I firmly believe in the merits of quality and valuation when looking to invest in stocks. My watchlist contains the companies that meet my quality criteria, and which I intend to partner for many years – except if fundamentals deteriorate beyond my risk tolerance, or if dividends get cut or suspended. However, a good quality company can be a terrible investment if one pays more than it should for it. Hence the importance of valuation.

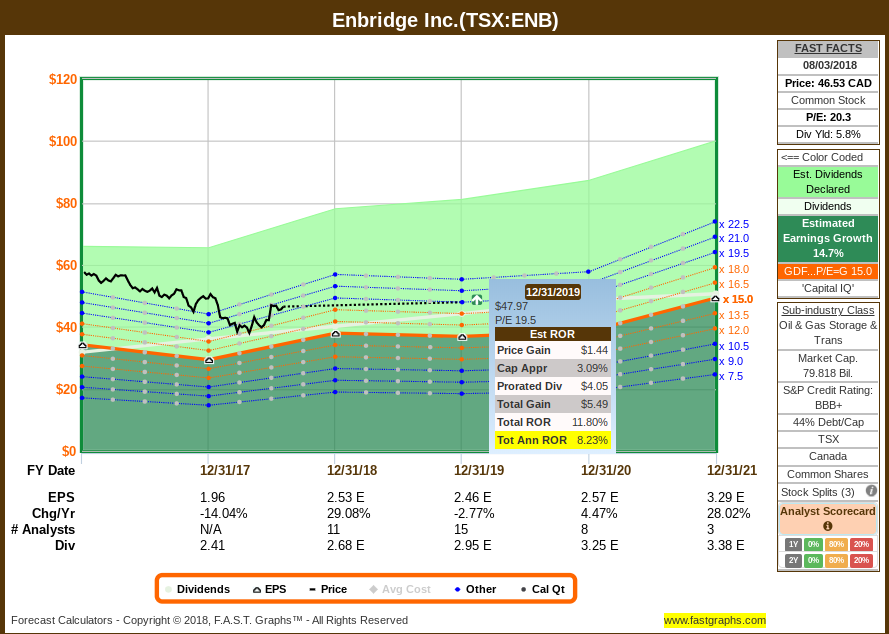

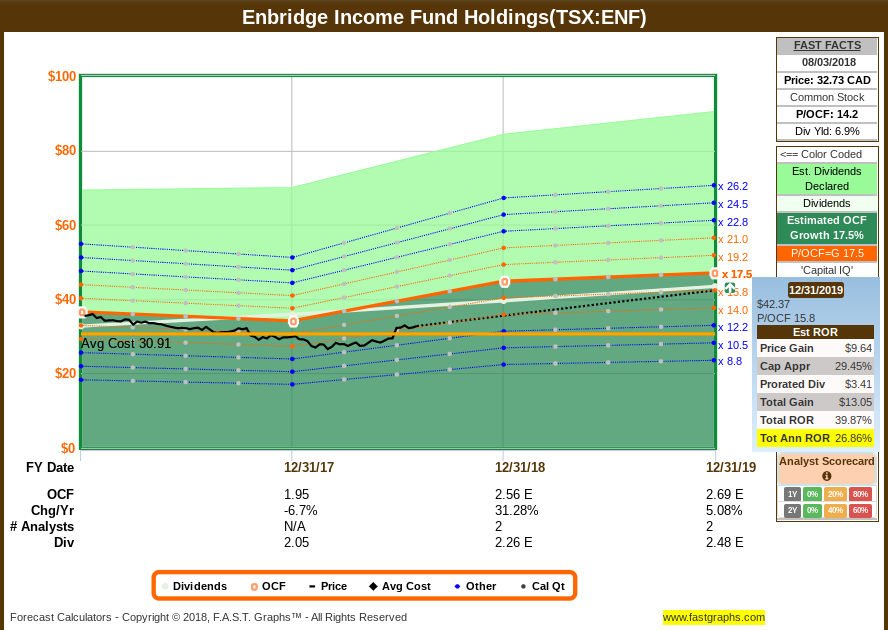

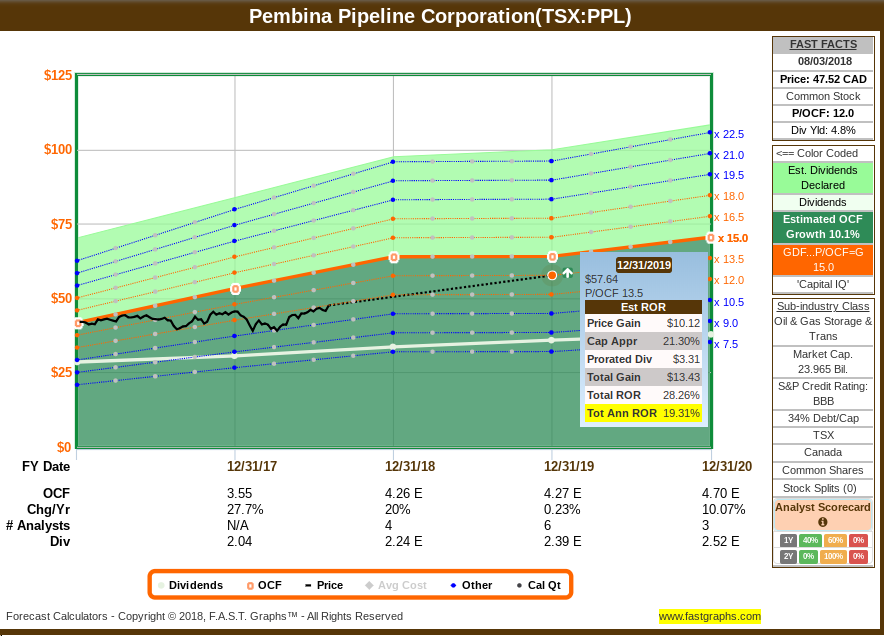

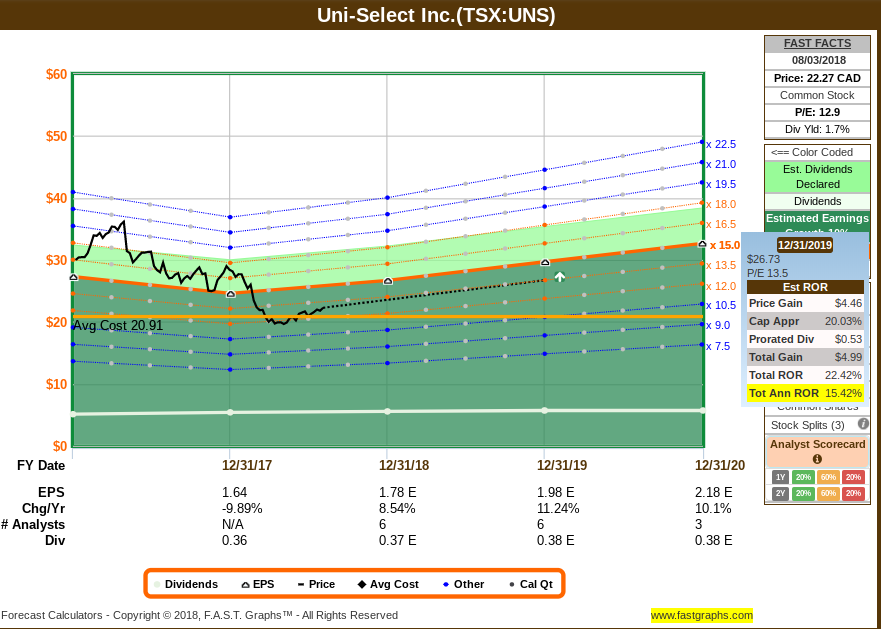

When I buy a stock, I’m buying their earnings potential. I’m buying a piece of business that is trading at or below the company’s intrinsic value, calculated by a blended multiple of annual earnings considering typically what the market values that company at in the past, plus its present valuation, plus what I expect that valuation to become given the estimated earnings. It’s not a precise calculation, and it doesn’t have to be: having a consensus on the direction is more important than trying to nail what the specific earnings number will be. Besides earnings, I also evaluate cash flow (where applicable, depending on the sector) and its growth projection, as well as validating that the current dividend and the projected one is sustainable according to the current and project operating cash flow (or adjusted funds from operations, depending on the industry).

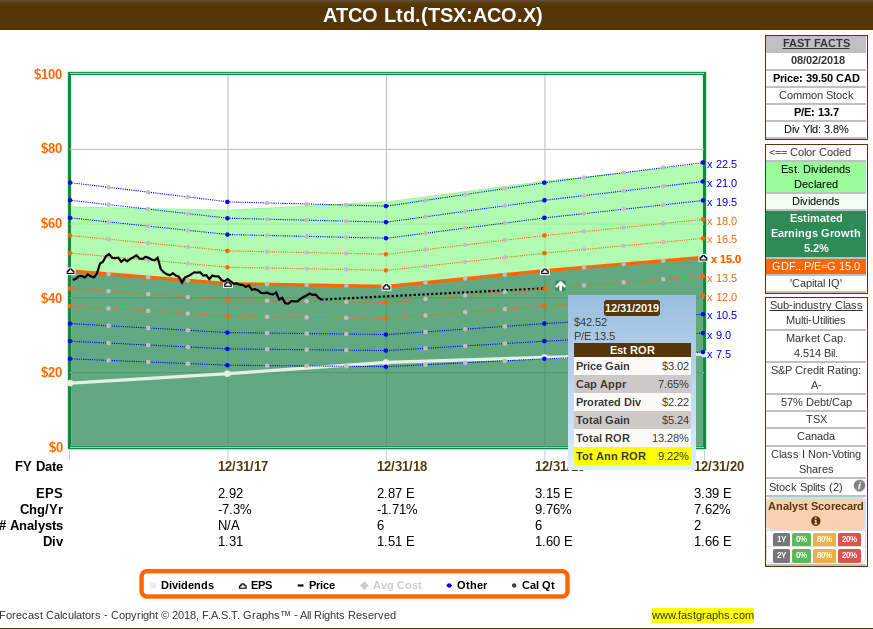

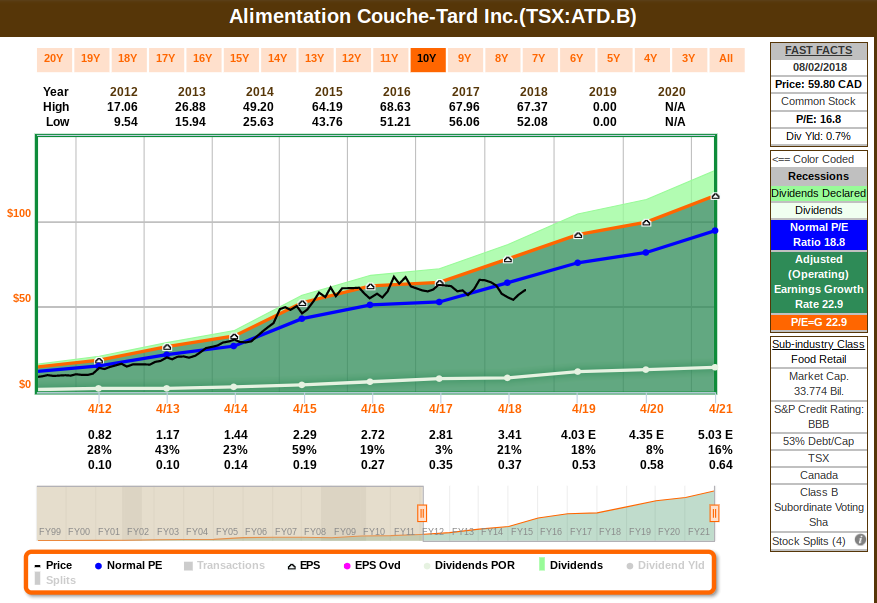

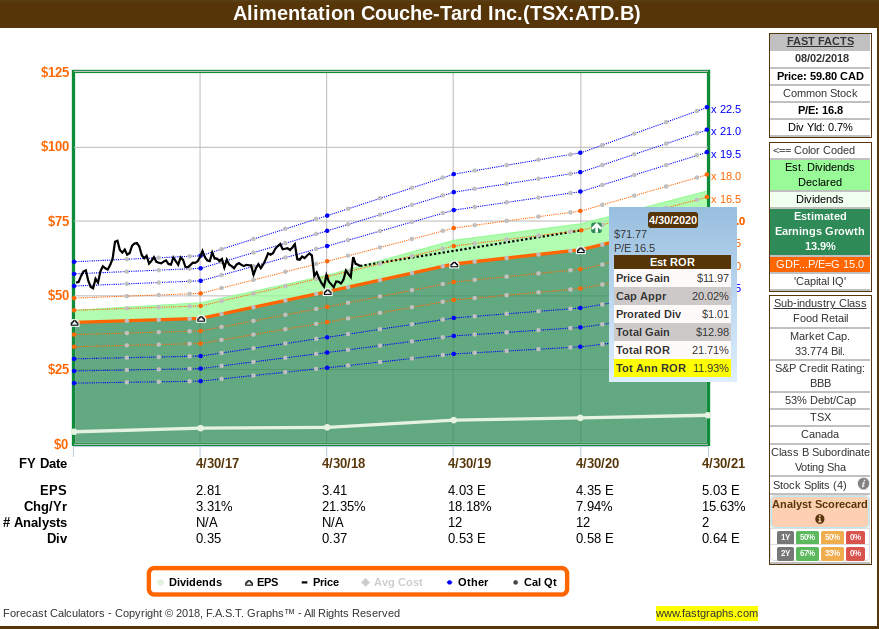

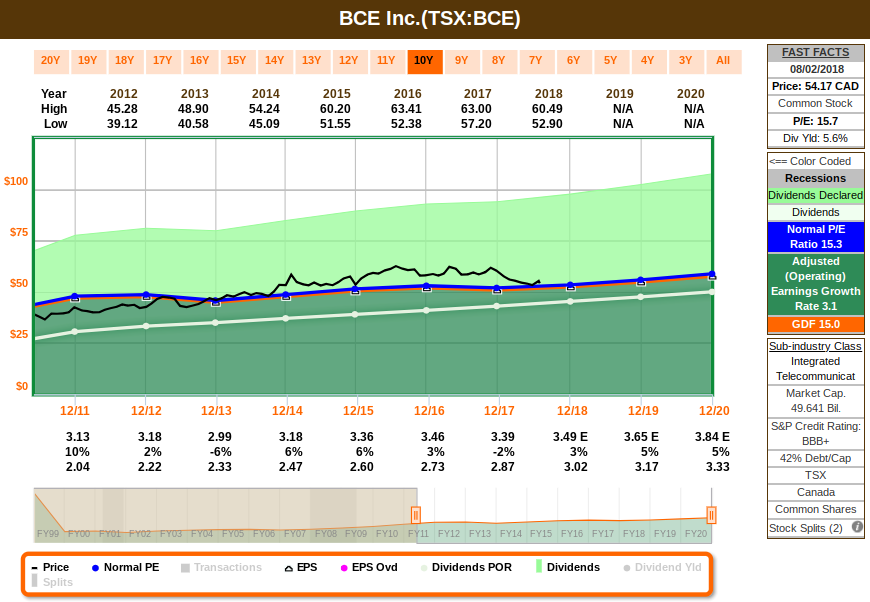

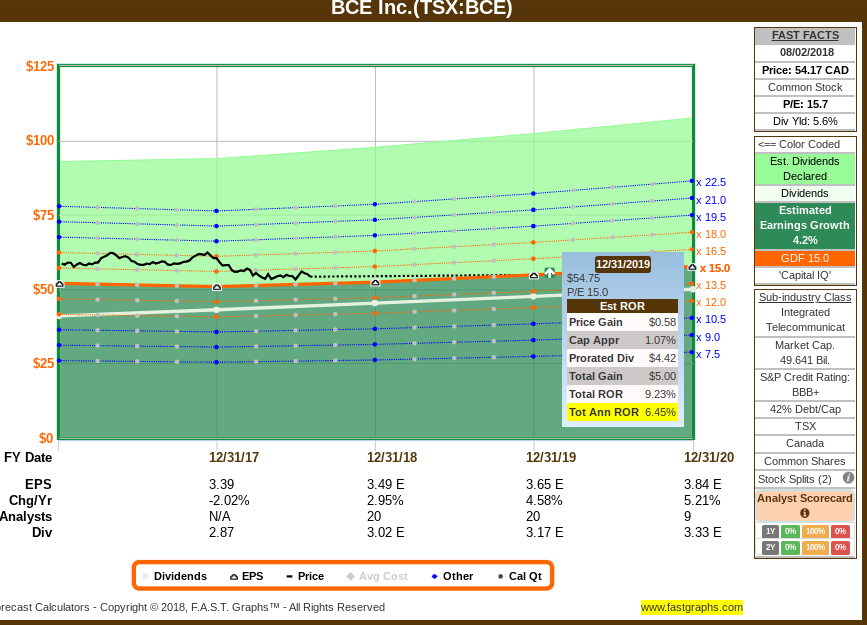

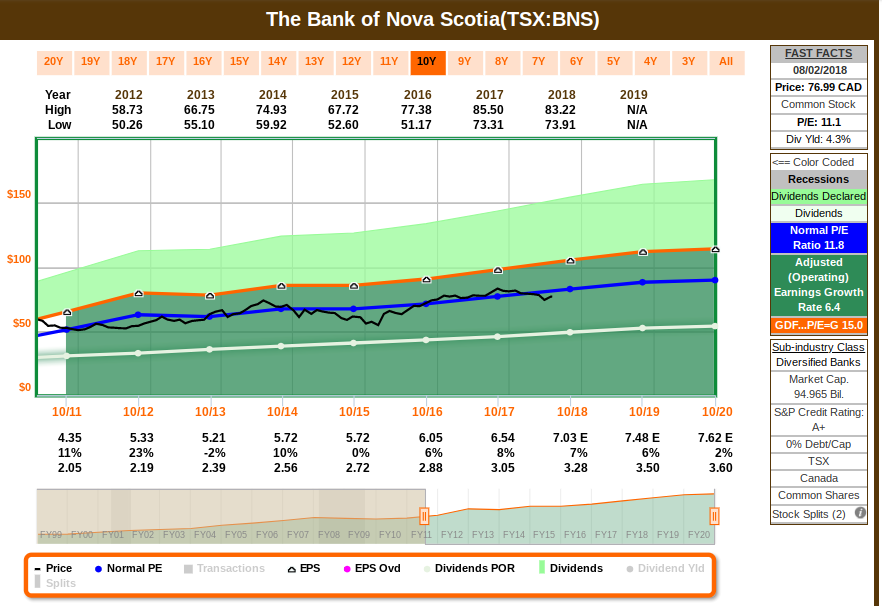

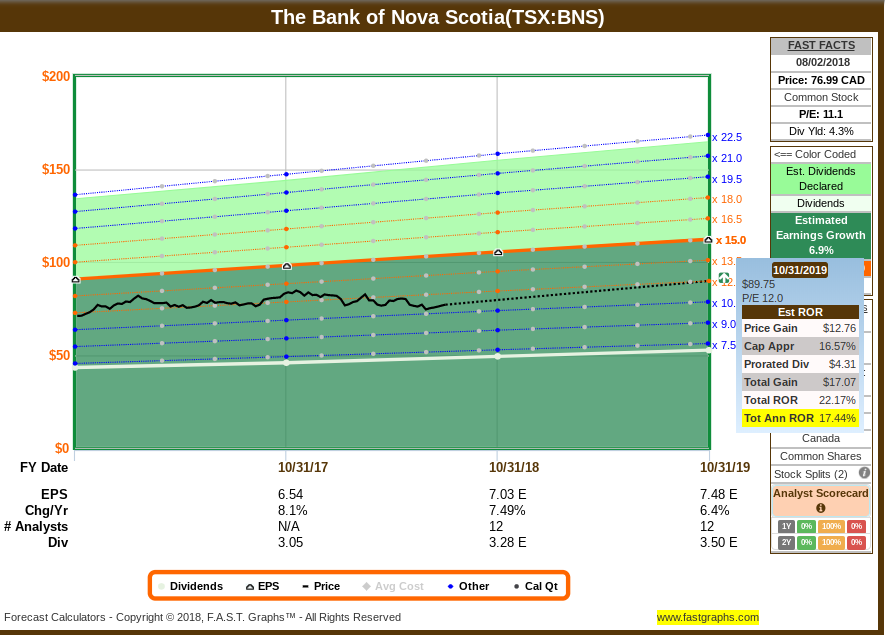

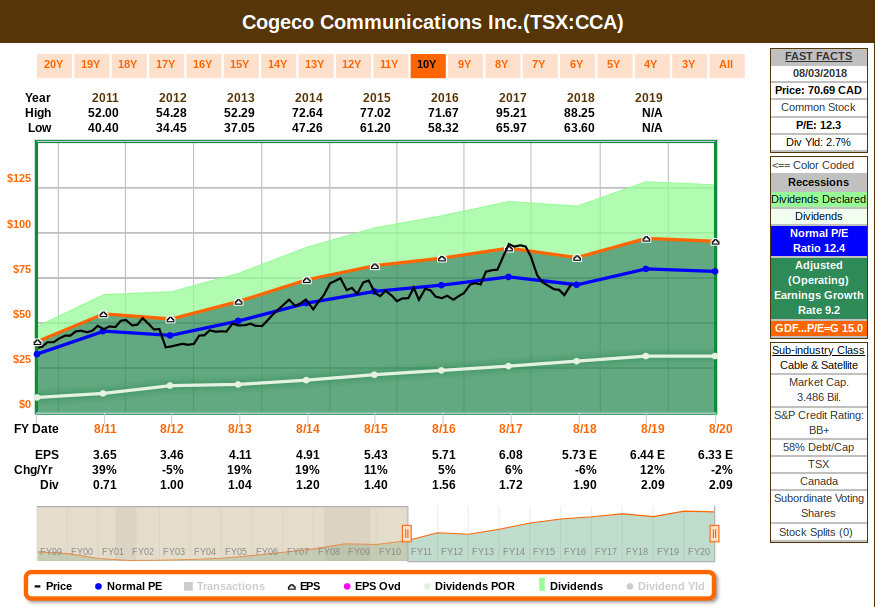

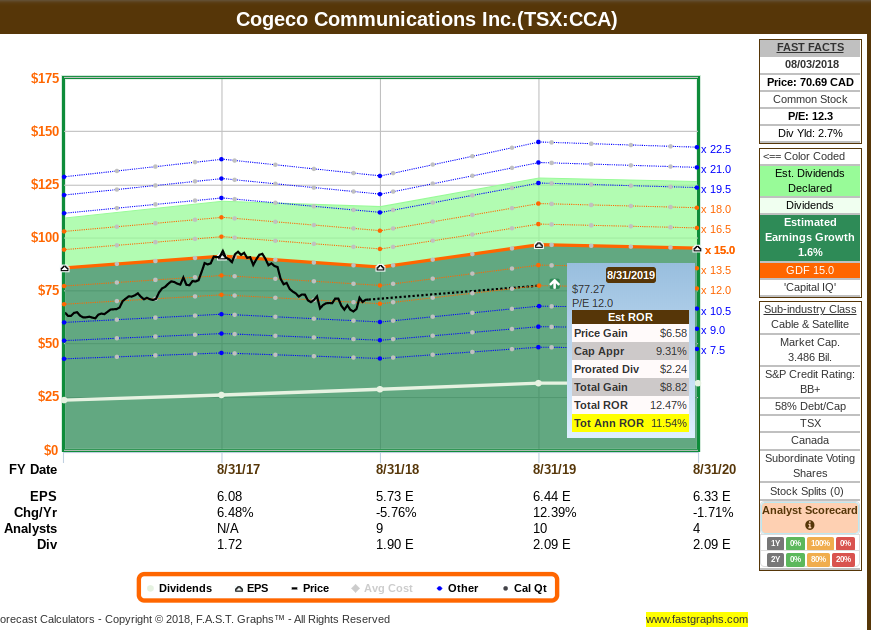

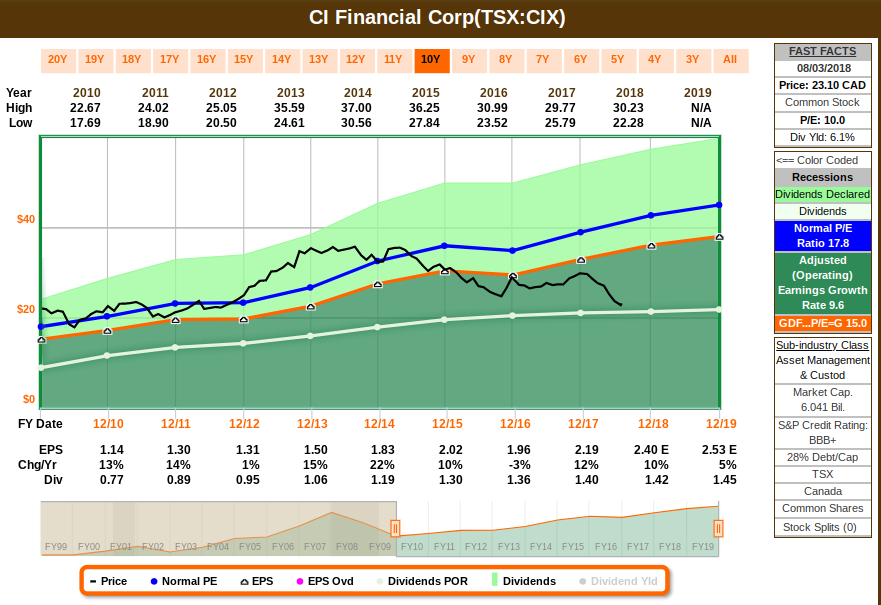

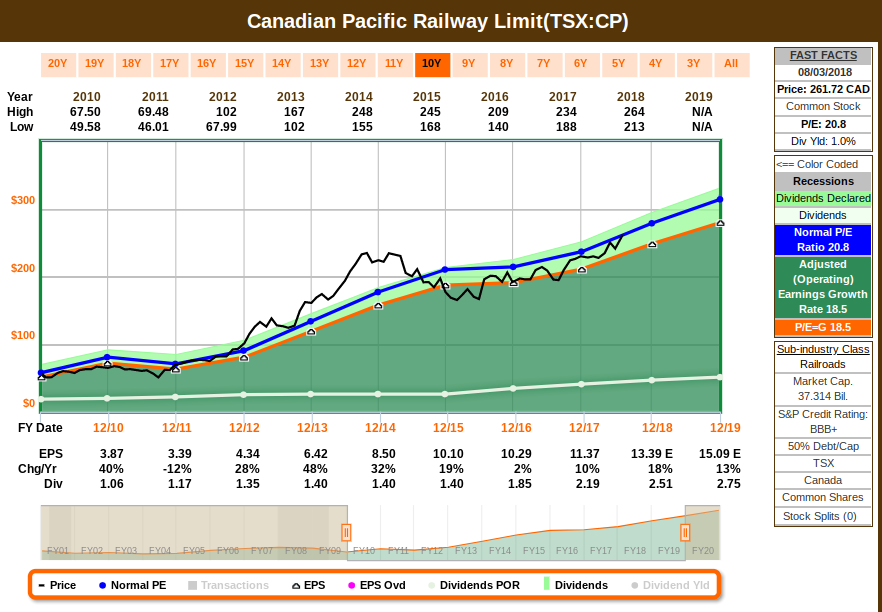

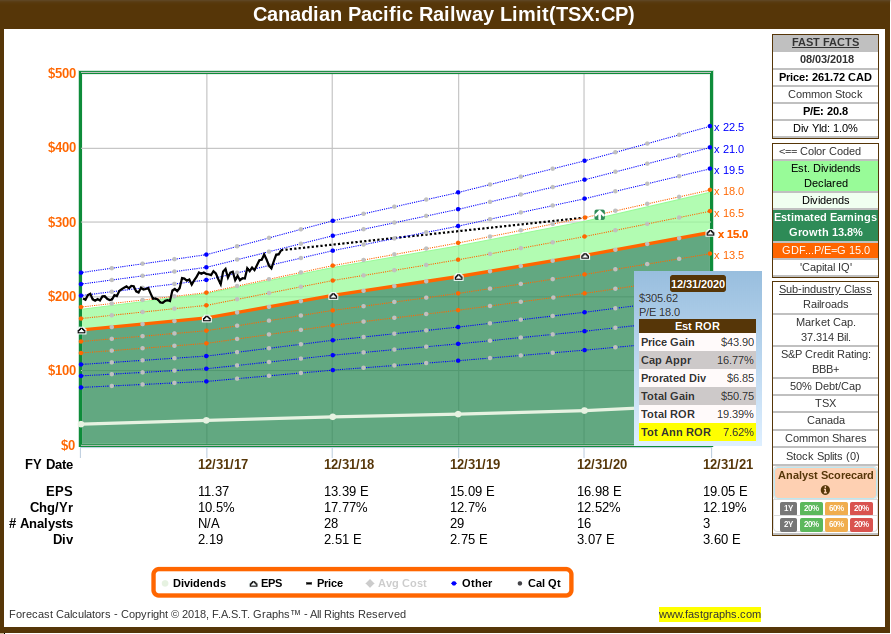

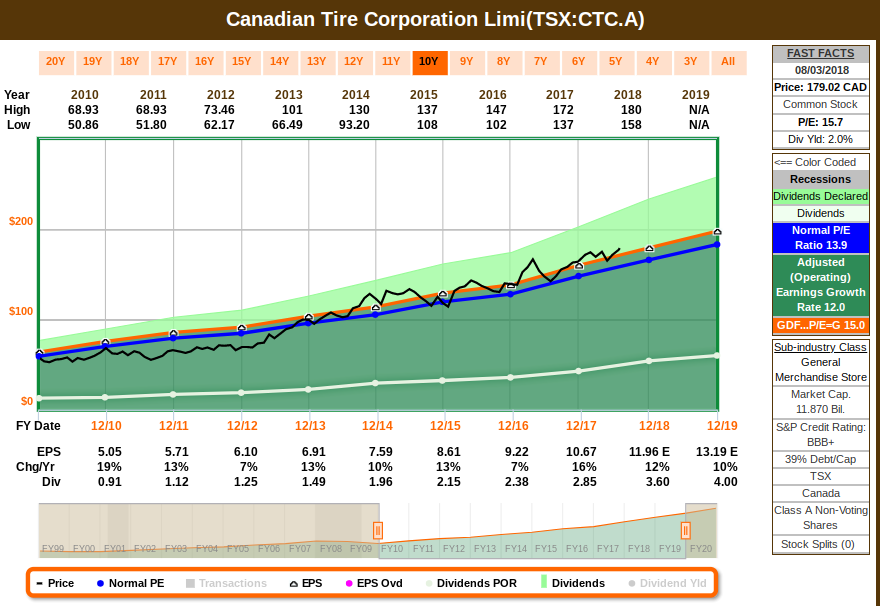

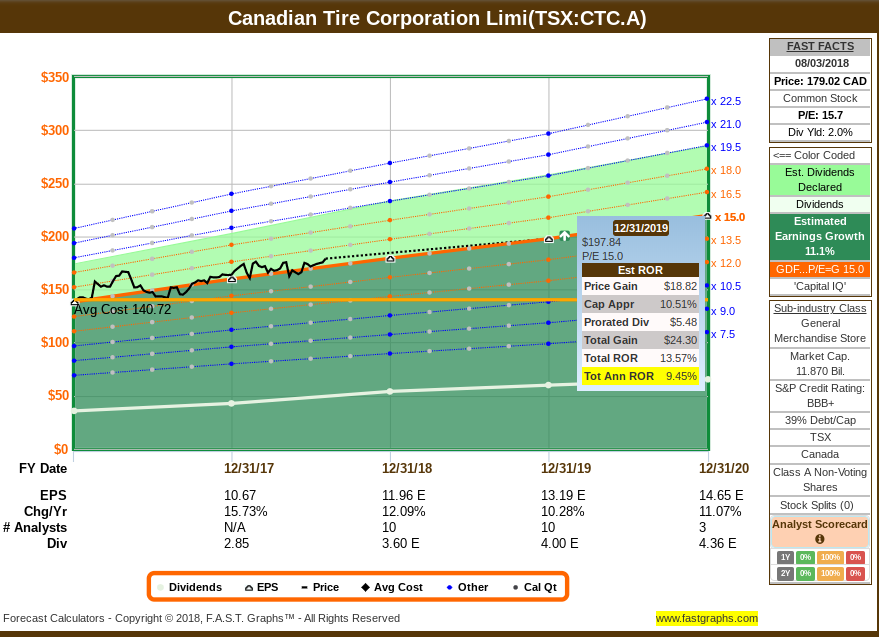

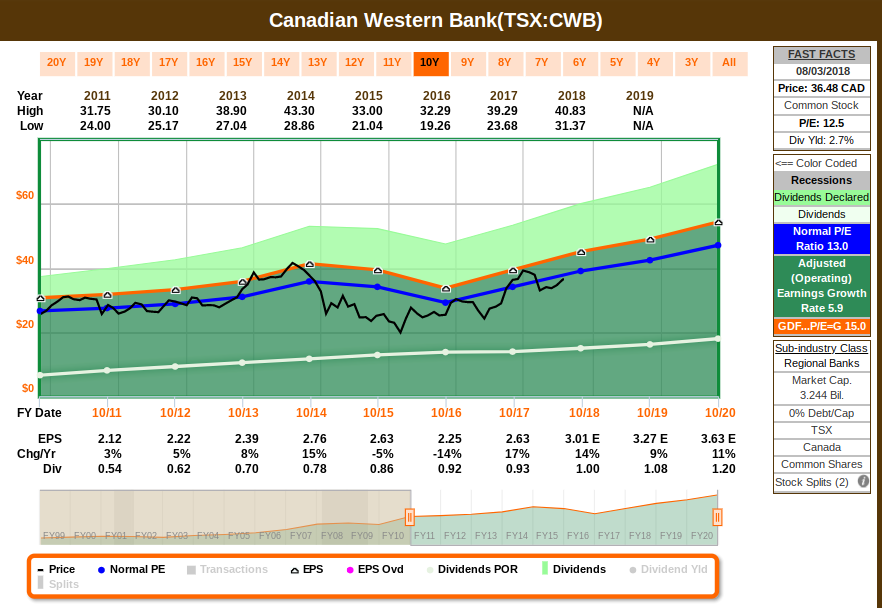

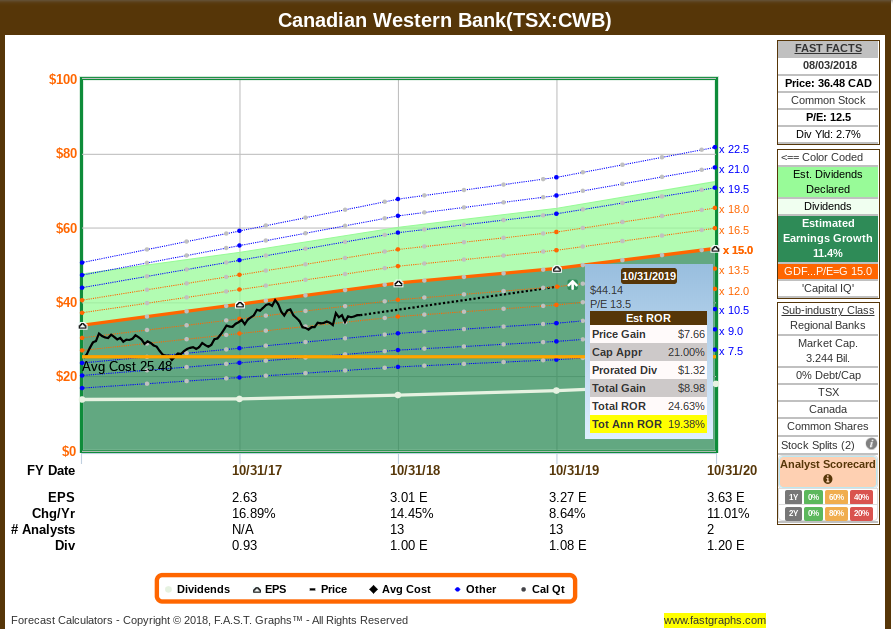

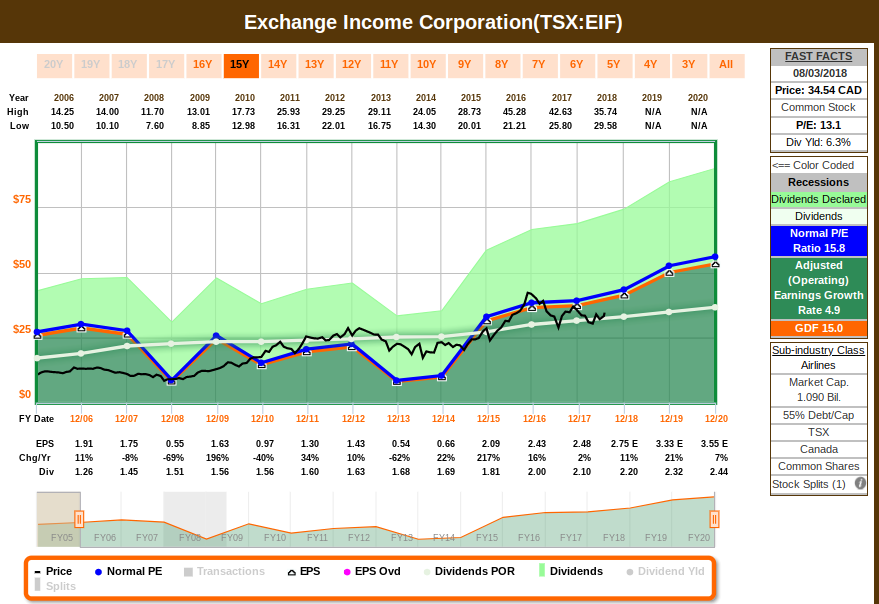

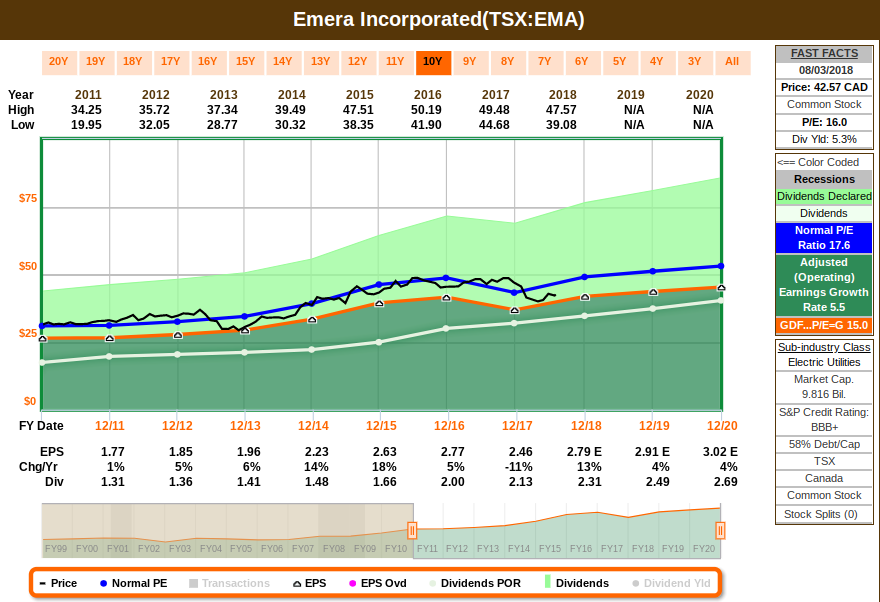

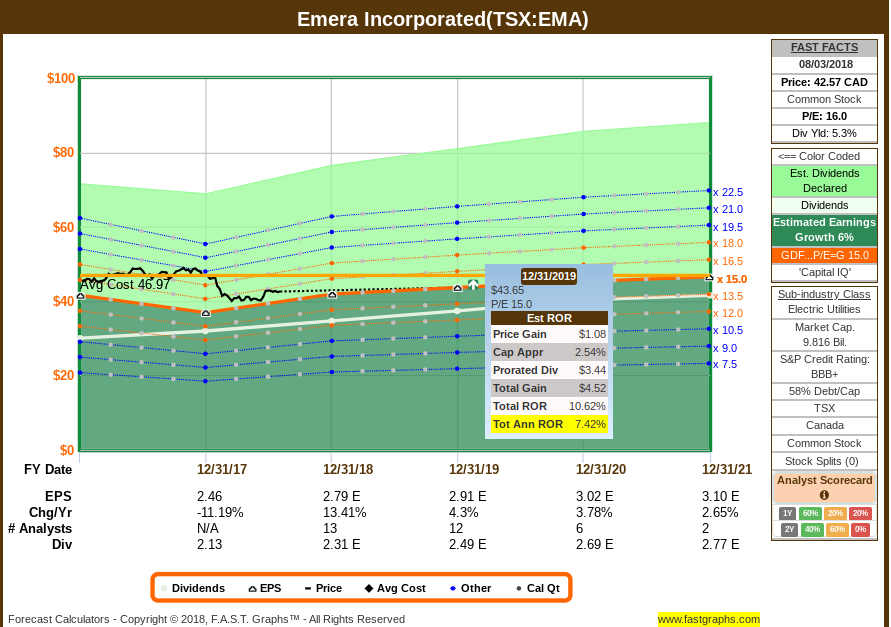

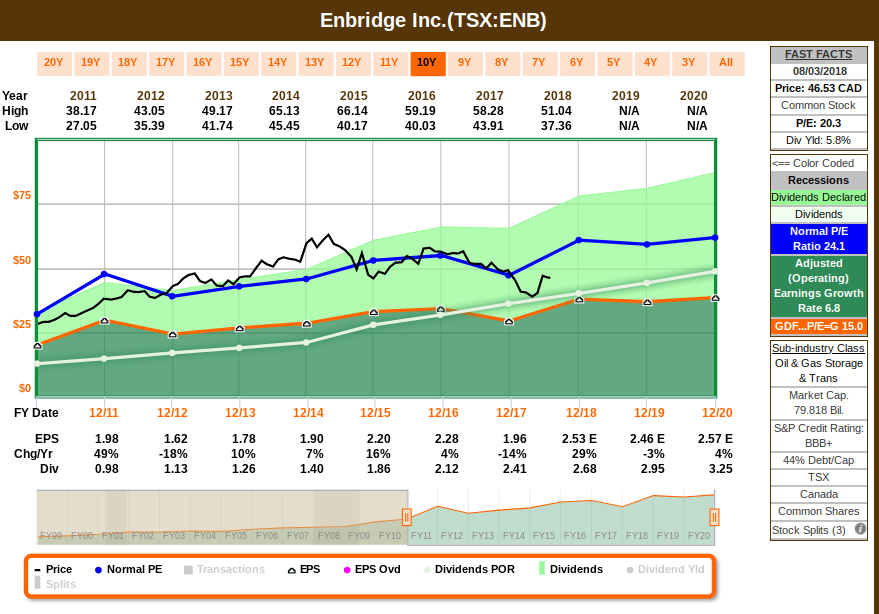

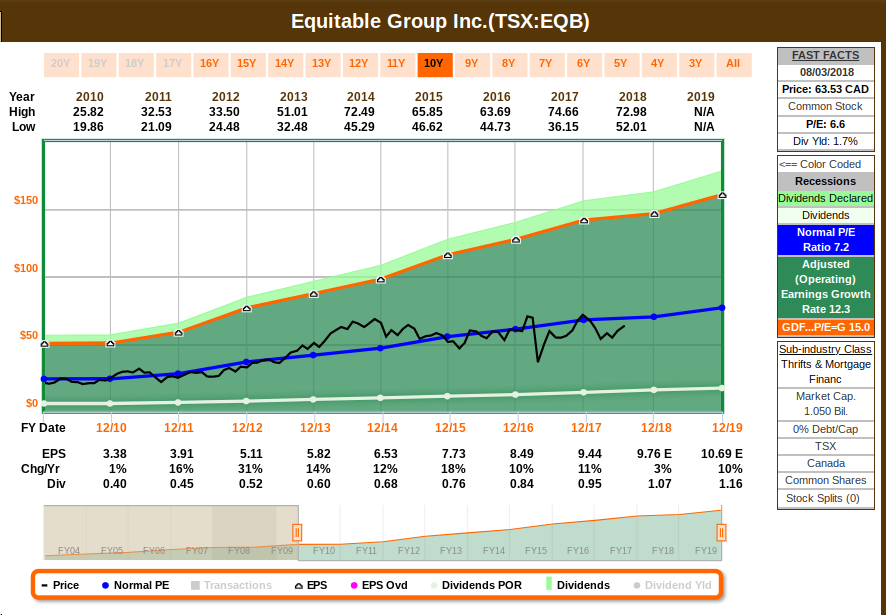

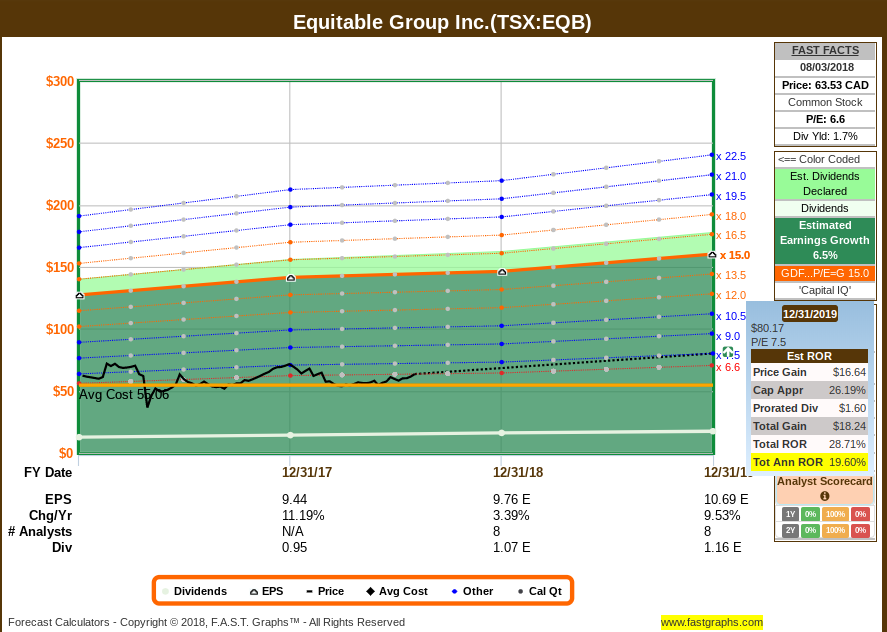

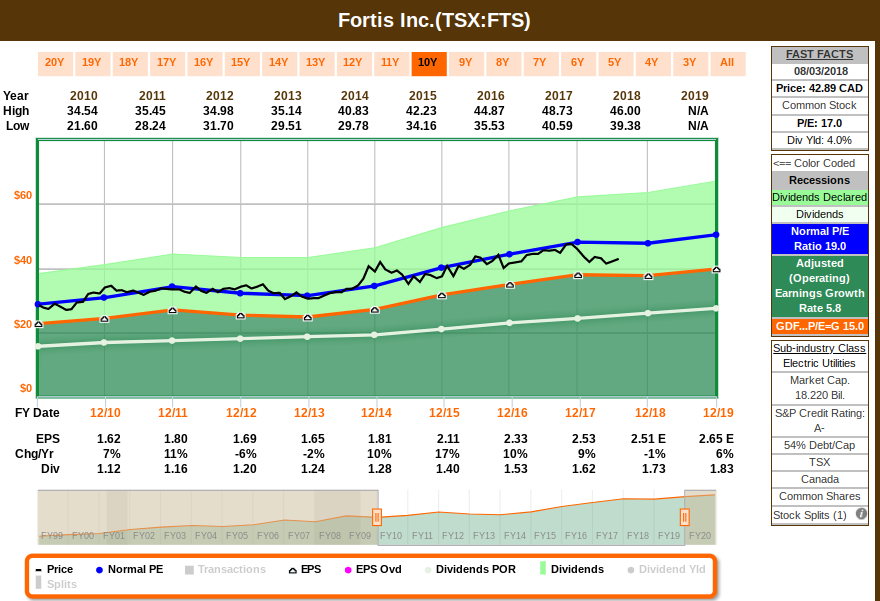

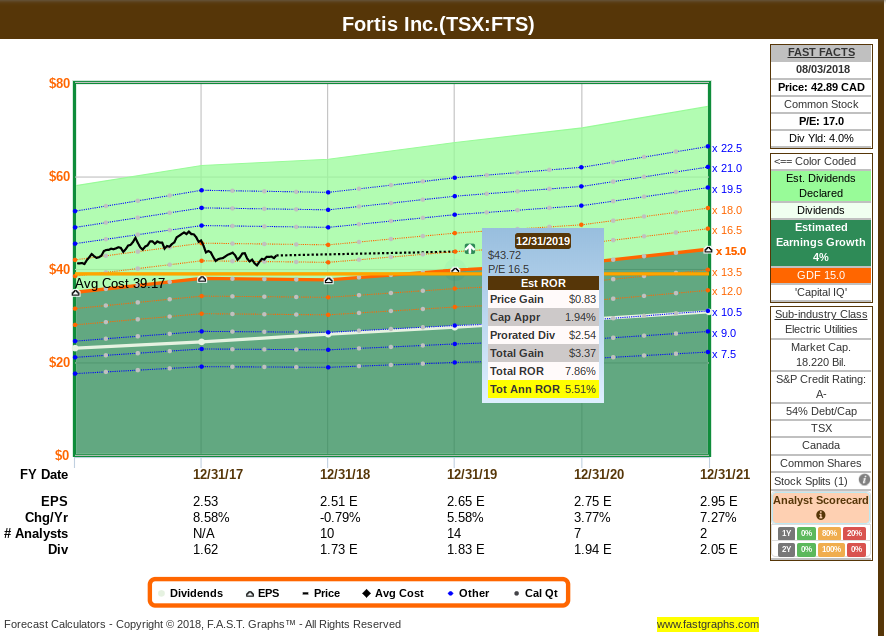

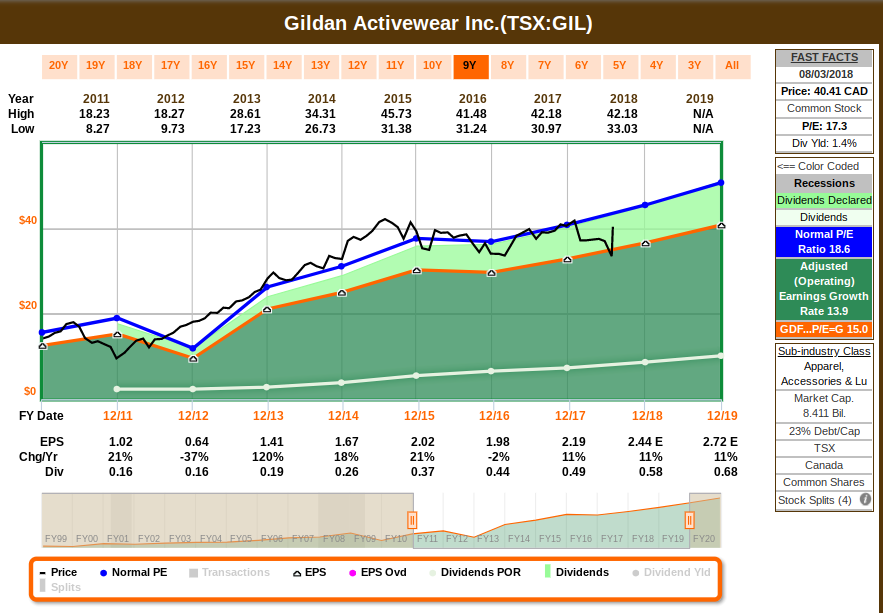

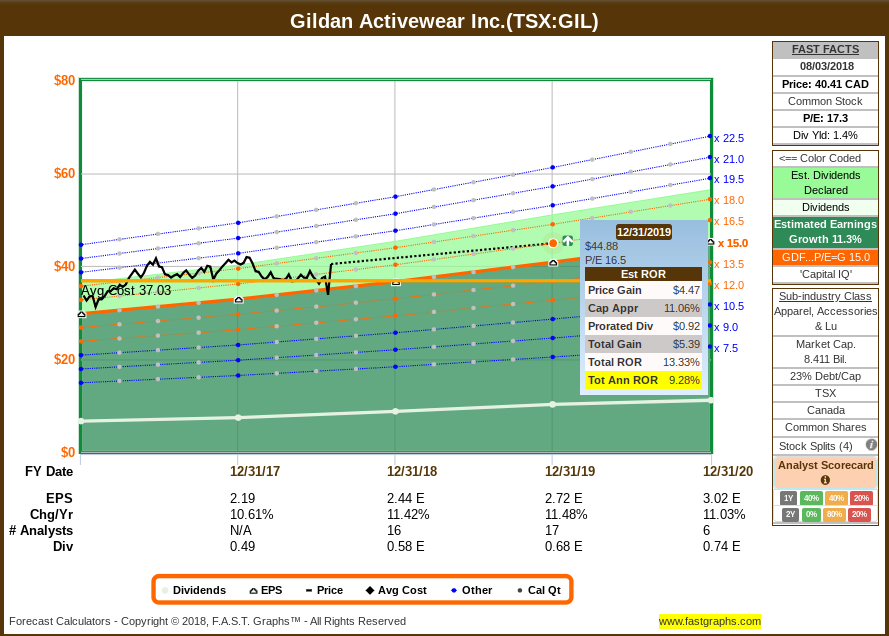

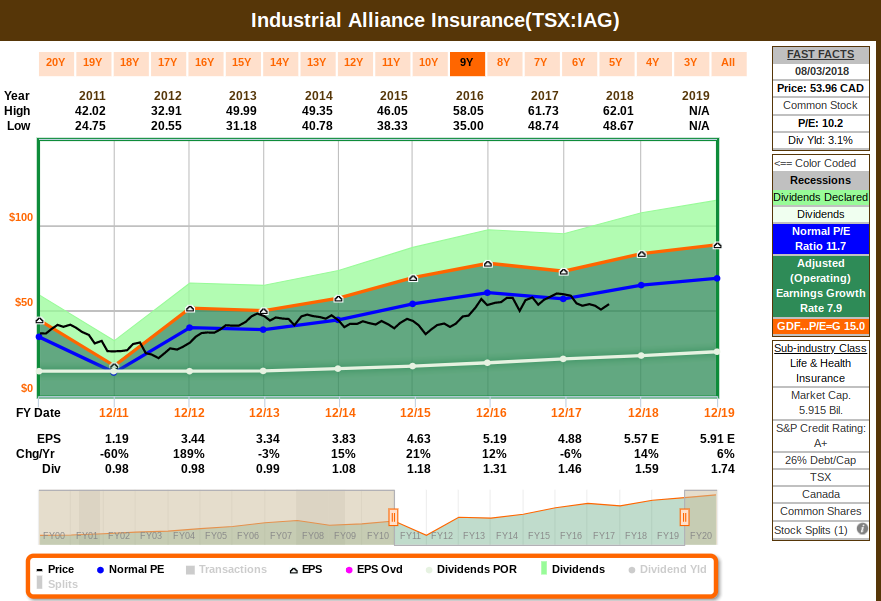

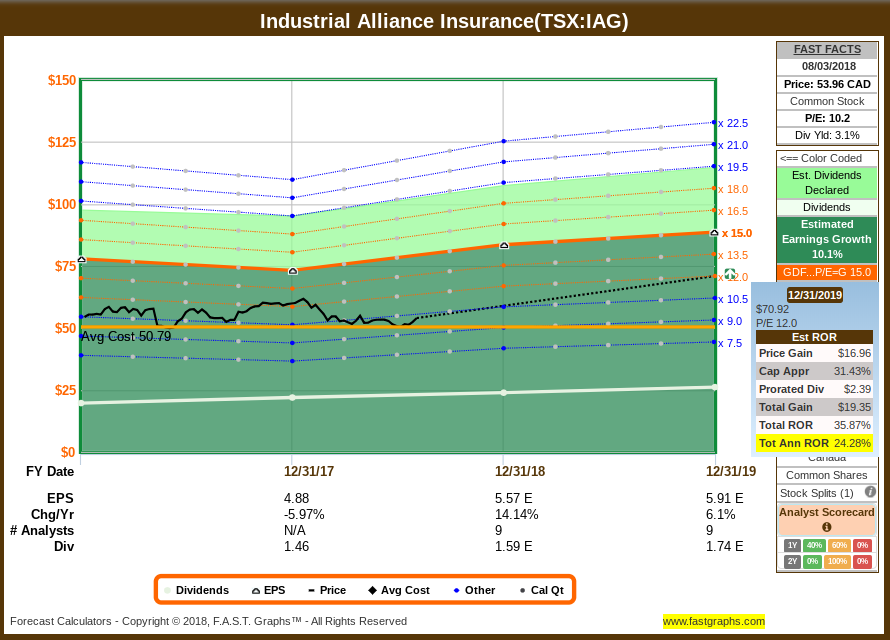

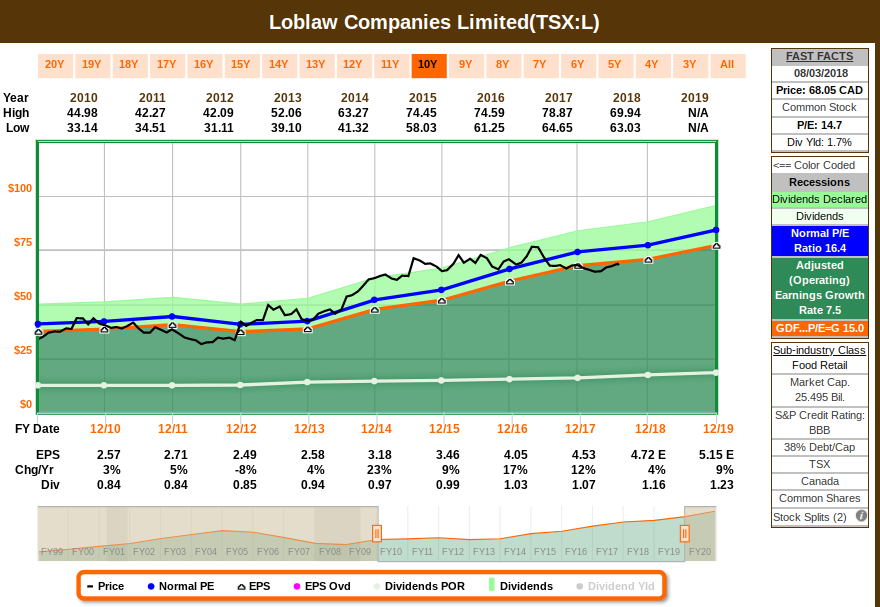

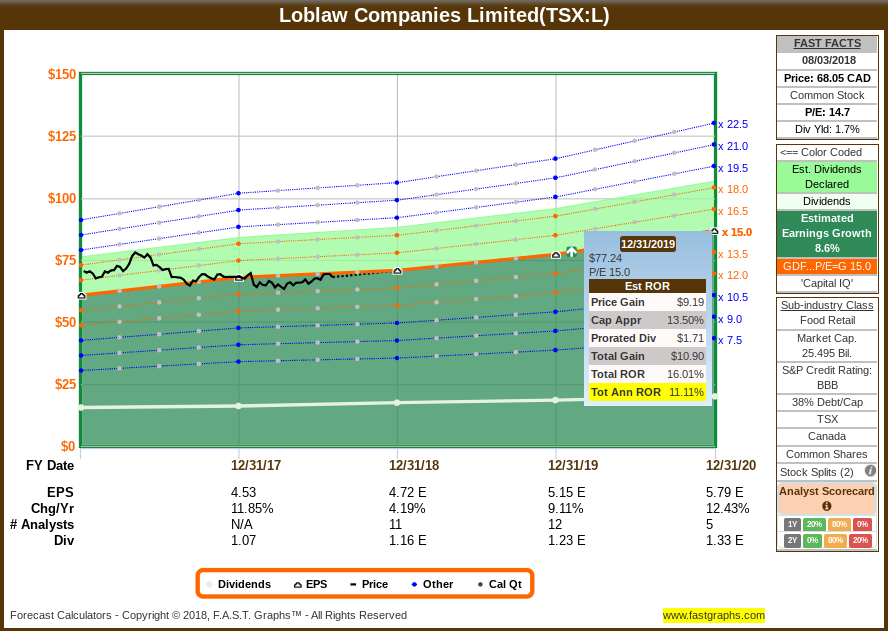

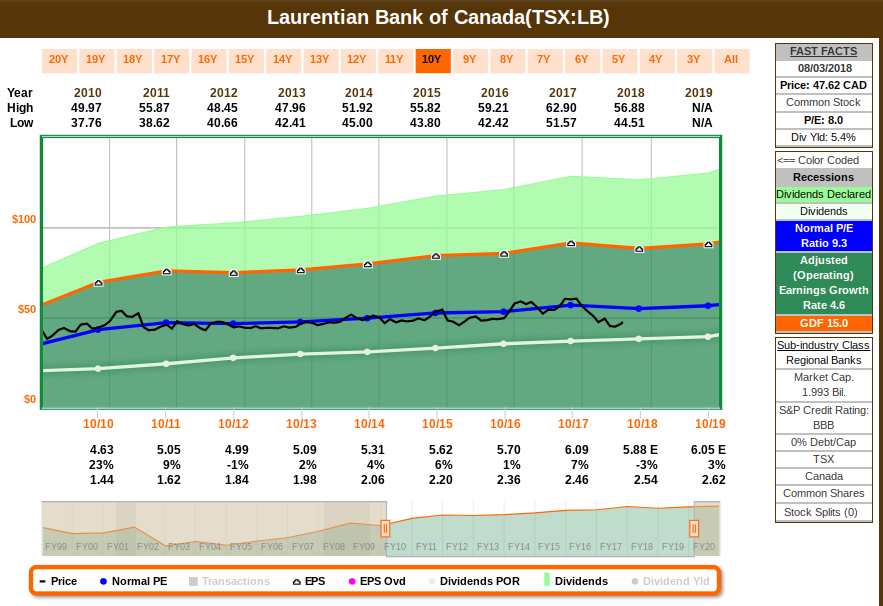

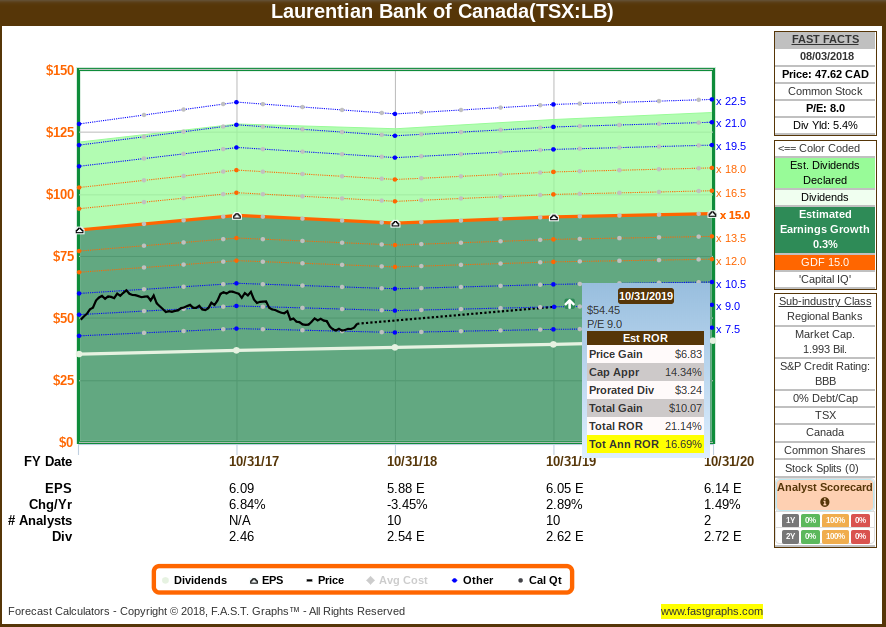

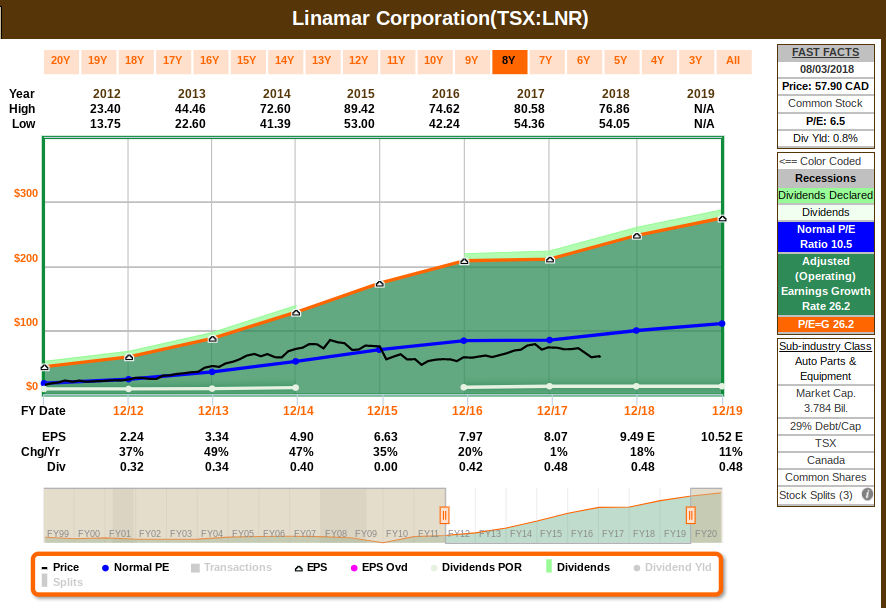

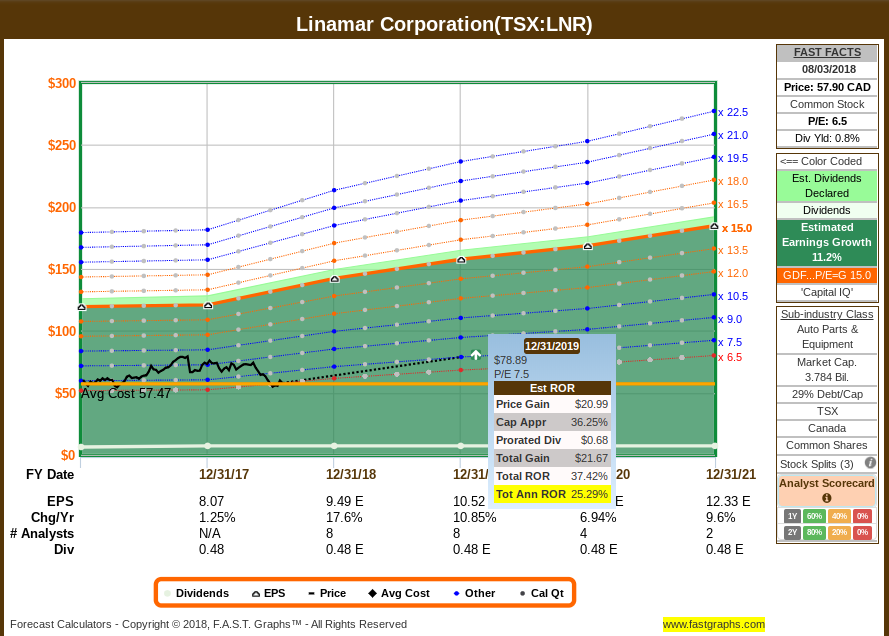

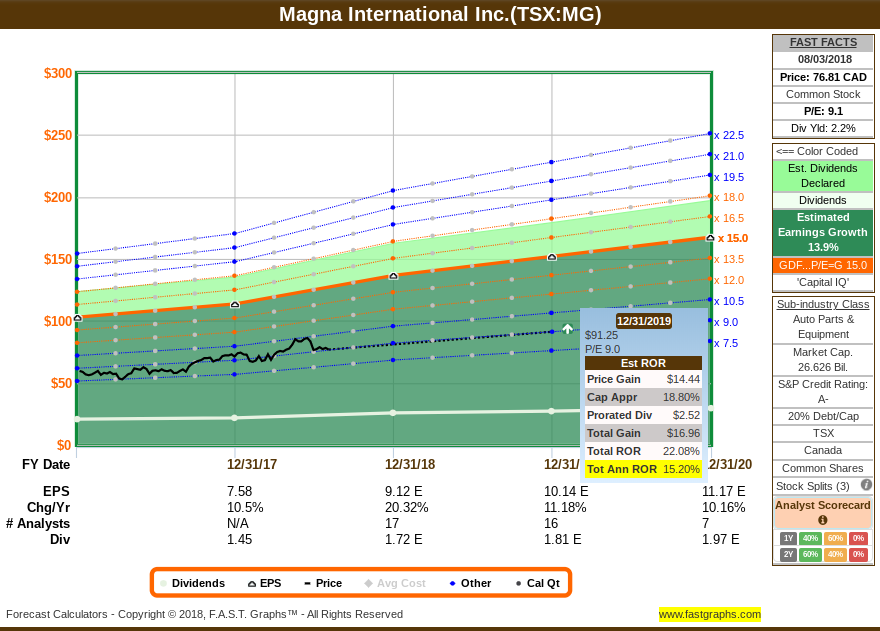

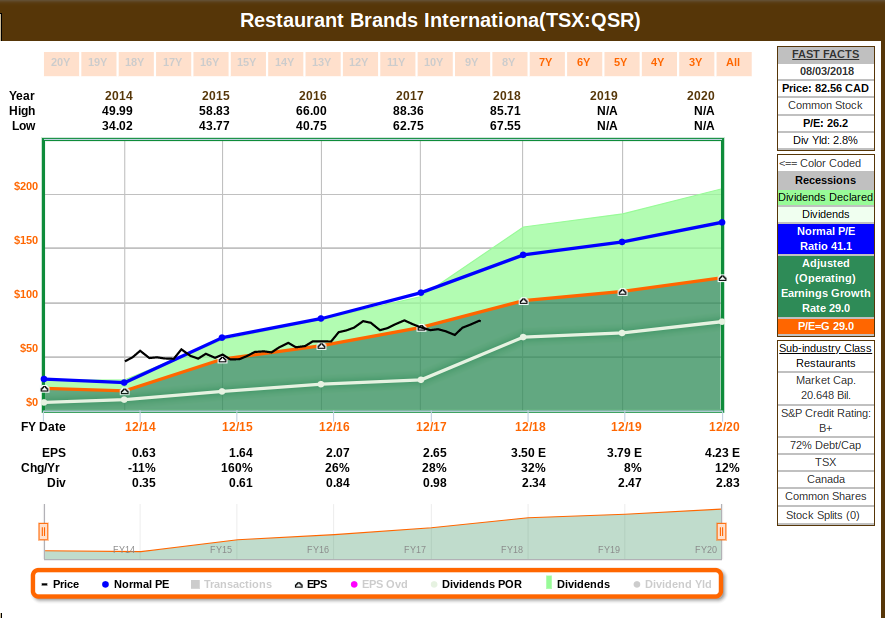

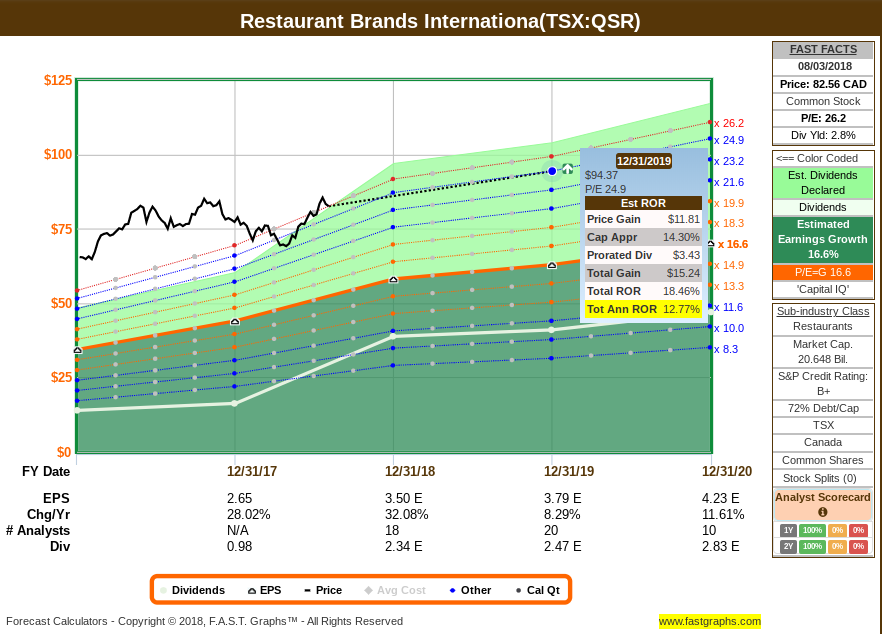

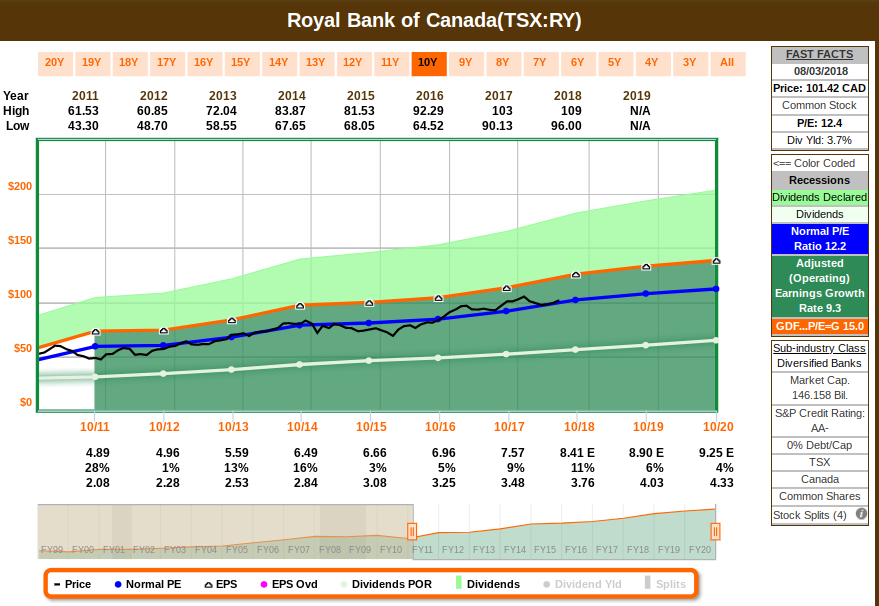

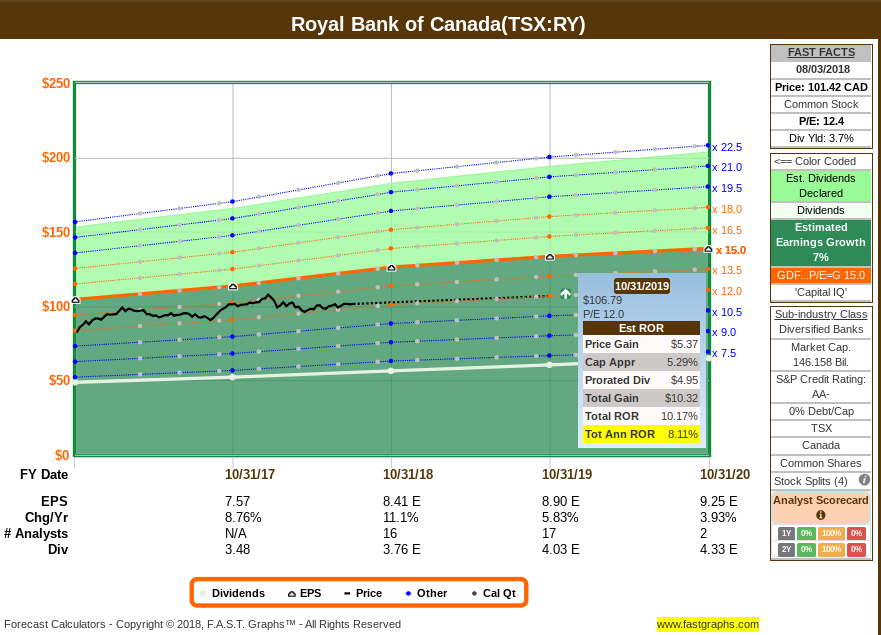

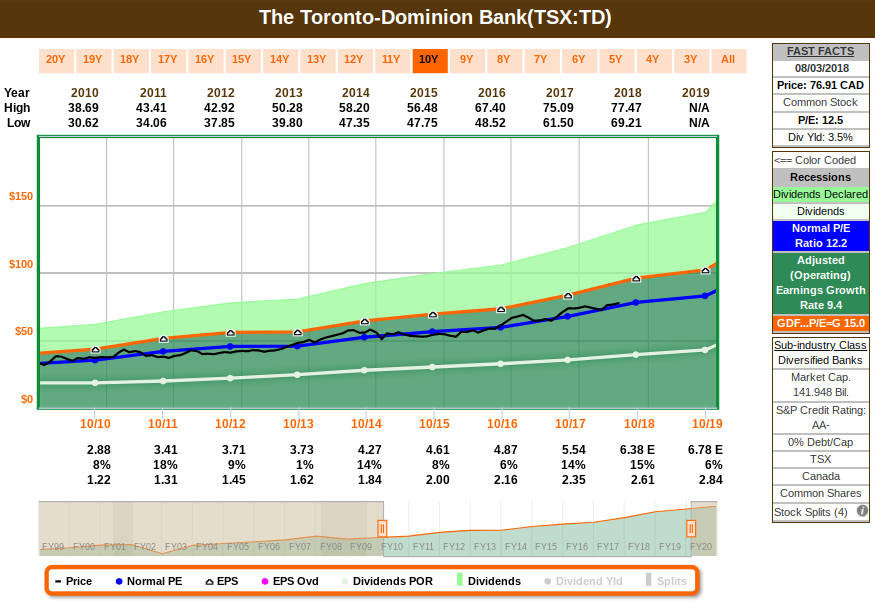

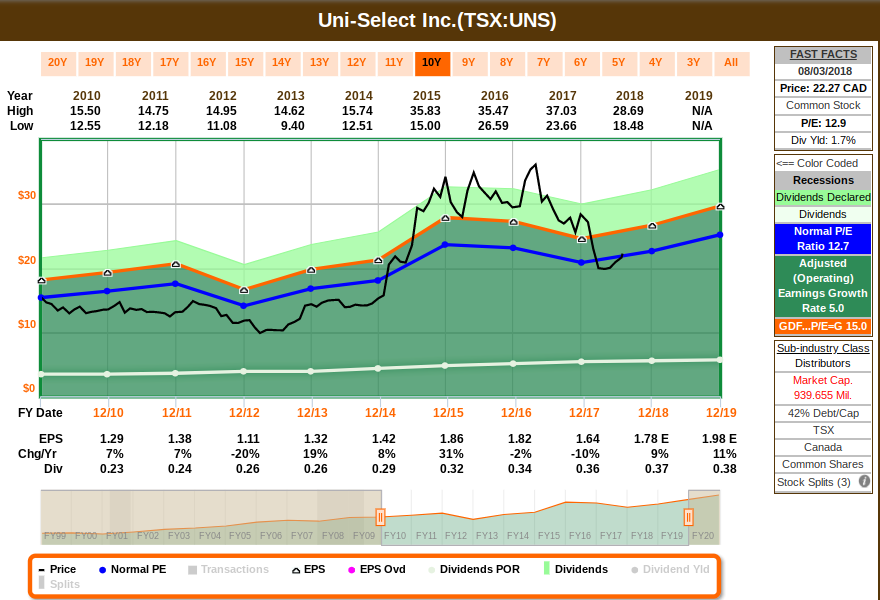

I use Chuck Carnevale’s FAST Graphs tool to help me with this exercise. The graphs below allow one to quickly visualize how a company delivered earnings and cash flow (orange line, which is typically a P/E of 15 for low / medium growth companies of P/E = earnings growth rate for high growth companies), what the market typically values at (blue line, which is typically the P/E that the market has priced that company for the indicated period), dividends (white line) and total return (green area mountain graph). The stock price is the black line, which shows that it typically follows earnings and that volatility creates opportunity to acquire shares of these business with a higher margin of safety.

The following list are in alphabetical order for the ticker, covering multiple sectors, taking into consideration corporate guidance and a consensus from institutional investors that cover these companies for estimated earnings and cash flow. For the graph that shows earnings growth projection, it will display the number of analysts covering the stock, and on the bottom right it will display the analyst scorecard for 1 year and 2 years estimates: in green is the % that a company beat analyst’s estimates, in yellow is the % that a company meet estimates and in red is the % that a company missed estimates. That’s another variable that I like to take into consideration because a company with a reasonable number of analysts that has a good record of meeting or exceeding analysts estimates gives me confidence that the current estimates are fairly reliable. For companies with a poor record of analyst score card, it simply tells me that the company is either too cyclical / subject to external factors like commodity prices where it’s hard to predict results or it’s a business that analysts don’t understand it well, and therefore, the estimated guidance might not be as reliable. However, if such company passed my quality test and it’s trading at a fair valuation, I will consider adding more shares, as I’m confident that management will drive growth in the long term.

The graphs contain useful information depending on your investing objectives – some offer a good total return projection (but lower income), some offer a low total return projection (but a higher income). The graphs display yield information, normal P/E (blended P/E based on historical period plus forward estimates for the next year or two), earnings growth rate, S&P Credit Rating and the month where their fiscal year ends.

Some stocks have price following earnings already and are estimated to continue to grow; Some stocks have price disconnected from earnings and fundamentals, suggesting that they are undervalued when the price comes back to its intrinsic value according to the historical multiples that the market typically price these companies. I like the combination of investing into stocks with good price momentum (supported by fundamentals), while also investing into undervalued stocks that will eventually rebound – we don’t know when, but there’s a high degree of confidence that they will, given how earnings, cash flow and fundamentals overall is disconnected from some of the stocks below.

Canadian stocks that are fairly valued:

ATCO Ltd. engages in structures and logistics, electricity, and pipelines and liquids businesses worldwide. Its Structures & Logistics segment manufactures, sells, and leases workforce housing and modular facilities, as well as offers construction, site support, and logistics and operations management services. The company’s Electricity segment generates, transmits, and distributes electricity, as well as offers related infrastructure services. This segment operates gas-fired, coal-fired, and hydroelectric generation facilities. Its Pipelines & Liquids segment transmits, distributes, and store integrated natural gas; provides industrial water solutions; and develops related infrastructure. The company’s Corporate & Other segment retails electricity and offers natural gas services; and engages in commercial real estate activities. ATCO Ltd. was founded in 1947 and is headquartered in Calgary, Canada.

Alimentation Couche-Tard Inc. operates and licenses convenience stores. Its convenience stores sell tobacco products, grocery items, beverages, and fresh food offerings; road transportation fuel; and stationary energy, marine fuel, aviation fuel, and chemicals. The company operates its convenience store and road transportation fuel retailing chain under various banners, including Circle K, Couche-Tard, Holiday, Ingo, Mac’s, Re.Store, and Topaz. It is also involved in the sale of lottery tickets, calling cards, gift cards, postage stamps, and bus tickets; issuance of money orders; and provision of automatic teller machines, cashing checks, and car wash services. As at April 30, 2018, it operated and licensed 12,740 convenience stores, which include 9,718 company-operated stores in North America, Ireland, Scandinavia, Poland, the Baltics, and Russia, as well as 2,000 stores, which are operated under the Circle K banner in China, Costa Rica, Egypt, Guam, Honduras, Hong Kong, Indonesia, Macau, Malaysia, Mexico, the Philippines, Saudi Arabia, the United Arab Emirates, and Vietnam. The company was formerly known as Actidev Inc. and changed its name to Alimentation Couche-Tard Inc. in December 1994. Alimentation Couche-Tard Inc. was founded in 1980 and is headquartered in Laval, Canada.

BCE Inc., a telecommunications and media company, provides wireless, wireline, Internet, and television (TV) services to residential, business, and wholesale customers in Canada. The company operates through three segments: Bell Wireless, Bell Wireline, and Bell Media. The Bell Wireless segment offers integrated digital wireless voice and data communications products and services. The Bell Wireline segment provides data, including Internet access, Internet protocol TV and telephony, local telephone, and long distance, as well as other communications services and products; and satellite TV and connectivity services. This segment also offers home security and monitoring services; competitive local exchange carrier services; business service solutions, such as hosting and cloud, managed, professional, and infrastructure services; virtual private networks, point-to-point data networks, and international network solutions; and Web and audio conferencing, and email solutions. The Bell Media segment offers conventional, specialty, and pay TV; and digital media, radio broadcasting, and out-of-home advertising services, as well as sports and other event production and broadcasting services. This segment owns and operates approximately 30 conventional TV stations; 34 specialty and 4 pay TV channels; 105 licensed radio stations; 31,000 advertising faces; and 200 Websites and approximately 30 apps. The company also distributes mobile products. BCE Inc. offers its services through a network of corporate and dealer-owned retail stores, national retailers, and call center representatives, as well as Websites and door-to-door sales representatives. The company was formerly known as Bell Canada Enterprises Inc. BCE Inc. was founded in 1880 and is headquartered in Verdun, Canada.

The Bank of Nova Scotia provides various financial services in North America, Latin America, the Caribbean and Central America, and the Asia-Pacific. It offers financial advice and solutions, and day-to-day banking products, including debit and credit cards, chequing and saving accounts, investments, mortgages, loans, and related creditor insurance to individuals and small businesses; and commercial banking solutions comprising lending, deposit, cash management, and trade finance solutions to medium and large businesses, including automotive dealers and their customers. The company also provides a suite of investment and wealth management advice, services, products, and solutions to customers, as well as advisors. Its asset management business focuses on developing investment solutions for retail and institutional investors; and wealth management solutions include private customer, online brokerage, full-service brokerage, pension, and institutional customer services. In addition, the company offers corporate lending; trade finance and cash management; investment banking services comprising corporate finance, and mergers and acquisitions; fixed income and equity underwriting, sales, trading, and research services; prime brokerage and stock lending services; foreign exchange sales and trading services; commodity derivatives; precious and base metals sales, trading, financing, and physical services; and collateral management services for corporate, government, and institutional investor clients, as well as international banking services for retail, corporate, and commercial customers. Further, it provides mobile, Internet, and telephone banking services. The company operates a network of 963 branches and approximately 3,600 automated banking machines in Canada; and approximately 1,800 branches internationally, as well as contact and business support centers. The Bank of Nova Scotia was founded in 1832 and is headquartered in Toronto, Canada.

Cogeco Communications Inc. operates as a communications corporation in North America. The company operates in three segments: Canadian Broadband Services, American Broadband Services and Business Information and Communications Technology Services. It offers digital video services and programming, such as basic services, digital tier packages, pay-per-view channels, discretionary services, video-on-demand services, high definition television, 4K television, and advanced video services; Internet services; and telephony services to residential customers comprising direct international calling, international long distance plans, voicemail, and other custom calling features. The company also provides a range of Internet packages; video services; telephony services; managed cloud services; and other advanced network connectivity services, such as session initiation protocol, primary rate interface trunk solutions, hosted private branch exchange solutions, and business and software efficiency services for business customers. In addition, it offers colocation, network connectivity, hosting, cloud services, and a portfolio of managed services to small, medium, and large enterprises operating in online retail, financial services, technology, public sector, education, health care, business services, manufacturing, media, and online gaming markets in Canada, the United States, Europe, and internationally. The company was formerly known as Cogeco Cable Inc. and changed its name to Cogeco Communications Inc. in January 2016. Cogeco Communications Inc. was founded in 1972 and is headquartered in Montreal, Canada. Cogeco Communications Inc. is a subsidiary of Cogeco Inc.

CI Financial Corp. is a publicly owned asset management holding company. Through its subsidiaries, the firm manages separate client focused equity, fixed income, and alternative investments portfolios. It also manages mutual funds, hedge funds, and fund of funds for its clients through its subsidiaries. The firm was founded in 1965 and is based in Toronto, Canada.

Canadian Pacific Railway Limited, together with its subsidiaries, owns and operates a transcontinental freight railway in Canada and the United States. The company transports bulk commodities, including grain, coal, potash, fertilizers, and sulphur; and merchandise freight, such as finished vehicles and machineries, automotive parts, chemicals and plastics, petroleum and crude products, and metals and minerals, as well as forest, industrial, and consumer products. It also transports intermodal traffic comprising retail goods in overseas containers that could be transported by train, ship, and truck, as well as in domestic containers and trailers that could be moved by train and truck. The company offers rail and intermodal transportation services through a network of approximately 12,500 miles serving business centers in Montreal, Quebec and Vancouver, British Columbia, Canada; and the United States Northeast and Midwest regions. In addition, it offers transload, leasing, and logistics services. Canadian Pacific Railway Limited was founded in 1881 and is headquartered in Calgary, Canada.

Canadian Tire Corporation, Limited provides a range of retail goods and services in Canada. The company operates through three segments: Retail, CT REIT, and Financial Services. The Retail segment retails general merchandise, apparel, footwear, sporting equipment, and petroleum under the Canadian Tire, Canadian Tire Gas, Mark’s, PartSource, and FGL banners. The CT REIT segment operates as a closed-end real estate investment trust that holds a portfolio of properties comprising Canadian Tire stores, Canadian Tire anchored retail developments, mixed-use commercial property, and distribution centers. The Financial Services segment markets a range of Canadian Tire credit cards, and insurance and warranty products; participates in the Canadian Tire loyalty program; offers savings deposit accounts, tax free savings accounts, and GIC deposits, directly and through third-party brokers; and issues debt to third-party investors to fund its purchases. The company was founded in 1922 and is based in Toronto, Canada.

Canadian Western Bank provides personal and business banking products and services primarily in Western Canada. The company offers current, savings, cash management, US dollar, senior, chequing, youth, and student accounts, as well as specialized accounts, including corporate and commercial, organization, strata solution/condo, general trust, and trust fund investment accounts. It also provides leading products, such as commercial lending and real estate, energy lending, and equipment financing products; mortgages; secured and unsecured lines of credit; registered retirement savings plan (RRSP), consolidation, car, and recreation vehicle loans; and credit cards. In addition, the company offers cash management services; life and disability insurance products that cover various loans, including residential mortgages, home improvement loans, collateral mortgages, lease loans, commercial mortgages, car loans, debt consolidation, education loans, investment loans, business loans, home equity lines of credit, business leases, personal lines of credit, and business lines of credit; and ATM, telephone, mobile, and online banking services, as well as deposit register and cheque order services. Further, it provides investment products comprising guaranteed investment certificates, RRSPs, registered retirement income funds, tax-free savings accounts, registered education savings plans, and mutual funds, as well as personal and business planning services. The company was founded in 1984 and is headquartered in Edmonton, Canada.

Exchange Income Corporation engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide. It operates through two segments, Aerospace & Aviation, and Manufacturing. The Aerospace & Aviation segment scheduled airline and charter services, and emergency medical services to communities located in Manitoba, Ontario, and Nunavut; and scheduled airline and charter service in Newfoundland and Labrador, Quebec, New Brunswick, and Nova Scotia. This segment also offers after-market aircraft, engines, and component parts to regional airline operators; designs, modifies, maintains, and operates custom sensor equipped aircraft; and provides maritime surveillance and support services in Canada, the Caribbean, and the Middle East. In addition, this segment offers parts, services, and MRO capabilities to Twin Otter operators; and provides intelligence, surveillance, reconnaissance (ISR), and situational awareness software solutions for the maritime, land, and air environments to defense, security, and commercial clients. The Manufacturing segment manufactures stainless steel tanks, vessels, and processing equipment; heavy duty pressure washing and steam systems; commercial water recycling systems; custom tanks for the transportation of various products primarily oil, gasoline, and water; and precision sheet metal and tubular products. This segment also focuses on the engineering, design, manufacture, and construction of communication infrastructure, as well as provision of technical services; and manufacture of unitized window wall system, as well as precision parts and components used in the aerospace and defense sector. Exchange Income Corporation is headquartered in Winnipeg, Canada.

Emera Incorporated, an energy and services company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity to various customers. The company is also involved in gas transmission and utility energy services businesses; and the provision of energy marketing, trading, and other energy asset management services. In addition, it transports re-gasified liquefied natural gas to consumers in the northeastern United States through its 145-kilometre pipeline in New Brunswick. The company serves approximately 375,000 customers in Florida; 525,000 customers in New Mexico; 515,000 customers in Nova Scotia; 158,000 customers in the state of Maine; and 129,000 customers in the Island of Barbados. Emera Incorporated was founded in 1919 and is headquartered in Halifax, Canada.

Enbridge Inc. operates as an energy infrastructure company in Canada and the United States. The company operates in five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution, Green Power and Transmission, and Energy Services. The Liquids Pipelines segment operates common carrier and contract crude oil, natural gas liquids (NGL), and refined products pipelines and terminals. The Gas Transmission and Midstream segment owns interests in natural gas pipelines, and gathering and processing facilities. The Gas Distribution segment is involved in natural gas utility operations serving residential, commercial, and industrial customers in Ontario, as well as in Quebec and New Brunswick. The Green Power and Transmission segment operates renewable energy assets, such as wind, solar, geothermal, and waste heat recovery facilities; and transmission facilities in the provinces of Alberta, Ontario, and Quebec, Canada; and in Colorado, Texas, Indiana, and West Virginia, the United States. The Energy Services segment provides energy supply and marketing services to refiners, producers, and other customers; crude oil and NGL marketing services; physical barrel marketing services; natural gas marketing services; and natural gas supply, transportation, balancing, and storage services for third parties. The company was formerly known as IPL Energy Inc. and changed its name to Enbridge Inc. in October 1998. Enbridge Inc. was founded in 1949 and is headquartered in Calgary, Canada.

Enbridge Income Fund Holdings Inc., through its investment in Enbridge Income Fund, holds energy infrastructure assets in Canada. The company holds interests in the 2,306-kilometre Canadian Mainline, the Regional Oil Sands System, and Southern Lights Pipeline, as well as other crude oil gathering pipelines and storage facilities in Alberta, Saskatchewan, Manitoba, Ontario, and Quebec; and crude oil storage terminals and caverns in Hardisty, Alberta. It also owns a 50% interest in the 3,719-kilometre Alliance System, which transports natural gas from western Canada and the Bakken region to delivery points near Chicago, Illinois. In addition, the company holds interests in 14 renewable and alternative power generation assets that include solar, wind, and waste heat recovery facilities comprising a generation capacity of approximately 1400 megawatts of power in the areas of Alberta, Saskatchewan, Ontario, and Quebec. Enbridge Income Fund Holdings Inc. was incorporated in 2010 and is headquartered in Calgary, Canada.

Equitable Group Inc., through its subsidiary, Equitable Bank, provides various financial services to retail and commercial customers in Canada. Its deposit products include guaranteed investment certificates (GICs), high interest savings accounts (HISAs), and deposit notes. The company also provides single family lending services, such as loans secured by owner-occupied and investment properties comprising detached and semi-detached houses, townhouses, and condos through a range of products, such as mortgages, home equity lines of credit, and equity release mortgages; and commercial lending products that include mortgages on commercial properties comprising mixed-use, multi-unit residential, shopping plaza, professional office, and industrial properties. In addition, it offers securitization financing products comprising insured mortgages on multi-unit and single family residential properties funded through securitization programs. Further, the company provides EQ savings plus account, an interest rate product that includes flexible day-to-day features, including bill payments, instant EQ to EQ transfers, and preauthorized transactions under the EQ Bank brand name. Additionally, it offers brokered deposit products, such as savings products, which include GICs and brokered HISAs under the Equitable Bank brand name. The company was founded in 1970 and is headquartered in Toronto, Canada.

Fortis Inc. operates as an electric and gas utility company in Canada, the United States, and the Caribbean. It generates, transmits, and distributes electricity to approximately 422,000 retail customers in southeastern Arizona; and 96,000 retail customers in Arizona’s Mohave and Santa Cruz counties with an aggregate capacity of 2,834 megawatts (MW), including 64 MW of solar capacity. The company also sells wholesale electricity to other entities in the western United States; owns gas-fired and hydroelectric generating capacity totaling 64 MW; and distributes natural gas to approximately 1,008,000 customers in British Columbia, Canada. In addition, it owns and operates the electricity distribution system that serves approximately 556,000 customers in southern and central Alberta; owns four hydroelectric generating facilities with a combined capacity of 225 MW; and provides operation, maintenance, and management services to hydroelectric generating facilities. Further, the company distributes electricity in the island portion of Newfoundland and Labrador serving approximately 266,000 customers with an installed generating capacity of 139 MW; and on Prince Edward Island serving approximately 80,000 customers through generating facilities with a combined capacity of 145 MW. Additionally, it provides integrated electric utility service to approximately 66,000 customers in Ontario; approximately 44,000 customers on Grand Cayman, Cayman Islands; and approximately 15,000 customers on certain islands in Turks and Caicos, as well as holds long-term contracted generation assets in British Columbia and Belize, and the Aitken Creek natural gas storage facility. It also owns and operates transmission and distribution lines; and natural gas pipelines. Fortis Inc. was founded in 1885 and is headquartered in St. John’s, Canada.

Gildan Activewear Inc. manufactures and sells a range of apparel products in the United States, Canada, Mexico, Europe, the Asia-Pacific, and Latin America. It operates in two segments, Printwear and Branded Apparel. The company manufactures and markets active wear products, including T-shirts, fleece tops and bottoms, and sport shirts under Gildan, Gildan Performance, Gildan Platinum, Gildan Hammer, Smart Basics, Comfort Colors, American Apparel, Anvil, Alstyle, Gold Toe, and Mossy Oak brands. It also offers athletic, dress, casual, workwear, legwear, and therapeutic socks under the Gildan, Gildan Platinum, Smart Basics, Under Armour, Gold Toe, PowerSox, GT a Gold Toe Brand, Silver Toe, Signature Gold by Goldtoe, Peds, MediPeds, Kushyfoot, Therapy Plus, All Pro, and Mossy Oak brand names. In addition, the company provides men’s and boys’ top and bottom underwear, and ladies panties under Gildan, Gildan Platinum, Smart Basics, and American Apparel brand names; hosiery comprising sheer panty hose, tights, and leggings under Secret, Silks, Secret Silky, Peds, and American Apparel brand names; and ladies shapewear and intimates accessories under Secret and American Apparel brand names, as well as other products, such as denim, jackets, sweaters, bodysuits, skirts, dresses, and accessories. Gildan Activewear Inc. serves wholesale distributors, screen printers/embellishers, retailers, and individual consumers. The company was formerly known as Textiles Gildan Inc. and changed its name to Gildan Activewear Inc. in March 1995. Gildan Activewear Inc. was incorporated in 1984 and is headquartered in Montreal, Canada.

Industrial Alliance Insurance and Financial Services Inc., doing business as, iA Financial Group, primarily provides various life and health insurance products in Canada. The company operates through four segments: Individual Insurance, Individual Wealth Management, Group Insurance, and Group Savings and Retirement. It offers various individual insurance products and services, including life, car, leisure vehicle, home, mortgage, critical illness, disability, personal accident, travel, and other group insurance products; and residential mortgage loans, registered retirement savings plan (RRSP) loans, registered education savings plan (RESP) loans, auto loans, and investment loans, as well as provides savings and retirement products, such as RRSP products, tax-free savings accounts, locked-in retirement accounts, voluntary retirement savings plans, and non-registered savings plans; registered retirement income funds, life income funds, and annuities; RESP products for children’s education; segregated funds; and various financial products. The company provides group insurance products and services, including medical and paramedical care, homecare, vision and dental care, life insurance and accidental death and dismemberment, short and long-term disability, and travel insurance products; administrators services; special market solutions; group retirement plans; investment solutions; fund governance; and dealer services for various insurance products, as well as leases office space. Further, it provides advisory and brokerage services for individual and group insurance, individual savings, lawyer or notary, and automobile and recreational vehicles; and advisory services for group retirement plans and securities, as well as acts as a broker for special risk insurance products, mortgage, and real estate. The company was founded in 1892 and is headquartered in Quebec City, Canada.

Loblaw Companies Limited, a food and pharmacy company, provides grocery, pharmacy, health and beauty, apparel, general merchandise, credit card, insurance brokerage, gift card, and telecommunication services in Canada. It operates through three segments: Retail, Financial Services, and Choice Properties. The Retail segment operates corporate and franchise-owned retail food and associate-owned drug stores, including instore pharmacies, other health and beauty products, apparel, and other general merchandise, as well as provides the PC Optimum program. The Financial Services segment provides credit card services, loyalty programs, insurance brokerage services, deposit taking services, and telecommunication services. The Choice Properties segment owns, manages, and develops retail and commercial properties. The company provides its products and services under the President’s Choice, Life Brand, and no name brand. Loblaw Companies Limited was founded in 1919 and is headquartered in Brampton, Canada.

Laurentian Bank of Canada, together with its subsidiaries, provides banking services to individuals, small and medium-sized enterprises, and independent advisors in Canada and the United States. It operates through four segments: Retail Services, Business Services, B2B Bank, and Capital Markets. The company offers transactional products and current accounts, term deposits, and investment accounts; personal line of credit, personal loans, student loans, and registered retirement savings plans; financing for agriculture, real estate, and commercial industries, as well as small and medium-sized enterprises; mortgage solutions, such as variable-rate mortgage, fixed-rate mortgage, equity line of credit, mortgage insurance, and retirement line of credit; and credit and business cards, as well as equipment finance and leasing solutions. It also provides investment products, including fixed-rate investments, indexed investments, mutual funds, systematic savings plans, retirement projection plans, registered plans, bank securities, deposit-insurance, and power-of-attorneys; short-term and long-term investment solutions; and guaranteed investment certificates, as well as offers credit insurance products. In addition, the company offers advising services in the areas of portfolio management, personal finances management, and financial planning; securities brokerage services; and foreign trade services, as well as cash management and international services. Laurentian Bank of Canada was founded in 1846 and is headquartered in Montreal, Canada.

Linamar Corporation manufactures and sells precision metallic components, modules, and systems in Canada, the United States, the Asia Pacific, Mexico, and Europe. It operates through two segments, Powertrain/Driveline and Industrial. The company offers hybrid power units, power transfer units, rear drive units/modules, and engineered gears; and shaft and shell assemblies, differential assemblies, transmission gears, clutch modules, center housings, transmission/driveline shafts, transfer case pump housings, and other transmission components. It also provides cylinder blocks, cylinder heads, connecting rods, camshafts, flywheels, fuel rails, pumps and bodies, balance shaft modules, fuel injector bodies, fuel pump housings, and turbo charger housings; and wheel hubs and bearings, axle shafts, and steering knuckles. In addition, the company offers precision machined castings and metallic assemblies; and planetary carriers, gearbox housings, bearing housings, and torque arms. Further, it provides mobile industrial and harvesting equipment, aerial work platforms, telehandlers, draper headers, and self-propelled windrowers; markets corn and sunflower heads under the Harvestec and OROS brands; and produces assemblies for hay rake equipment, track modules for tracked construction equipment and tractors, combine head trailers, and other agricultural related fabrications and systems. Additionally, the company offers carriers and housings, oil/water pumps, flywheel covers, crankshaft gears, vertical mast lifts, DC electrical scissor lifts, rough terrain scissor lifts, hollow shafts, and down hole drill heads; aluminum castings; and freight solutions. It serves automotive, commercial vehicle, off highway, marine and recreational, industrial, aerial work platforms, energy, and agricultural industries. Linamar Corporation was founded in 1966 and is headquartered in Guelph, Canada.

Magna International Inc. designs, develops, and manufactures automotive systems, assemblies, modules, and components in North America, Europe, Asia, and South America. The company offers body systems, including exterior sheetmetal and closure systems, body structure systems, and energy management solutions; chassis systems, such as frames and chassis subframes, suspension links and arms, and chassis modules; and engineering services comprising support, program management, virtual tool, prototype build and validation, testing, and research and development services. It also provides fascia and exterior trims, liftgate and exterior modules, front end modules, ACTERO active aerodynamics, and lightweight composites; and roof systems that include softtops, retractable hardtops, modular tops, and hardtops. In addition, the company offers latching system, hinge and wire forming, power closure, electronic, door module, window system, engineered glass, sealing, trim and roof rack, testing center, and running board closures; and driveline systems, fluid pressure and controls, and metal-forming solutions. Further, it provides driver assistance systems and electronic components; and interior and exterior mirrors, actuators, electronic vision systems, door handle and overhead console technologies, and front and signal lightings. Additionally, the company offers seating systems, mechanism and seat structure solutions, foam and trim solutions, and design and development solutions; and engineering services, vehicle contract manufacturing services, and fuel systems. The company serves original equipment manufacturer, tier 1, medium and heavy truck, and non-automotive customers. Magna International Inc. was founded in 1957 and is headquartered in Aurora, Canada.

Pembina Pipeline Corporation provides transportation and midstream services for the energy industry in North America. It operates through three divisions: Pipelines, Facilities, and Marketing & New Ventures. The company operates approximately 10,000 kilometers of pipeline network that transports hydrocarbon liquids and extends across Alberta and parts of British Columbia, Saskatchewan, and North Dakota; and owns and operates the Nipisi and Mitsue pipelines, which provide transportation for producers operating in the Pelican Lake and Peace River heavy oil regions of Alberta; transports synthetic crude oil for the Syncrude project and the Horizon project to delivery points near Edmonton, Alberta; and operates Cheecham Lateral, which transports synthetic crude to oil sands producers operating southeast of Fort McMurray, Alberta. Its Oil Sands & Heavy Oil business operates approximately 1,650 kilometers of pipeline and has 1,060 thousands of barrels per day of capacity. In addition, the company provides natural gas gathering, compression, condensate stabilization, and shallow and deep cut processing services. Further, its NGL Midstream business offers products and services, including storage, terminalling, and hub services through 14 truck terminals; 21 inbound and 13 outbound pipeline connections; 1.2 mmbpd of crude oil and condensate supply; and approximately 900 mbbls of ground storage in the Edmonton North Terminal, as well as 2 NGL operating systems. Additionally, the company offers tariff-based operations of pipelines and related facilities; natural gas gathering and processing facilities; NGL fractionation facility and gas processing capacity near Chicago, Illinois; and other natural gas and NGL processing facilities, logistics, and distribution assets in the United States and Canada. Pembina Pipeline Corporation was founded in 1997 and is headquartered in Calgary, Canada.

Restaurant Brands International Inc. owns, operates, and franchises quick service restaurants under the Tim Hortons (TH), Burger King (BK), and Popeyes (PLK) brand names. The company operates through three segments: TH, BK, and PLK. Its restaurants offer blend coffee, tea, espresso-based hot and cold specialty drinks, donuts, Timbits, bagels, muffins, cookies and pastries, grilled paninis, classic sandwiches, wraps, soups, hamburgers, chicken and other specialty sandwiches, french fries, soft drinks, chicken, chicken tenders, fried shrimp and other seafood, red beans and rice, and other food items. As of December 31, 2017, the company owned or franchised a total of 4,748 TH restaurants, 16,767 BK restaurants, and 2,892 PLK restaurants in approximately 100 countries and U.S. territories worldwide. Restaurant Brands International Inc. was founded in 1954 and is headquartered in Oakville, Canada.

Royal Bank of Canada, together with its subsidiaries, operates as a diversified financial service company worldwide. The company’s Personal & Commercial Banking segment offers personal and business banking services, as well as auto financing and retail investment products. This segment also provides a suite of financial products and services to individual, business clients, and public institutions through its branch, automated teller machines, online, mobile, and telephone banking networks, as well as through sales professionals. Its Wealth Management segment offers a suite of investment, trust, banking, credit, and other wealth management solutions to high net worth and ultra-high net worth clients; and asset management products and services directly to institutional and individual clients through its distribution channels and third-party distributors. The company’s Insurance segment provides life, health, home, auto, travel, wealth, group, and reinsurance products and solutions through retail insurance branches, field sales representatives, advice centers, and online network, as well as through independent insurance advisors and affinity relationships. Its Investor and Treasury Services segment offers asset services, custody, payments, and treasury services for financial and other institutional investors. This segment also provides cash management, correspondent banking, and trade finance for financial institutions; and short-term funding and liquidity management services. The company’s Capital Markets segment offers corporate and investment banking, as well as equity and debt origination, distribution, and structuring and trading for public and private companies, institutional investors, governments, and central banks. Royal Bank of Canada was founded in 1864 and is headquartered in Toronto, Canada.

The Toronto-Dominion Bank, together with its subsidiaries, provides various personal and commercial banking products and services in Canada and the United States. It operates through three segments: Canadian Retail, U.S. Retail, and Wholesale Banking. The company offers personal deposits, such as checking, savings, and investment products; financing, investment, cash management, international trade, and day-to-day banking services to small, medium, and large businesses; financing options to customers at point of sale for automotive and recreational vehicle purchases through auto dealer network; credit cards; investing, advice-based, and asset management services to retail and institutional clients; and property and casualty insurance, as well as life and health insurance products. It also provides capital markets, investment banking, and corporate banking products and services, including underwriting and distribution of new debt and equity issues; providing advice on strategic acquisitions and divestitures; and trading, funding, and investment services to companies, governments, and institutions, as well as offers telephone, Internet, and mobile banking services. The company offers its products and services under the TD Canada Trust, TD Bank, and America’s Most Convenient Bank brand names. It offers personal and business banking products and services to approximately 15 million customers through a network of 1,128 branches and 3,157 automated teller machines in Canada; and to approximately 8 million retail customers through a network of 1,270 stores. The company was founded in 1855 and is headquartered in Toronto, Canada.

Uni-Select Inc. distributes automotive refinish, and industrial paint and related products in the United States, Canada, and the United Kingdom. The company operates through FinishMaster US, Canadian Automotive Group, and The Parts Alliance UK segments. It also distributes automotive original equipment manufacturer and aftermarket parts. The company serves automotive and collision repair center customers, and corporate stores through its BUMPER TO BUMPER, AUTO PARTS PLUS, and FINISHMASTER stores. Uni-Select Inc. was founded in 1968 and is headquartered in Boucherville, Canada.

The examples above cover many types of stocks – dividend growth, high yield stocks and low yield stock with higher potential total return growth. I firmly believe that a diversified portfolio exposed to different sectors and with different driving forces of return allows one to build a decent nest egg into retirement, and provide sufficient income to stay invested during retirement.

Please let me know if there are any questions, and feel free to provide any feedback in the comment section below.

Happy investing!

It is very important to consider the quality and valuation when looking to invest in stocks. It will make sure that you make the right decision when getting into this business.

Might be off topic but, can you comment on where to put dividend stocks and REITS into which investment accounts? At the moment I have a TFSA and a RRSP account at TD and a Non-Registered Account account at Questrade.

Both the TFSA and RRSP have the td e-series accounts and I want to move away from those funds and focus on dividend stocks. I heard I should be putting REITS in TFSA and US stocks in RRSP to save on the 15% withholding tax. Is this correct?

My non-registered questrade account has a mixture of about 30 Canadian Dividend Stocks and 5 REITS. Should I be selling these REITS here and re-buy them in the TFSA account?

Thank you in advance for any advice

There are many ways to implement this, so you will find multiple valid answers to this. My personal setup, from an investing perspective, is to hold Canadian stocks in TFSA and non-registered account, and hold US stocks in RRSP, since the 15% withhold tax does not apply on RRSP. Drilling Canadian investments further, I prefer to have all my REITs and income trusts in TFSA, to be more tax efficient. Some REITS / income funds distributes interest with their dividends, so I rather have that on a TFSA (interest is taxed as income). Some REITs / income trusts pay return of capital, which makes ACB calculation complex during tax time, hence another reason to hold them on TFSA. Companies that are eligible for the Canadian dividend tax credit are held on non-registered accounts only after I maximize my TFSA. I only have US stocks in RRSP simply to provide further diversification, since a large portion of Canadian stocks are in TFSA and non-registered accounts – and to save the withhold tax on US stocks too. But RRSP only makes sense if your tax bracket when you retire is lower than today. And I would maximize TFSA before putting anything on a non-registered account.

Also, if you need to liquidate investments for a large purchase, it’s always best to use funds from TFSA, because you gain that room back next year, allowing you to move funds from your non-registered account to your TFSA (on the following year), and therefore, save on dividend tax for that portion that you managed to move. This will ensure that not only you didn’t have to pay tax on the proceeds to fund your large purchase, but you also keep your TFSA maxed out to lower the total tax that you need to pay.

Also, if you are planning to sell from the non-registered account and buy back in the TFSA, make sure to wait 30 days before purchasing back, or the superficial loss rule might apply.

Lastly, the suggestion above might not apply to your particular financial circumstances. The information above is not intended to provide legal or tax advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, make sure to obtain professional advice from a qualified tax advisor.

thank you for this, it will help with my allocation of accounts.

btw, did you make that spreadsheet for tracking dividend investing performance? or is that available somewhere online? it’s a really nice and simple sheet.

This spreadsheet was made to track my yearly income growth and share the results on this website and inspired from a template that I found on the web a while ago. It’s been modified a few times since Google Finance don’t have reliable data for dividends anymore, so now it has formulas to import data from investing.com. Also, the graphs and data below the holdings use some custom formulas as well. If you want to track it for your portfolio, I would look into stockers.ca – It’s a neat interface with nice capabilities to track one’s portfolio according to their website. Other options include building your own portfolio on Yahoo Finance or Morningstar, but I haven’t tested that in a while.

I was thinking of doing all REITS in TFSA, however, I’m not sure whether to just purchase individual REITS like I have been doing in my non-registered or just buying an REIT ETF like vanguard VRE which already has most of the top REITS in canada. The MER is just 0.39% for VRE and although individual REITS don’t have a MER, I would have to spend on commissions every month to add to their positions.

Hi David,

I firmly believe in evaluating a business at a time. That’s the best way to tailor your purchases towards the companies you really want to partner with, besides allowing you to pay the right price for it whenever you want. A REIT ETF is simply a convenient way to get exposure to that sector, but it’s not optimal, because of 3 issues that every ETF has (and individual companies don’t have):

First, quality. When buying an ETF you must purchase the whole package they offer. If there is a company there that don’t meet your quality criteria, you don’t have an option to skip it. Not only poor quality investments drag return in the long run, but also it adds risks to your choice, if you are buying a piece of company that you wouldn’t do individually. For example, VRE holds FCR, which doesn’t pass my quality criteria. FCR adjusted funds from operations didn’t really go anywhere considering the 10-year time frame below:

Second, valuation. You must pay market price for everything. And when you pay more than you should for a company, that would drag returns as well. A great company can turn into a poor investment if you pay too much for it. Take for example VRE 2nd biggest holding, CAR.UN. It’s very overvalued:

Third, MER. 0.39% is not small if you have a large investment. And the more your investment grows, the more MER you are paying, because it’s a percentage of what you have, not a fixed fee. A $10,000 investment (which is not much) pays $39 in MER. If you purchase your individual stocks in a brokerage like Interactive Brokers, it’s only $1 to buy and $1 to sell. No need to purchase all companies at once, since not all of them will have the best valuation at the same time. I rather purchase one or two per month. If you have a much larger investment, say $100,000, then it’s $390 in MER. It adds up.

In sum, VRE ETF works to have the REIT exposure without effort. Just dollar cost average. But if you want to maximize your investments further, use their holdings as an initial screener and take valuation into account to build your portfolio a company at the time. The higher your margin of safety, the less risk you have, the better positioned your porfolio will be for higher returns.

Nice Post !!

Couple more things:

1. I think it would be great if you covered div paying ETF’s and combined your knowledge of the assets within + the value of which ones have the best MER etc etc.

2. On your most recent post, I only see the names that are under the “fairly valued” category but not the “Undervalued” category. Did I miss something?

Hi Hugh,

I find it very difficult to evaluate ETFs, since each one has a specific criteria to buy and sell the stocks underneath the ETF. Also, we can’t benefit from choosing valuation when buying ETFs, because when we buy an ETF we pay market price for all companies that compose that ETF. Also, not every company in a given ETF meets my quality criteria, so I don’t like having to buy a piece of a business that I would never invest myself. ETFs are very convenient, but it comes at the cost of not taking valuation into account, and have to accept the basket of company as-is. Plus, MER compounds fees on top of that. For this reason, I prefer to evaluate a business at the time.

2. The list above contains both undervalued companies (like ATD.B, CIX, IAG, LB, LNR or any other company trading below Graham’s valuation of PE15 and below the company’s historical PE) as well as fairly valued companies (like ACO.X, BCE, CP or any other company trading close to its historical PE, taking into consideration what the earnings growth for that business will be for the next year or two).

The info on the company is too long. Just say Enbridge – Pipeline and maybe why you like it, or what they are working on, or what pushed the price down. Just more personalized commentary. The graphs are awesome, but accompany them!

It looks like you have removed TD and RY from your portfolio which might be fairly valued, and are focusing on a couple others that are undervalued LB, BNS.

Hi Shea,

I appreciate the feedback. The idea behind the long details is to provide a comprehensive idea on what the business entail, as many companies listed here might not be known to everyone. Many of these companies trade in US Exchange, so the details allow the US readers to have a better idea what some of these business are.

Once a year I post a comprehensive list of what I consider fairly valued / overvalued across my entire watchlist, so it would be too long to cover specific details to what pushed the price down. I typically do that once I provide my monthly purchases, although I purchase only 4 companies per month (2 Canadian and 2 US). Regarding why I like these companies can be related to the fact that they are on my watchlist: these are companies that passed my quality criteria, with a decent balance sheet and good metrics on income statement, good proven record of continuous earnings, cash flow and dividend growth for many years, and that are estimated to continue to grow, through a diligence process similar to this post that I did for Blackrock a while ago. If you want to leverage a screener for some of these quality metrics, I wrote this post about how one can implement it.

In closing, the companies above already meet my quality criteria, the graphs are to illustrate that they are also fairly valued.

Thank you for the thorough explanation

Great post – and very similar to one I had posted recently (although more in depth):

https://moneymaaster.wordpress.com/2018/07/27/moneymaasters-summer-stock-screen-13-stocks-to-check-out/

Glad I stumbled across this site on reddit, i’ll have to check back 🙂

Thank you for the link, we share many of the companies in our list. Some of these companies, however, are overvalued, so I wouldn’t buy them now.

Your post says these companies are fairly valued or undervalued, but this comment says some of the companies are overvalued. Can you please explain?

I am new to investing and am following your public Canadian model. I was wondering if I should invest in the companies in this post (and the US one)

Hi TR,

My comments were was in reply to Jordan, who also posted a list of quality companies for the long term. Some of the companies that he posted, such as Andrew Peller and Dollarama are overvalued in my opinion, because the stock grew more than the business. All companies provided in the post above are considered fairly valued or undervalued, because the business is estimated to have a reasonable growth (blue and orange line on the graphs above), but stock price (black line) hasn’t been following that expected growth yet. My watchlist contains many more companies than what I posted above, but the rest is overvalued in my opinion, or it would provide an estimated low total return (below 5% annualized), with little margin of safety.

Therefore, the companies that I posted above with the graphs not only meet my quality criteria, but they also meet my fair valuation criteria. Meanwhile, the companies on my watchlist simply meet my quality criteria. That means, the rest of the companies in my watchlist that were not mentioned above are overvalued in my opinion.

Thank you so much for the explanation.

Your list includes Canadian Tire (CTC), but then in your public model, you indicated a selling order around the same time. Can you please clarify?

Hi TR,

The public model is a trading model. The lists on this post is for investing for the long term. These are 2 different strategies. The trading model is meant for short term gains. It focus in minimizing drawdown and locking profits in the short term – features that are not required when investing. The trading models simply pick stocks based on buy and sell rules, according to each trading model. This is a completely different strategy than investing for dividend growing companies. The focus is on the growth of dividends, to hold these companies for a very, very long time, by partnering with the business, where we don’t care about the temporary drawdown nor to lock profits quickly. Investing has the mentality of buying a piece of their business and holding for a long time, very different than trading, which sees stocks simply as tickers to buy and sell for the short term.

CTC has a good value now, and it’s a good quality company, features that are attractive when looking to partner with a business that has a solid tracking record to grow dividends and it’s estimated to continue to grow. That value makes it attractive to invest, but not necessarily attractive to trade, because momentum has stalled. An investor don’t attempt to time the bottom, all we need is to buy a company with a decent value. Very different than a trader mentality.

So as an investor, I hold CTC.A because the goal of that investment is the long term growth of earnings, cash flow and dividends. As a trader, I no longer hold CTC.A on my Graham model, because it no longer ranks in the top from a quality, value, growth and momentum combinations, and it’s been replaced with other stocks that meet the Graham buy rules and rank better as an attempt to profit for the short term.

Please let me know if you have any questions.

Great website and post. A note about the content. Perhaps some anecdotal commentary on the company and what you like about the business financial fundamentals you find most appealing.

Ie cash on hand, cash flow, margins etc

Thank you. Agreed, and I typically provide some insight when listing some of my monthly purchases. I will certainly elaborate more on those details when going through my next purchases.

What I typically like is a combination of factors that meet all my criteria for quality when choosing to partner with these businesses. Quality can be found on companies with a good record is growing earnings and cash flow. It shows how resilient they’ve been through different economic cycles and how management can react and adapt. A full due diligence should be done taking into consideration other metrics for fundamentals, such as a strong balance sheet, good margins, reasonable liquidity and any attributes that shows financial strength.

Once I find a good quality business it goes to my watchlist, and I treat it as a business that I’m partnering with, for many years. Companies report results just 4 times a year, so I only re-evaluate the operating metrics for that company once a year. However, a good quality company doesn’t always trade at a reasonable price. A great company can be a terrible investment if one pays too much for it. Therefore, I take valuation into account, every time that I’m about to buy more shares of a business – which are the graphs above.

This list covered a lot of companies and my intent was a visual representation of how stock price follows earnings and cash flow, and how they are estimated to perform in the next years.