alliance Insurance and Financial Services Inc., provides various life and health insurance products in Canada and the United States. The company operates through Individual Insurance, Individual Wealth Management, Group Insurance, Group Savings and Retirement, US Operations, and Other segments. It offers various individual insurance products and services, including life, car, leisure vehicle and RV, home, mortgage, critical illness and disability, personal accident, travel, and other group insurance products; residential mortgage loans, registered retirement savings plan loans, registered education savings plan loans, and investment loans; and savings and retirement products. The company also provides group insurance products and services, including medical and paramedical care, homecare, vision and dental care, life insurance and accidental death and dismemberment, short and long-term disability, and travel insurance products; distinctive and administrators services; special market solutions; group retirement plans; investment solutions; fund governance; dealer services for various insurance products; and multi-residential and commercial mortgages, as well as leases space. In addition, it offers individual insurance and individual savings financial security, group retirement plan, and securities, advisory services; group insurance advisory and brokerage services; special risk insurance and group insurance, mortgage, real estate, and deposit brokerage services; and advisory and brokerage services for lawyer or notary, and automobile and recreational vehicle dealers. The company was founded in 1892 and is headquartered in Quebec, Canada.

IAG price has been declining even though they are estimated to continue to grow earnings, presenting a nice opportunity to add further. Continued execution from management and positive resolution on litigation could help with the current multiples that they’re trading on. IAG released its 2019 EPS guidance range of $5.75-$6.15, with the mid-point implying 10% growth. Regarding litigation, the Saskatchewan Court of Queen’s Bench dismissed, in its entirety, the application commenced by Ituna Investment LP against IAG. In addition, IAG has multiple actions planned to achieve its 2019 guidance: profit improvement across six unique items is expected to contribute 6 points of growth. Distribution acquisitions that have already been completed are expected to add 3 points of growth, including efficiency gains and synergies. Share repurchases are budgeted for up to 1 point of growth. Run-rate organic growth of 6% is effectively offset by lower starting AUM. The wide range of growth drivers reduces risk that growth will fall far from the mark. The capital story continues to improve. The LICAT ratio was up 7 points Q/Q on last earnings, and organic capital generation is now expected to be $250MM-$300MM versus $200MM previously estimated. For these reasons, I believe that IAG is priced attractively and estimated to continue to grow earnings and dividends at a decent pace.

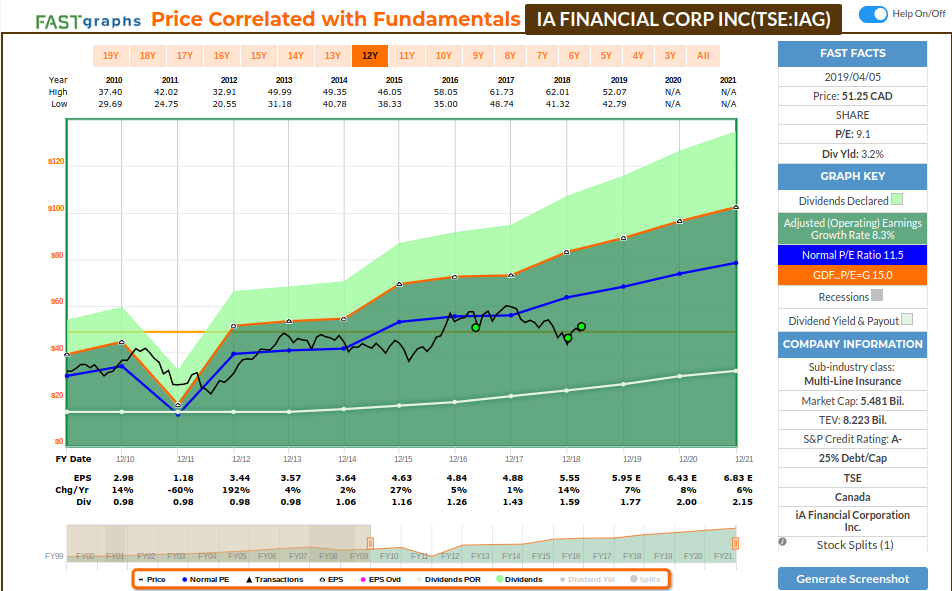

My next purchase was to start a new position with Rogers Communications (RCI.B.TO), on this portfolio.

Rogers Communications Inc. operates as a communications and media company in Canada. It operates through three segments: Wireless, Cable, and Media. The Wireless segment offers wireless voice and data communication services to individual consumers, businesses, governments, and other telecommunications service providers; postpaid and prepaid wireless services under the Rogers, Fido, and chatr brands; and wireless devices, services, and applications to consumers and businesses. It provides its services to approximately 10.8 million subscribers. The Cable segment provides high-speed Internet, television, voice communication, and smart home monitoring services to consumers, businesses, governments, and wholesale resellers; and operates a transcontinental fiber-optic network that extends approximately 70,000 route kilometers, which provides voice and data communications and advanced services, including data centers and cloud computing to the enterprise, public sector, and carrier wholesale markets. Its service territory covers approximately 4.4 million homes. The Media segment owns the Toronto Blue Jays league baseball team and the Rogers Centre event venue; and offers television and radio broadcasting, multi-platform shopping experience, digital media, and publishing services. Rogers Communications Inc. was founded in 1920 and is based in Toronto, Canada.

Rogers Communications is Canada’s leading wireless service provider and has historically had arguably the best cable network in Canada’s most populous province, Ontario. It also has media operations and owns several valuable sports assets, including the Toronto Blue Jays and the Sportsnet television stations. But competition is increasing rapidly for Rogers, with Freedom Mobile’s ambition to become a national wireless competitor, and with BCE’s fiber-to-the-home buildout. Time will tell how management will react to the landscape changing around them and adapt accordingly. During last quarter results, management provided guidance of 3%-5% revenue growth and 7%-9% adjusted EBITDA growth. I believe the present valuation is reasonable and although growth is estimated to slow down and competition to continue to increase, Rogers belong to a defensive sector that provides good diversification, and they have a solid tracking record in delivering constant dividend growth in any conditions. I believe the 3 main Canadian telecom companies (BCE, Telus and Rogers) are a must for any DGI portfolio, and I think RCI.B is reasonably priced.

My April 2019 purchases for the US portfolio:

For this month, I’m adding to 4 existing positions and I’m starting 2 new positions – Qualcomm and T Rowe Price Group.

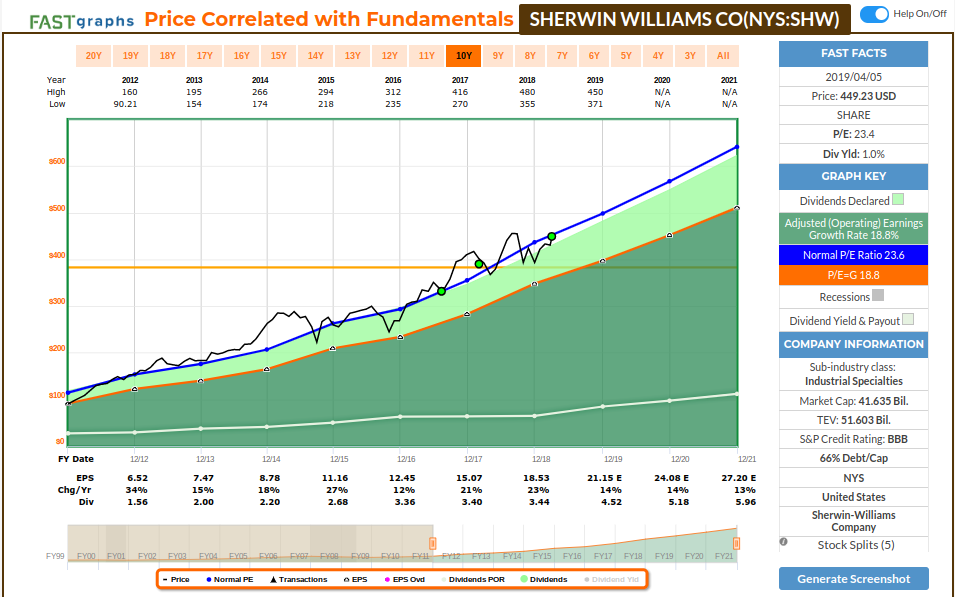

My first purchase is to add Sherwin-Williams Co. (SHW) to my existing position.

The Sherwin-Williams Company develops, manufactures, distributes, and sells paints, coatings, and related products to professional, industrial, commercial, and retail customers. It operates in three segments: The Americas Group, Consumer Brands Group, and Performance Coatings Group. The Americas Group segment offers architectural paints and coatings, and protective and marine products, as well as OEM product finishes and related products for architectural and industrial paint contractors and do-it-yourself homeowners. The Consumer Brands Group segment provides branded and private-label architectural paints, stains, varnishes, industrial products, wood finishes products, wood preservatives, applicators, corrosion inhibitors, aerosols, caulks, and adhesives to retailers and distributors. The Performance Coatings Group segment develops and sells industrial coatings for wood finishing and general industrial applications, automotive refinish products, protective and marine coatings, coil coatings, packaging coatings, and performance-based resins and colorants. It serves retailers, dealers, jobbers, licensees, and other third-party distributors through its branches and direct sales staff, as well as through outside sales representatives. The company has operations primarily in North and South America, the Caribbean, Europe, Asia, and Australia. As of February 19, 2019, it operated approximately 4,900 company-operated stores and facilities. The company was founded in 1866 and is headquartered in Cleveland, Ohio.

SHW is nicely positioned to continue to grow earnings and dividends, and current price is aligned with the historical multiple justifying such growth rate. As the largest supplier of architectural coatings in the United States with approximately a third of the market, Sherwin-Williams is the go-to provider of premium paint for contractors in the industry. As housing starts rebound over the next few years, they should propel sales for the company to record levels. Looking at the latest quarterly results, the Americas Group and Consumer Brands segments, both focused on architectural coatings, were the hardest hit. However, management still expects stronger consolidated sales growth of 4%-7% and adjusted EPS growth of 12.8% for 2019. According to one of the firms covering SHW, the professional segment will continue to expand share, creating a larger market for this company. Professional painting benefits from demographic tailwinds. The professional painter share has increased from 40% of the industry two decades ago to approximately 60% of the $7 billion U.S. paint market today. Residential repainting makes up two thirds of paint volume. Homeowners view repainting as a low-cost, high-return way of increasing the value of their home, especially before selling the property. Older homeowners tend to hire professional painters’ services. As the share of homeowners who are 60 and older has increased from a third in the 1980s to around 40% today, the professional painter has taken a greater share of the market. We believe this demographic trend will continue over the next decade due to the aging baby boomer population, with the 60 and older segment growing to 46% by 2024. Sherwin-Williams is well positioned to take advantage of this trend, given its strong foothold in the South and Southeast, which are aging more quickly than the rest of the country.

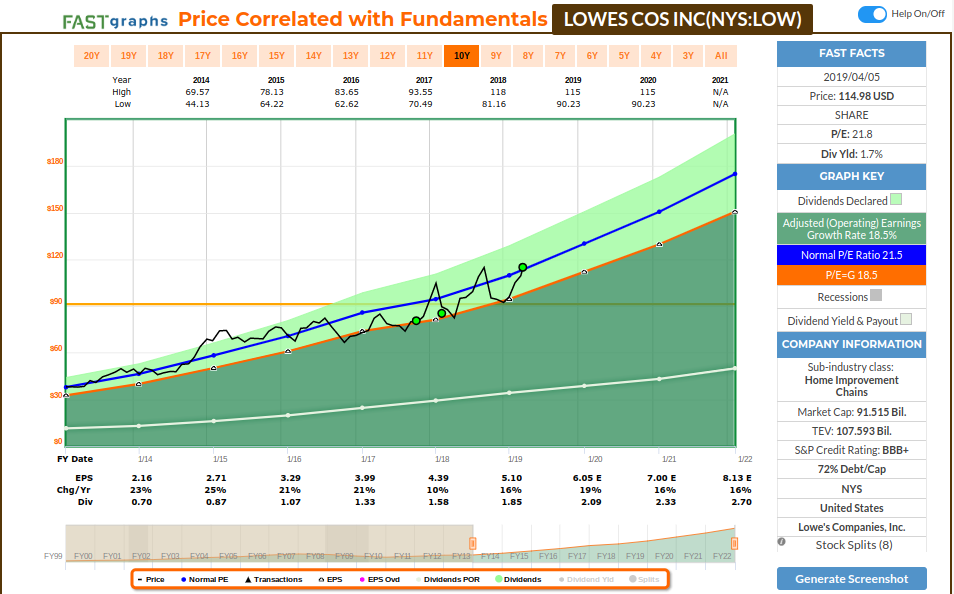

My second purchase is also housing related, which should benefit further as housing improves, so I’ve added more Lowe’s (LOW) shares to my existing position.

Lowe’s Companies, Inc., together with its subsidiaries, operates as a home improvement retailer in the United States, Canada, and Mexico. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It provides home improvement products in various categories, such as lumber and building materials, appliances, seasonal and outdoor living, tools and hardware, fashion fixtures, rough plumbing and electrical, paint, millwork, lawn and garden, flooring, and kitchens. It also offers installation services through independent contractors in various product categories; extended protection plans; and in-warranty and out-of-warranty repair services. The company sells its national brand-name merchandise and private branded products to homeowners, renters, and professional customers. As of February 1, 2019, it operated 2,015 home improvement and hardware stores. The company also sells its products through online sites comprising Lowes.com and Lowesforpros.com; and through mobile applications. Lowe’s Companies, Inc. was founded in 1946 and is based in Mooresville, North Carolina.

Lowe’s are in the middle of a transformation, started when the new CEO took helm and re-arranged how top management is structured. Management is targeting a long-term operating margin of 12% and returns on invested capital of 35%, with 9.6% operating margin expected in 2019. A relatively stable housing market, consumer confidence, and rising household formations should lead consumers to spend more in the home improvement category supporting sales growth and expense leverage. Management also suggested that the recent initiatives to improve the supply chain and inventory management and the actions to unwind underperforming Orchard Supply and Lowe’s locations will help to position the company to focus on productivity and profitability at the core business by expanding operating margins.

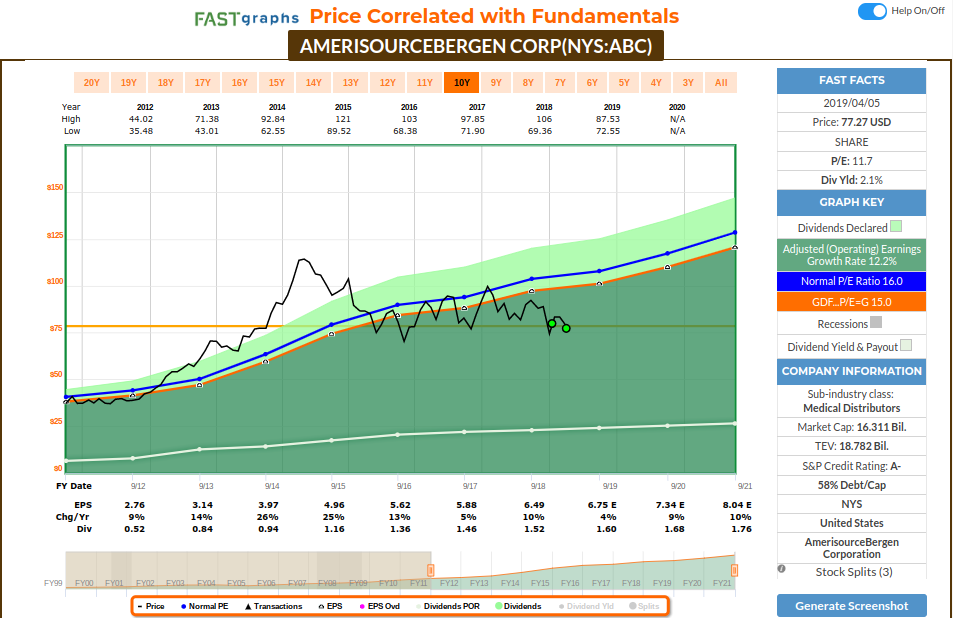

My next purchase was to add further positions to AmerisourceBergen Corporation (ABC).

AmerisourceBergen Corporation sources and distributes pharmaceutical products in the United States and internationally. Its Pharmaceutical Distribution segment distributes brand-name and generic pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, outsourced compounded sterile preparations, and related services to various healthcare providers, including acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, long-term care and other alternate site pharmacies, and other customers. It also provides pharmacy management, staffing, and other consulting services; supply management software to retail and institutional healthcare providers; and packaging solutions to various institutional and retail healthcare providers. In addition, this segment distributes plasma and other blood products, injectable pharmaceuticals, vaccines, and other specialty products; provides other services primarily to physicians who specialize in various disease states, primarily oncology, as well as to other healthcare providers, including hospitals and dialysis clinics; and offers data analytics, outcomes research, and additional services for biotechnology and pharmaceutical manufacturers. The company’s Other segment provides integrated manufacturer services, such as clinical trial support, product post-approval, and commercialization support; offers specialty transportation and logistics services for the biopharmaceutical industry; and sells pharmaceuticals, vaccines, parasiticides, diagnostics, micro feed ingredients, and various other products to customers in both the companion animal and production animal markets, as well as provides demand-creating sales force services to manufacturers. AmerisourceBergen Corporation was founded in 1985 and is headquartered in Chesterbrook, Pennsylvania.

ABC has a very reliable cash flow, an excellent credit rating and solid tracking record of earnings and dividend growth, so any opportunities where price looks disconnected from that operating growth is worth a look. The main driver of the stock price decline are the fears of lower sales volume if the US federal government were to implement scaled-back healthcare legislation or pricing controls. Although this is a possibility, ABC is worth more than 11.7 earnings multiples, being a major pharmaceutica distributor with over $100 billion in annual revenue. The pharmaceutical industry will continue to grow and ABC’s massive scale will benefit from that growth. AmerisourceBergen is one of three large pharmaceutical distributors and is the main supplier to large pharmacy outlets Walgreens and Express Scripts’ mail order pharmacy. The firm has a highly integrated strategic agreement with Walgreens where it supplies all of the retail pharmacy’s drug inventory, including generics, being one of the biggest generic drug retailers. Furthermore, AmerisourceBergen, Cardinal Health, and McKesson have a combined market share of well over 90%, making difficult for new competitors to become a threat. Over the course of fiscal 2018, the management team did an excellent job integrating approximately 1,900 Rite Aid stores into its distribution operations, reflecting the strong scale, leverage, and efficiency that have been built through the last several years. AB is also well positioned to enjoy the tailwind of this industry, as an aging U.S. population, an influx of previously uninsured people into the healthcare market, and greater use of pharmaceuticals as a front-line treatment should provide a platform for solid top-line and bottom-line growth. Given their size, efficiency, and projected growth, I believe the current price is a great opportunity.

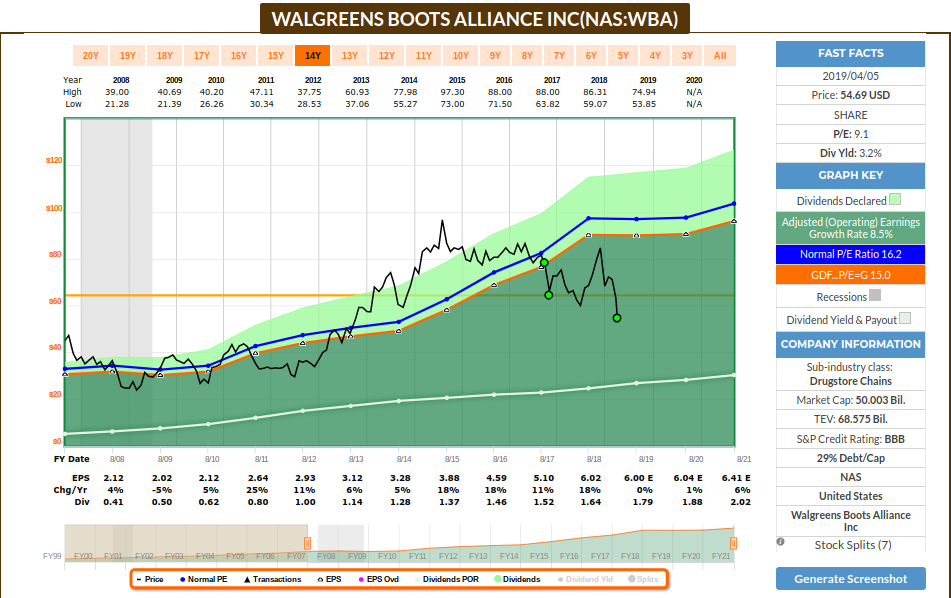

The next purchase is to add more positions in an industry facing similar issues, Walgreens Boots Alliance (WBA).

Walgreens Boots Alliance, Inc. operates as a pharmacy-led health and wellbeing company. It operates through three segments: Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical Wholesale. The Retail Pharmacy USA segment sells prescription drugs and an assortment of retail products, including health, beauty, personal care, consumable, and general merchandise products through its retail drugstores and convenient care clinics. It also provides specialty pharmacy services and mail services; and manages in-store clinics. As of August 31, 2018, this segment operated 9,560 retail stores under the Walgreens and Duane Reade brands in the United States; and 7 specialty pharmacies, as well as approximately 400 in-store clinic locations. The Retail Pharmacy International segment sells prescription drugs; and health, beauty, personal care, and other consumer products through its pharmacy-led health and beauty stores and optical practices, as well as through boots.com and an integrated mobile application. This segment operated 4,767 retail stores under the Boots, Benavides, and Ahumada in the United Kingdom, Thailand, Norway, the Republic of Ireland, the Netherlands, Mexico, and Chile; and 618 optical practices, including 167 on a franchise basis. The Pharmaceutical Wholesale segment engages in the wholesale and distribution of specialty and generic pharmaceuticals, health and beauty products, and home healthcare supplies and equipment, as well as provides related services to pharmacies and other healthcare providers. This segment operates in the United Kingdom, Germany, France, Turkey, Spain, the Netherlands, Egypt, Norway, Romania, the Czech Republic, and Lithuania. The company has a strategic partnership with Microsoft Corporation. Walgreens Boots Alliance, Inc. was founded in 1901 and is based in Deerfield, Illinois.

Wallgreens is facing a lot of pressure from increasing and direct competition from mass grocers and retailers; furthermore, the heavy dependence on nonpharmaceutical products is hurting their results for some time. However, I believe that time and patience is required to determine if management can react and adapt accordingly. Walgreens is the largest retail pharmacy (it processed around 20% of total US prescriptions), with approximately 10,000 US – based stores. It’s been a leader within the pharmaceutical supply chain for many decades, and with the acquisition of Europe-based Alliance Boots, the firm now scales as a global retail player. Dividends will continue to grow while we wait. Some analysts are skeptical of WBA’s strategy to drive sales volume through consolidation and selling more nonnpharmaceutical products, as WBA will be competing with stronger retailers in that space. Time will tell if the acquisition of Rite-Aid’s store can increase the same-store numbers. Although management continues to aggressively repurchase shares (share count is down 6.5%), WBA missed results last quarter, driving negative sentiment further. Management anticipates low to mid-single-digit growth in fiscal 2020 with the implementation of internal initiatives to offset reimbursement pressures and to increase volumes. For longer term, management will invest roughly $1 billion over three years to transform stores into destinations with improved digitization and product offerings (40% toward digitalization). Further, cost management initiatives and store optimizations are anticipated to contribute $1.5 billion in annual savings by 2022.

There are many articles that suggest that WBA’s is currently a value trap, not a value opportunity, as the negative sentiment increases (pricing pressure from pharmamcy customers, competition from retailers and dependency on nonpharma products). In response, Walgreens has sought to enhance its own supplier purchasing power by acquiring Alliance Boots (a major European pharmaceutical retailer and distributor), partnering with AmerisourceBergen (a major U.S. pharmaceutical distributor), and purchasing half of Rite Aid’s retail locations. The opportunity to gain distribution efficiency and enhanced manufacturer pricing leverage with these relationships will be a positive for Walgreens. However, these partnerships were in direct response to pricing pressure the firm is facing from large payers, and some analysts believe that a strategic response is required, along the lines of building its own supplier negotiating power and potentially gaining better manufacturer pricing. WBA carries more risks, and time will tell how management will succeed at growing ROIC again.

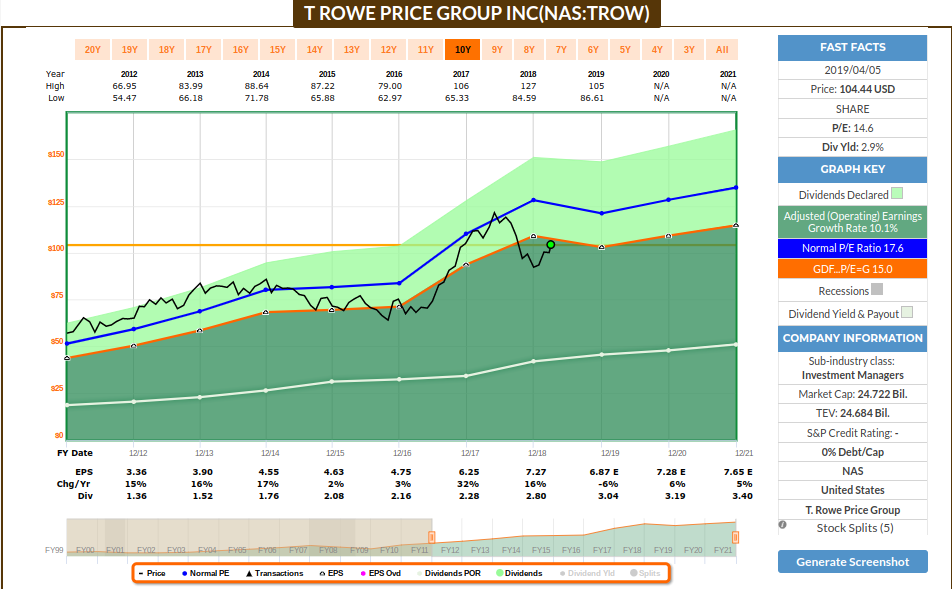

My next purchase was to initiate a position on T. Rowe Price Group (TROW).

T. Rowe Price Group, Inc. is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe. It employs fundamental and quantitative analysis with a bottom-up approach. The firm utilizes in-house and external research to make its investments. It employs socially responsible investing with a focus on environmental, social, and governance issues. It makes investment in late-stage venture capital transactions and usually invests between $3 million and $5 million. The firm was previously known as T. Rowe Group, Inc. and T. Rowe Price Associates, Inc. T. Rowe Price Group, Inc. was founded in 1937 and is based in Baltimore, Maryland, with additional offices in Colorado Springs, Colorado; Owings Mills, Maryland; San Francisco, California; Tampa, Florida; Toronto, Ontario; Hellerup, Denmark; Amsterdam, The Netherlands; Luxembourg, Grand Duchy of Luxembourg; Zurich, Switzerland; Dubai, United Arab Emirates; London, United Kingdom; Sydney, New South Wales; Hong Kong; Tokyo, Japan; Singapore; Frankfurt, Germany, Madrid, Spain, Milan, Italy, Stockholm, Sweden, Melbourne, Australia, and Amsterdam, Netherlands.

TROW has been overvalued since the end of 2016, so I’m happy to start a position now it has reached a fair price, considering the future estimated growth and the current multiples. With $962.3 billion in total AUM at the end of 2018, T. Rowe Price is one of the larger U.S.-based asset managers. Retirement accounts and variable annuity investment portfolios account for two thirds of the firm’s managed assets. However, they face revenue pressure during periods of market volatility. Last quarter results show that while average AUM was up 3.6% year over year during the December quarter, T. Rowe Price reported only a 0.6% increase in revenue compared with the prior year’s period (due primarily to a 13.1% decline in administrative, distribution, and servicing fees, as well as a lowering of its overall effective fee rate to 0.464% from 0.471%). As for profitability, full-year adjusted operating margins of 43.7% were 125 basis points higher than 2017 levels. For this year, TROW estimates low- to mid-single-digit AUM growth on average, with organic growth averaging close to 2% annually and revenue expanding at a 3.2% CAGR. TROW’s biggest advantage over peers has been the level and consistency of its investment performance. In addition, benefiting from a steady stream in investor inflows into defined contribution and other retirement plans, the firm has recorded net long-term outflows in only 14 calendar quarters during the past two decades. Furthermore, the firm’s cost-conscious culture and stable AUM and revenue levels have allowed it to consistently generate operating margins in excess of 40%, providing them a solid model to generate a more stable revenue, profitability, and cash flows than its peers.

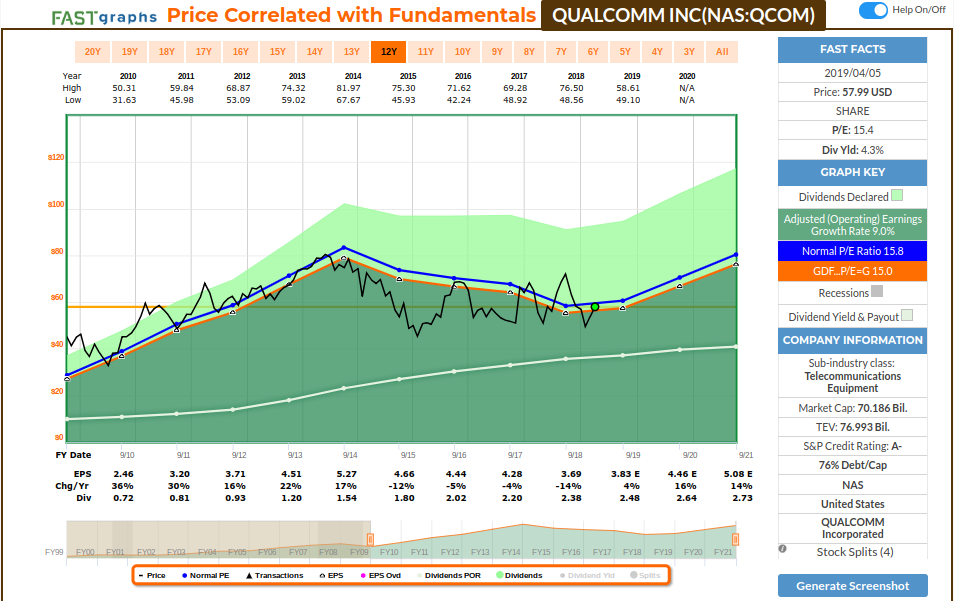

My last purchase for this month is a new position into Qualcomm (QCOM).

QUALCOMM Incorporated designs, develops, manufactures, and markets digital communication products worldwide. It operates through three segments: Qualcomm CDMA Technologies (QCT); Qualcomm Technology Licensing (QTL); and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on code division multiple access (CDMA), orthogonal frequency division multiple access, and other technologies for use in wireless voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses or provides rights to use portions of its intellectual property portfolio, which include various patent rights useful in the manufacture and sale of wireless products comprising products implementing CDMA2000, wideband CDMA, CDMA time division duplex, long term evolution, and/or fifth generation standards and their derivatives. The QSI segment invests in early-stage companies in various industries, including automotive, Internet of things, mobile, data center, and healthcare for supporting the design and introduction of new products and services for voice and data communications, and new industry segments. The company also provides products and services for mobile health; products designed for the implementation of small cells; development, and other services and related products to the United States government agencies and their contractors; and software products, and content and push-to-talk enablement services to wireless operators. In addition, it licenses chipset technology, and products and services for use in data centers. QUALCOMM Incorporated was founded in 1985 and is headquartered in San Diego, California.

I like QCOM’s operating model to collect royalty income on the majority of 3G and 4G handsets sold, as it holds virtually all essential patents used in these networks. That, paired with a good tracking record to grow earnings, cash flow and dividends reflect a good execution leveraging the recent industry growth. I was on the sideline with QCOM due to some tailwind that could impact their business model, but now that earnings and cash flow are estimated to grow, aligned with the fact that shares are attractively priced, I think it presents a good opportunity to start a position. The biggest issues for QCOM’s licensing business are the regulatory scrutiny in US, Taiwan and South Korea, besides Apple’s lawsuit. QCOM is estimated to maintain its licensing business model and QCOM’s CEO Steve Mollenkopf also noted that management expects to reach a resolution with Apple through settlement or litigation in 2019 as additional court rulings in the U.S., China, and Germany come to fruition. QCOM’s earnings, operating cash flow, free cash flow and dividends are estimated to grow in FY19 and FY20, since these issues should be cleared out by then. Some analysts estimates that the circumstances for 5G might force Apple to settle with Qualcomm: Apple is expected to adopt 5G in 2020, but delays from Intel could push it to 2021 or beyond, as Apple doesn’t have any other alternatives for 5G modems. Samsung developed a 5G modem, as well as Qualcomm, but both has denied in supplying it to Apple (Samsung because of its tight supply and Qualcomm because of the current lawsuit). Apple does not want to lose to Qualcomm, as it wants to lower its component cost. However, lack of adequate options for 5G modem suppliers and lack of confidence in Intel could put pressure on Apple to reach a settlement with Qualcomm. Qualcomm’s estimated growth on earnings and cash flow suggests that their royalty revenue should grow along with the overall smartphone market, since it has a leading market share position in 4G LTE chipsets and relationships with every prominent smartphone maker.

Happy investing!!

Thank you so much for taking the time to go through these.

Do you have a preference on whether questions are asked on your blog comments or on the RFD forums?

I am looking at a few Canadian companies but they all seem a bit overpriced. I would appreciate your thoughts.

Imperial Oil (TSE:IMO)

TMX Group (TSE:X)

Aginco Eagle (TSE:AEM)

Toromont Industries (TSE:TIH)

Alamos Gold (TSE:AGI)

Constellation Software (TSE:CSU)

Thank you as always.

Apologies for the delay in replying, I was out of the country on vacation and my Internet access was limited. No preferences whether questions are asked here or on RFD forums, I encourage every channel for a good discussion! Give me a few days, I will run the charts later and will reply back here. Thanks!

Apologies for the delay.

Here is a quick glance about these companies:

IMO: This company is on my watchlist, so it meets my quality criteria to invest for the long term. I look to measure valuation by taking operating cash flow into account. Considering their current projects, IMO is fairly valued in my opinion:

X: Price seems to consistently follow earnings, so It seems a bit overvalued now:

AEM: Precious Metals companies are evaluated using other metrics, and since there are so many factors outside of the business competence that drives stock price, I’m not comfortable investing in this kind of industry. At a glance, AEM seems to follow cash flow, and if the projected cash flow materializes, there’s a good room potential for growth:

TIH: Good growth company, but it looks overvalued considering the projected their earnings growth, which is estimated to slow down for the next years, compared to their recent growth:

AGI: Another mining sector company, which I find very difficult to evaluate. It seems to be undervalued compared to cash flow, but these companies usually require other metrics to plot an accurate picture for valuation. In any case, it seems to have a good growth potential considering the projected cash flow – if that cash flow growth materializes:

CSU: This company also meets my quality criteria, but I consider CSU presently overvalued, from both earnings and operating cash flow perspective:

Please let me know if you have any questions.