Premium Model

Trading and Investing with ETFs and CEFs (US)Take advantage of 4 different ETF and CEF Portfolios tailored to your needs: some portfolios in this model are oriented towards investing, others in this model are oriented towards trading. These models explore opportunities using market timers, macro data, fundamentals, economic indicators and technical analysis to determine the best ETF to trade for the short term, and long term.

To add further diversification and higher income, this model also offers a portfolio of CEFs (closed-end funds) that are focused on a more conservative adjusted risk return by exposing growth through discounted NAV while investing in funds with an attractive yield.

This ETF model contains 2 Investing Portfolios and 2 Trading Portfolios.

Investing Portfolio:

This model covers the following investing Portfolios:

- ETF using Monthly Timer (US) (1 ETF)

- High Income with CEFs (US) (up to 5 ETFs)

ETF using Monthly Timer uses long term indicators for macro trends, trading directional ETFs (including leveraged ETFs) on a monthly basis. This portfolio is rebalanced monthly, always on the first business day of the month.

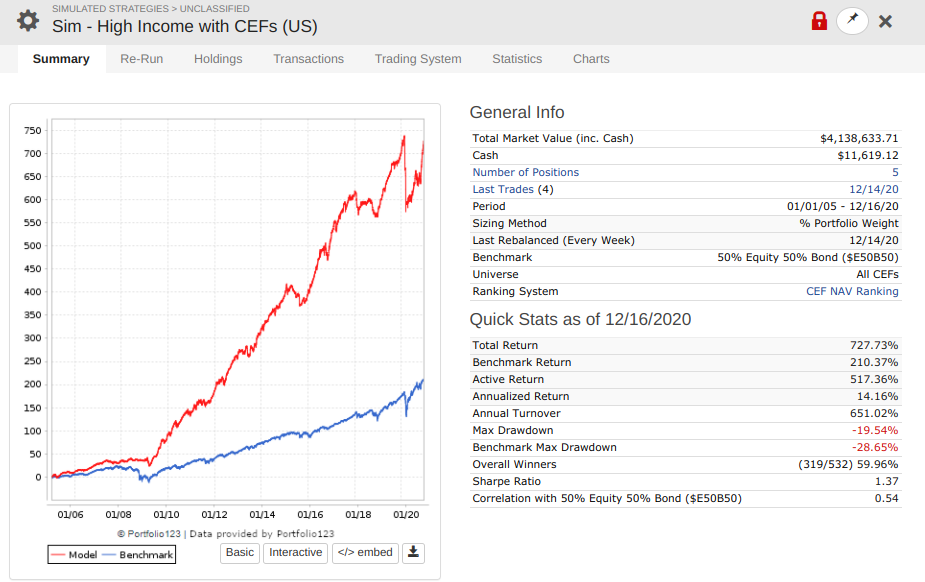

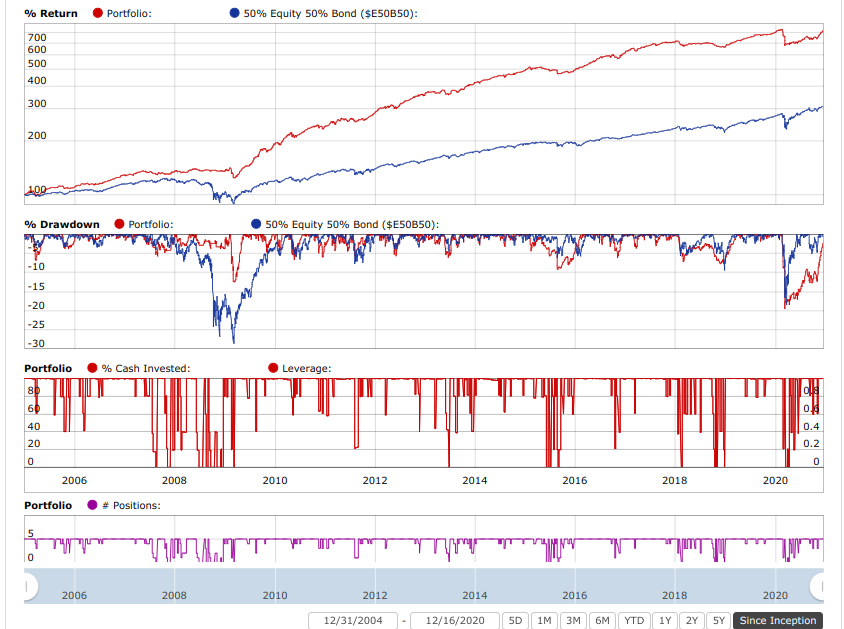

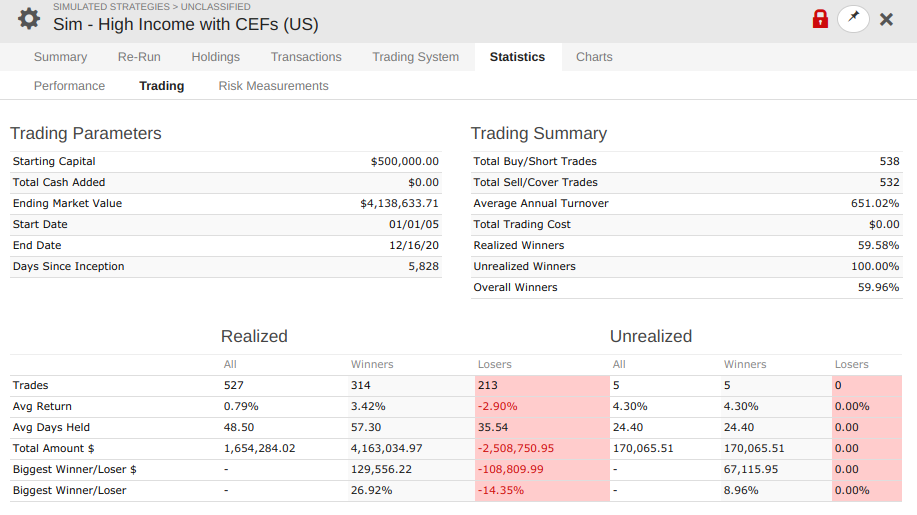

High Income with CEFs model is based on a portfolio of fixed income and other asset types, focused on high yield and discount to NAV. This portfolio is meant to replace balanced portfolio made of equities and fixed income. For this reason, the benchmark is set to emulate a portfolio made of 50% equity index and 50% bonds. This portfolio is rebalanced weekly.

These are mechanical models that chooses what to buy and sell based on a set of rules. Therefore, there will be losing trades from time to time. By no means it reflects a broken strategy. No model can outperform at all times, so it’s paramount to have the proper temperament to stick what a strategy that is aligned to your goals and risk tolerance.

Backtest results for High Income with CEFs:

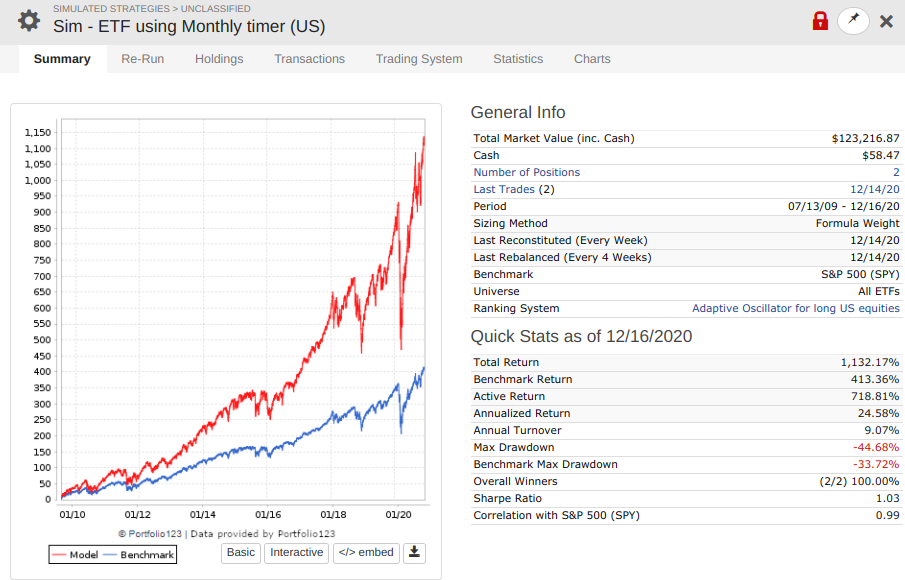

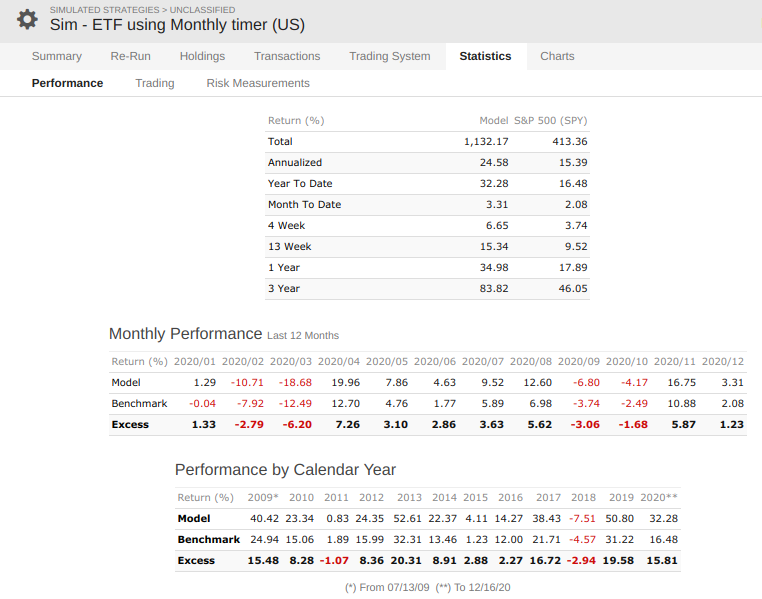

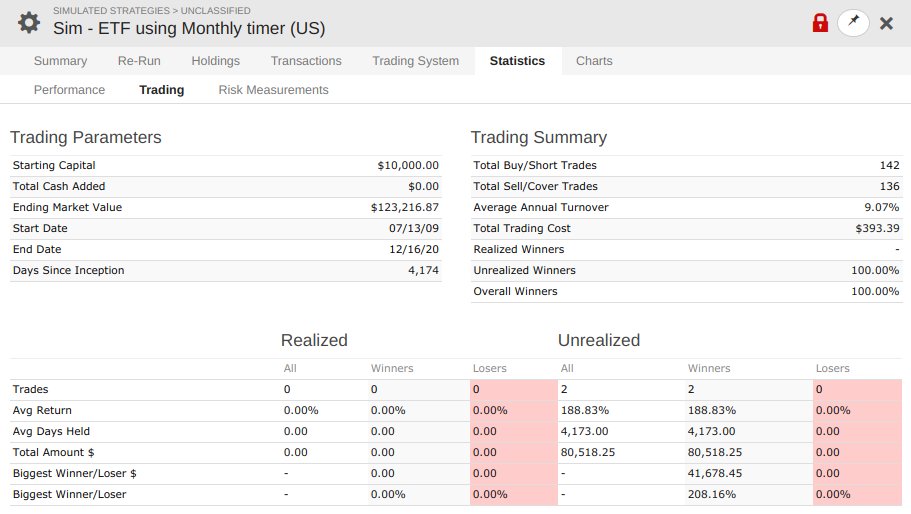

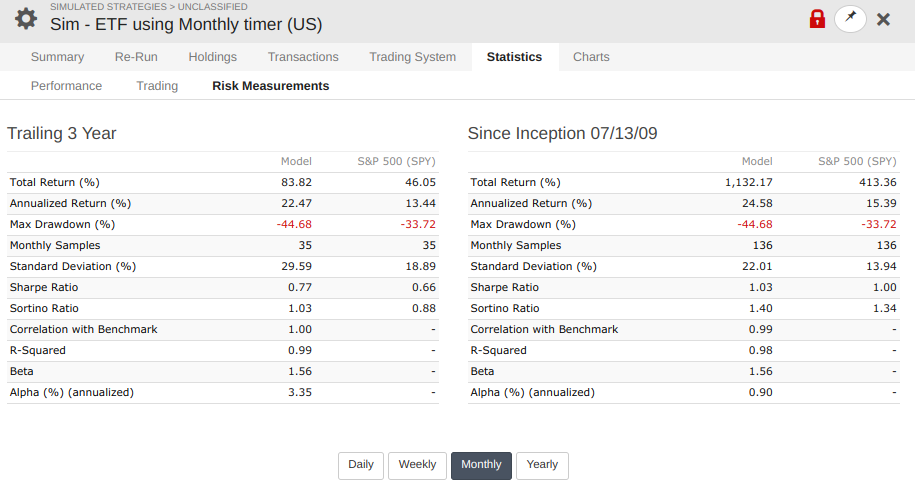

Backtest results for ETF using Monthly Timer:

Trading Portfolio:

This model also covers the following Trading Portfolios:

- ETF using Daily Timer (US) (up to 2 ETFs)

- Combined portfolio of Daily Timer and Monthly Timer (US) (up to 3 ETFs)

ETF using Daily Timer portfolio is based on short term momentum and sentiment indicators to switch between equities and fixed income. The portfolio signals are calculated daily, but notifications and rebalance are only sent when there’s an action required. Email notification for this portfolio is typically sent after market close, which is to be applied on the next business day, but it might be sent during the day (before 3pm) if it hits a stop loss level. The safest option is to verify if there’s a notification before the market closes. Daily notifications for stop losses are sent by 3pm EST (1 hour before the market closes) or it is sent after market closing hours, to be applied on next business day. Weekly notifications are sent on weekends to be applied on next business day.

Combined portfolio of Daily Timer and Monthly Timer portfolio simply combines the Daily Timer portfolio with the Monthly Timer portfolio. Email notification for this portfolio follows the same structure described for the Daily Timer with ETFs above.

These are mechanical models that chooses what to buy and sell based on a set of rules. Therefore, there will be losing trades from time to time. By no means it reflects a broken strategy. No model can outperform at all times, so it’s paramount to have the proper temperament to stick what a strategy that is aligned to your goals and risk tolerance.

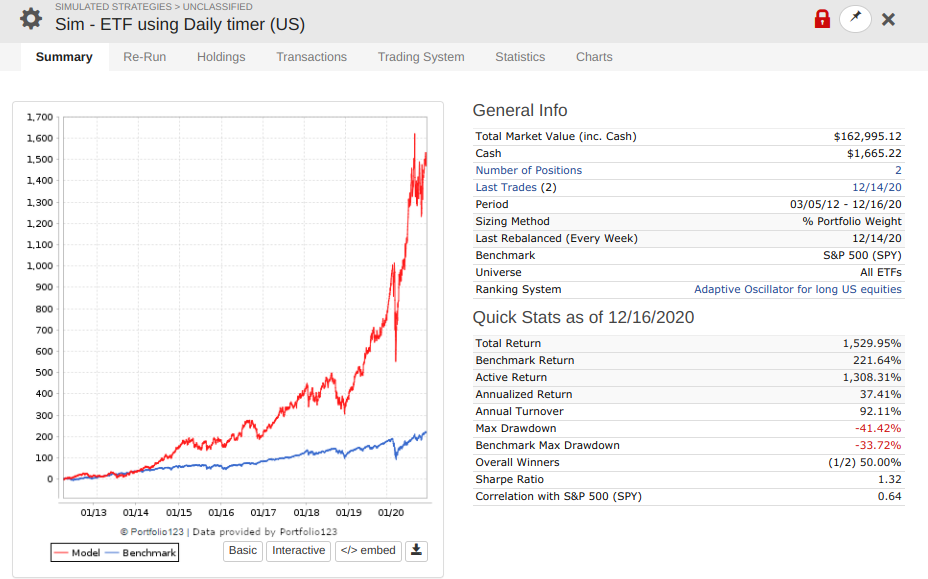

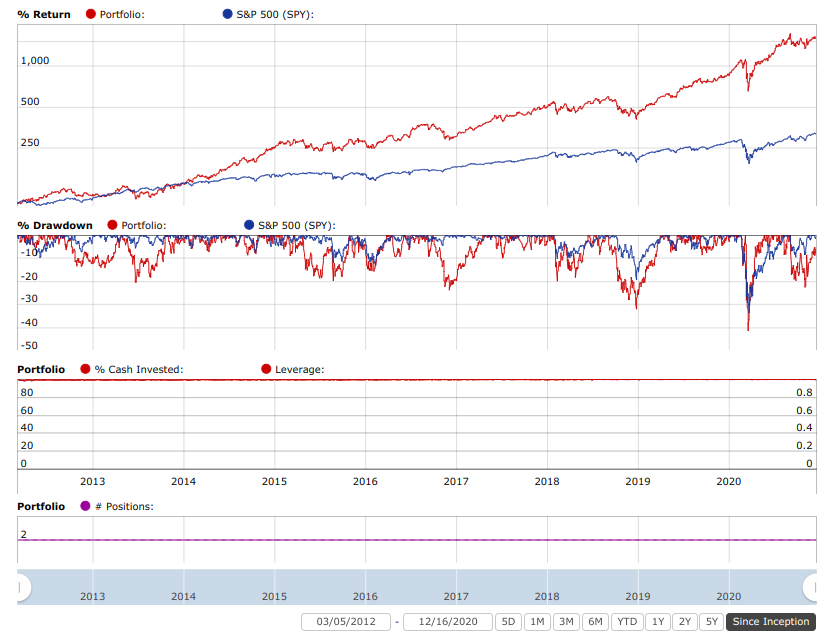

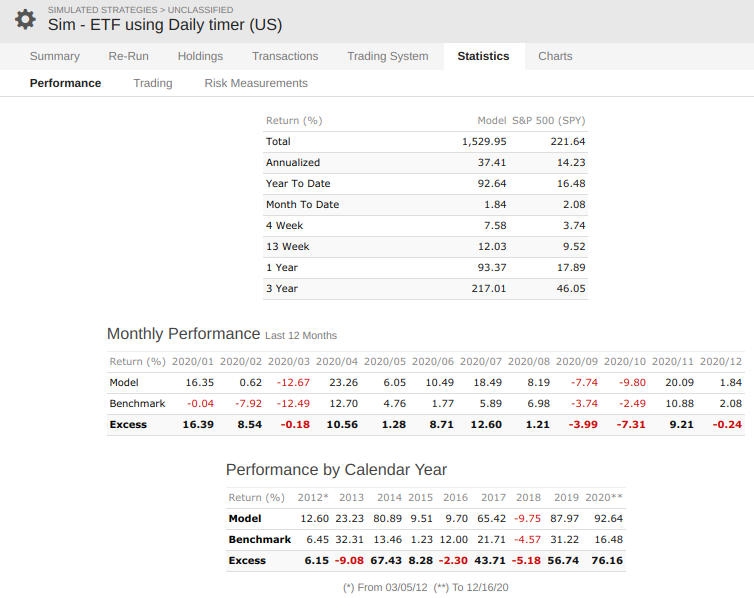

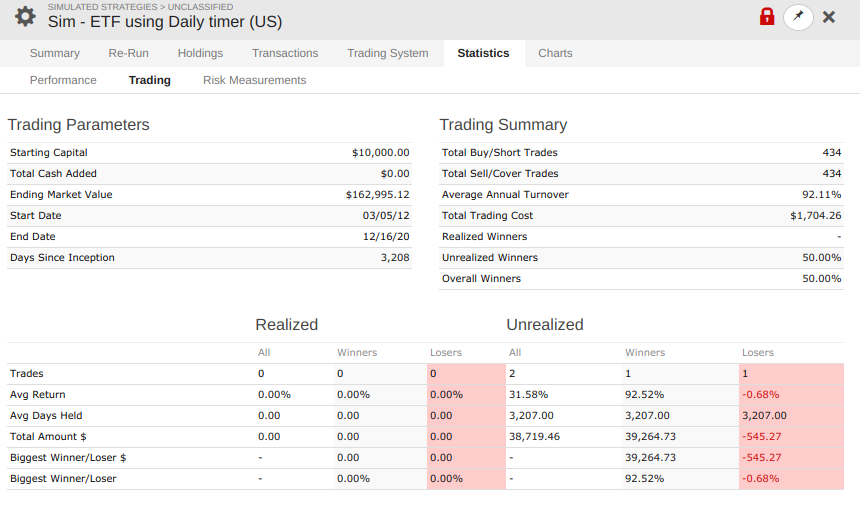

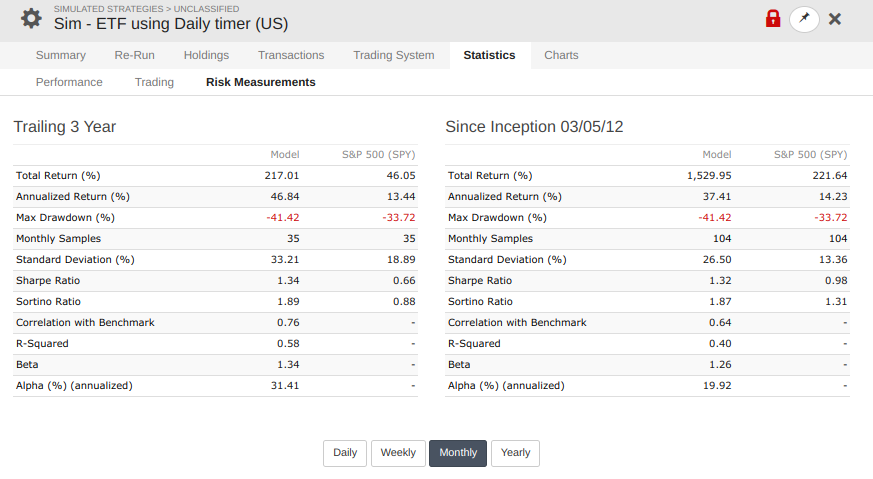

Backtest results for ETF using Daily Timer:

To determine the best ETF to invest for the short term and long term, several components are screened for:

- Volatility futures help to validate momentum (or anticipate changes) regarding the volatility index, by using concepts from this white paper and a variation of the VRP and rolling yield strategies, described on this white paper;

- Market timer on macro, sentiment and price reaction for the market;

- Economic indicators look for metrics to predict recession and sector rotation that favour different asset allocation;

- Technical analysis help to identify trends and predict changes based on classical patterns regarding market performance and sector performance to identify sector rotation;

The ETF portfolios take volatility (ration between 6-months VIX curve and 3-months VIX curve), technical analysis (seasonality and momentum ranked on different timeframes), and macro factors (economic indicators and ratio calculations in a mechanical effort to confirm a recession bias or not).

The CEF portfolio starts with the US CEF Universe and it’s filtered by liquidity and a rank based on CEF NAV Discount. The model trades up to 5 CEFs and a rotation approach is used as the criteria to when to buy and sell. Many investors looking for short-term gains are tempted to ride recent winners, identified either through ad-hoc observation or an objective trading system. Interestingly, though, it may be preferable to latch onto recent losers under the assumption that such shares may be ready for a bounce – the CEF NAV discount is a good indicator for that. In other words, we may do better with funds that have just experienced corrections or taken a breather. The idea of choosing recent losers instead of winners is emotionally challenging to many, however logically, it makes sense. No asset (equity or fixed income) can go up forever without consolidation phases, so the strongest among the recent winners may be the ones most vulnerable. This is a trading, rather than investing approach. Accordingly, it’s often better to rebalance lists created using this approach on a weekly, rather than, say, on a monthly basis. This particular rotational ranking system is based mainly on asset performance change over the past five trading days with weaker being better. To help tilt the balance toward stronger CEF experiencing a pause, rather than a deteriorating CEF continuing a downtrend, the model also looks at asset price change over the past 120 trading days and the 1-year Sharpe ratio (stronger being better in both cases). Furthermore, the model takes into account NAV gap, NAV growth (to attempt establishing momentum) and technical analysis of the underneath assets to justify the choice.

Subscribe to this model

Interested in subscribing to multiple models? Discounts are available when subscribing to 2 or more models. Simply subscribe to your first model and then let us know which model you want to subscribe next, and we’ll send you a discount coupon.

Discount rates:

| 1st model | full price |

| 2nd model | 10% discount (applied to the 2nd model) |

| 3rd model | 20% discount (applied to the 3rd model) |

| 4th model | 30% discount (applied to the 4th model) |

| 5th model | 40% discount (applied to the 5th model) |

| 6th model | 50% discount (applied to the 6th model) |

| 7th model | 60% discount (applied to the 7th model) |

| 8th model | 70% discount (applied to the 8th model) |

Got questions? Check our Frequently Asked Questions for Premium models or contact us.

Already a member?

Last updated on: June 29, 2025

ETF using Daily Timer

Performance Info:

ETF using Monthly Timer

Performance Info:

Daily and Monthly Timer portfolio combined

Performance Info:

High Income with CEFs

Performance Info:

Cost of this model: $36 / month. Cancel anytime.

This model includes 5 Portfolio signals:

3 Investing ETF / CEF Portfolios (includes Monthly Timer with ETF + Low Turnover Investing + High Income with CEFs) + 2 Trading ETF Portfolios (includes Daily Timer with ETF + Combined Portfolio using Daily and Monthly Timer).

Interested in subscribing to multiple models? Discounts are available when subscribing to 2 or more models. Simply subscribe to your first model and then let us know which model you want to subscribe next, and we’ll send you a discount coupon.

Discount rates:

| 1st model | full price |

| 2nd model | 10% discount (applied to the 2nd model) |

| 3rd model | 20% discount (applied to the 3rd model) |

| 4th model | 30% discount (applied to the 4th model) |

| 5th model | 40% discount (applied to the 5th model) |

| 6th model | 50% discount (applied to the 6th model) |

| 7th model | 60% discount (applied to the 7th model) |

| 8th model | 70% discount (applied to the 8th model) |

Got questions? Check our Frequently Asked Questions for Premium models or contact us.

Hi Rod,

I noticed the 5 CEFs starting value is significantly higher than your other models, i.e. 500K vs 10K – 100K. Is there a reason behind that?

Sorry, just saw this comment now. No reason, that was probably input after doing different simulations. CEF models can start with $10K just like most models.

Is the model busted?

No, the model continues to work. The model dropped more than the market due to the nature of leveraged ETFs, but it was not invested in inverse volatility products, since the VIX price structure is in backwardation since January 26th. The model takes that into account, and would only consider to buy an inverse volatility ETF (SVXY) if the VIX price structure is in contango. This is obviously a very volatile model, but you can’t outperform the market without volatility – any high beta model will do better than the market when going up and worse than the market when going down. Different simulation shows a max drawdown similar to the market (-50%), so the model continues to behave as expected.

Hi

Is this model available for subscription?

Given the high performance on backtests, this model is on “incubation” phase to validate out-of-sample performance. I expect to launch it for subscription in March. If you click on the Subscribe tab, you can add your email to be notified when the model is available.

Thanks!

This model is now available for subscription.