Premium Model

Seeking Income and Quality (US)

This model seeks companies with strong fundamentals, higher dividend yield and low volatility, as a mechanism to find value and quality. Only large-cap companies are traded, to ensure high liquidity. This model has been revised to consider companies with lower dividend yield if they rank higher from a quality perspective.

Although the stocks are held for an average of 4 months, the model uses market timing rules which are verified weekly, case macro conditions deteriorate, in order to preserve capital and income via other asset types.

This is a moderate-turnover model, inspired by the idea that low volatility stocks outperform high volatile ones in the long term, as per explanation of this white paper and this article. Therefore, having an additional focus to quality and high income is what this model aims to achieve: locking profits as a trading model and getting paid more than the market yield while waiting. This model is rebalanced weekly and it holds up to 10 stocks. Since the focus is on income, it only includes companies that are clearly able to sustain the current dividends. However, if stocks with a higher yield cannot be found, the model will select stocks with a lower yield, provided it scores high on the quality ranking. This model only considers stocks that pays some form of distribution.

Therefore, this model uses the higher yield as a form of valuation, as they rank stocks by high income and low volatility. Diversification, combined with quality factors enhance the probabilities of mitigating a value trap stock. Although the primary focus is income, the model does make use of total return by mixing stocks with a lower yield and higher profit potential if the model cannot find stocks with a higher yield first.

This is a mechanical model that chooses what to buy and sell based on a set of rules. Therefore, there will be losing trades from time to time. By no means it reflects a broken strategy. No model can outperform at all times, so it’s paramount to have the proper temperament to stick what a strategy that is aligned to your goals and risk tolerance.

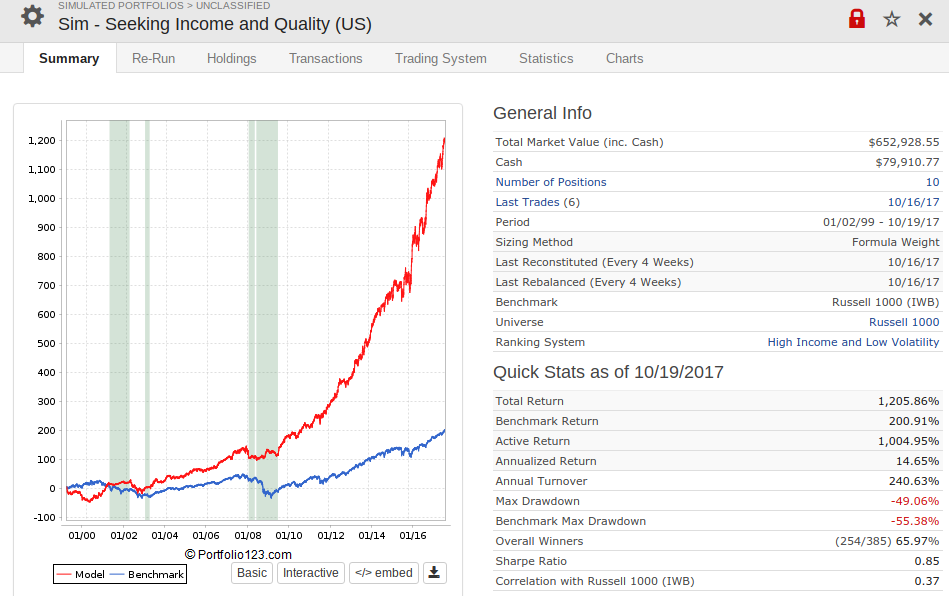

See backtest information below to evaluate how these rules would have worked since 1999:

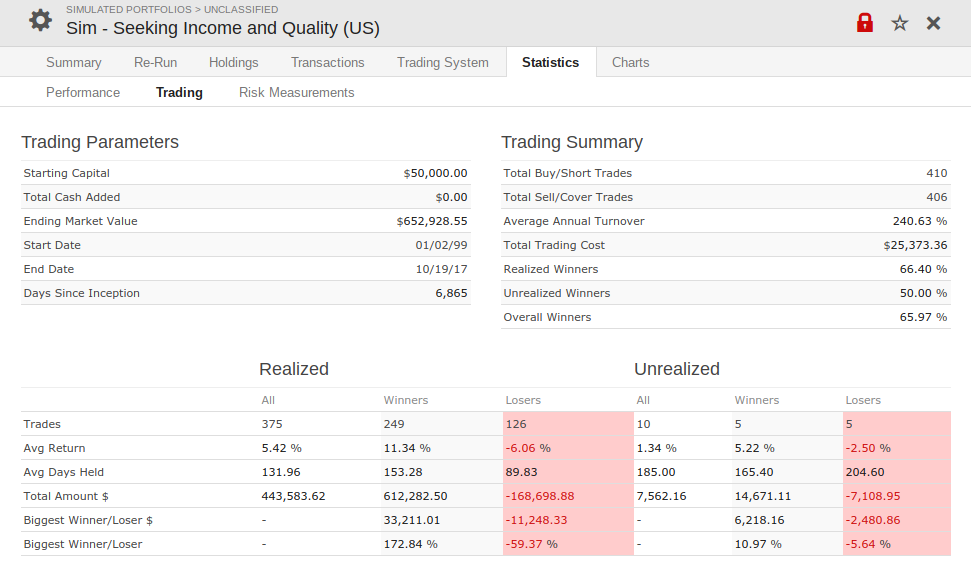

Model summary, including variable slippage (starting capital was $50,000) and fixed commission of $4.95:

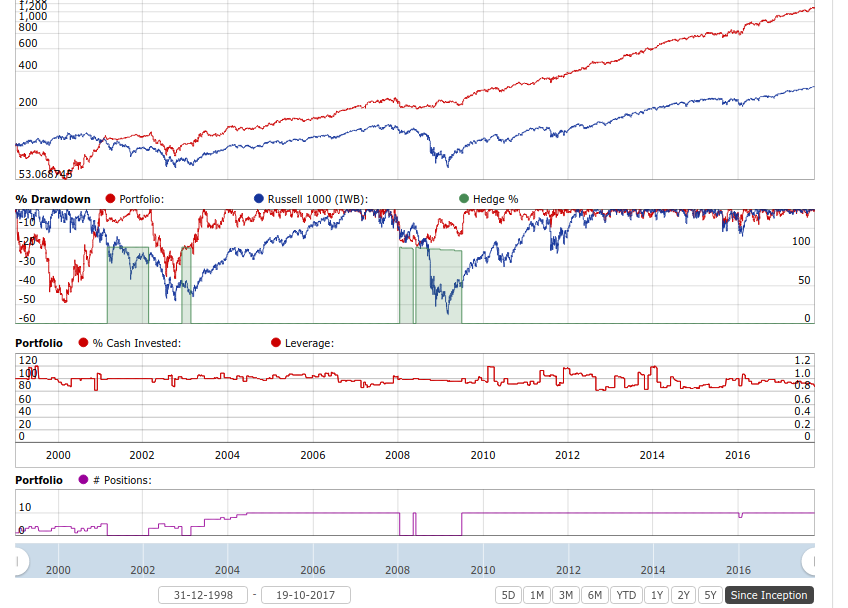

Performance summary (log scale):

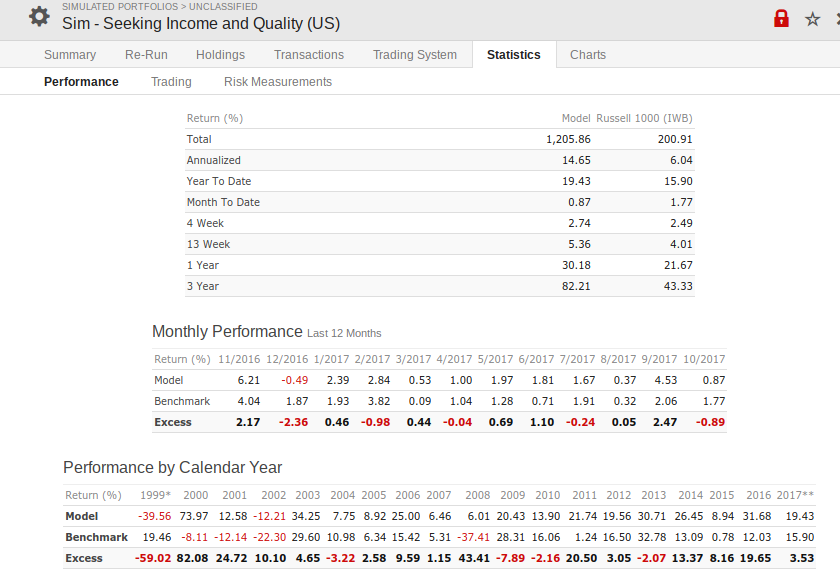

Stats information below, with winners, losers and how long typically these stocks are held for:

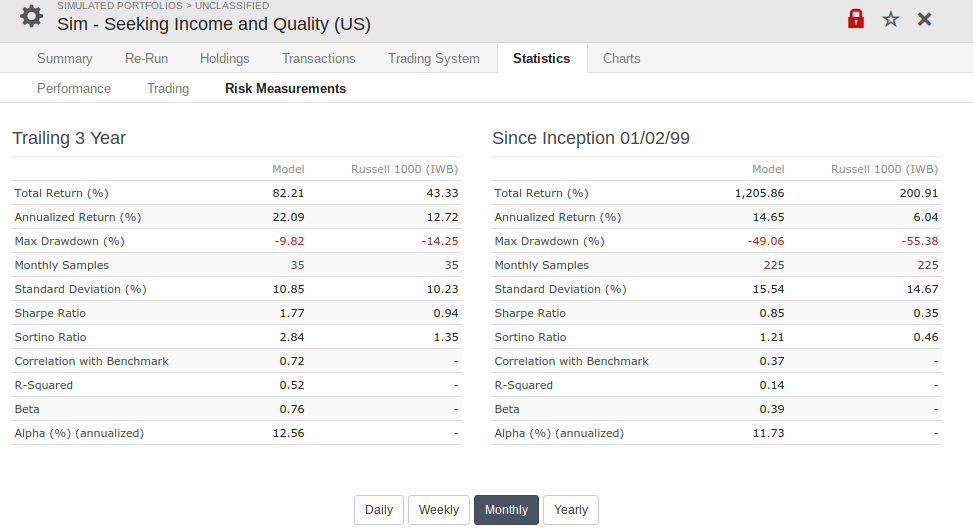

Below are various risk indicators as well:

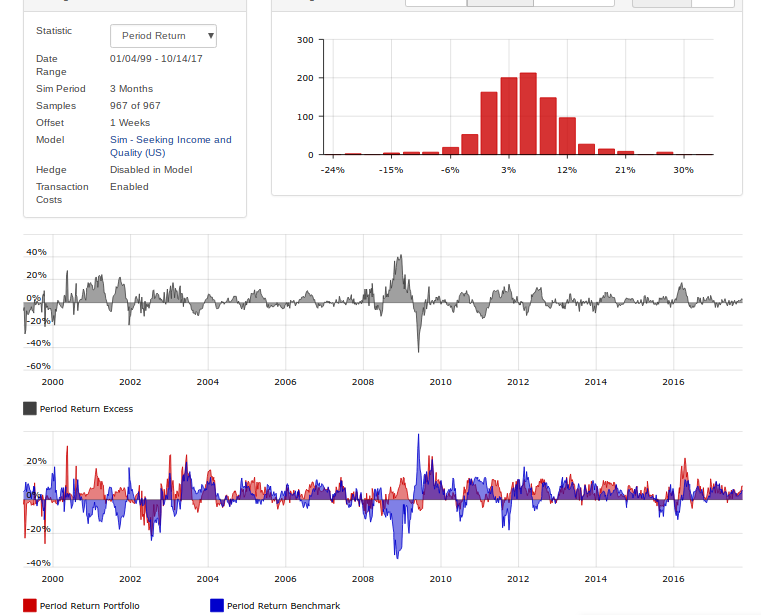

Since the worst performers typically holds positions for 3 months on average (the mode usually hold stocks for 5 months, which performs better), the following histogram was run, to evaluate how consistently the model would perform if it started at different periods (roling offset was set to 1 week, while the performance period was set to 3 months on the worst case scenario starting at different timeframes); below is the histogram excess performance when compared to the benchmark (Russell 1000):

And below is the same histogram, but showing the actual model portfolio performance, instead of the excess when compared to the benchmark (Russell 1000);

The first screening criteria is related to the market timing, to either be in equities or cash. This market timing rules use data from micro-elements (earnings and price movement trends for the whole market) as well as macro-elements, such as economic indicators (which might drive prices lower, regardless of solid fundamentals) to issue a sell all signal (move to cash) or buy according to the rules of this model.

The next screening criteria filters the stocks from US exchanges for quality, to only consider companies that are clearly able to sustain the dividends, by having a strong cash position, a low long term debt to market cap and a strong ROE.

Then the list is further reduced to include stocks that have increased dividends, is trading at a higher yield to be able to produce higher than market income and have good earnings yield for short term appreciation.

The stocks are then ranked regarding high income and low volatility, and the 10 highest ranked are chosen to buy. The model rebalances at every 4 weeks and starts over the process described above. If the model remains in cash after these set of rules took place, then the model will search for high quality stocks with a lower yield.

A stock will be sold if market timing conditions are triggered and it can be replaced with a higher ranked stock.

Subscribe to this model

Interested in subscribing to multiple models? Discounts are available when subscribing to 2 or more models. Simply subscribe to your first model and then let us know which model you want to subscribe next, and we’ll send you a discount coupon.

Discount rates:

| 1st model | full price |

| 2nd model | 10% discount (applied to the 2nd model) |

| 3rd model | 20% discount (applied to the 3rd model) |

| 4th model | 30% discount (applied to the 4th model) |

| 5th model | 40% discount (applied to the 5th model) |

| 6th model | 50% discount (applied to the 6th model) |

| 7th model | 60% discount (applied to the 7th model) |

| 8th model | 70% discount (applied to the 8th model) |

Got questions? Check our Frequently Asked Questions for Premium models or contact us.

Already a member?

Cost of this model: $23 / month. Cancel anytime.

Interested in subscribing to multiple models? Discounts are available when subscribing to 2 or more models. Simply subscribe to your first model and then let us know which model you want to subscribe next, and we’ll send you a discount coupon.

Discount rates:

| 1st model | full price |

| 2nd model | 10% discount (applied to the 2nd model) |

| 3rd model | 20% discount (applied to the 3rd model) |

| 4th model | 30% discount (applied to the 4th model) |

| 5th model | 40% discount (applied to the 5th model) |

| 6th model | 50% discount (applied to the 6th model) |

| 7th model | 60% discount (applied to the 7th model) |

| 8th model | 70% discount (applied to the 8th model) |

Got questions? Check our Frequently Asked Questions for Premium models or contact us.

0 Comments